Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

tumilet

napkin calculations @TheSpartanGroup | views are my own | 🇪🇸

AAAAHHH, now I have to take Stargate out of my dashboard

LayerZeroAug 11, 01:15

The LayerZero Foundation has proposed an acquisition of Stargate (STG).

Bring the Bridge Home.

1.16K

tumilet reposted

Some findings on $UNI:

A Uniswap forum post on May 1, 2025 announced the creation of the FFG - The Foundation Feedback Group. It was established by the Uniswap Accountability Committee (UAC) together with the Foundation to serve as a mechanism for *improved communication and accountability between the Foundation and the DAO*

In their first FFG post, in May - the fee switch was mentioned numerous times. The Uniswap foundation has milked this fee switch proposal about 10 times - but they seem a little more structured and prepared this time.

They mention in the post that they target mid-summer 2025 (now) for the DUNA proposal (A proposal that must be pushed first, *before the fee switch*), and then the fee switch proposal to go shortly afterwards. As such, 1. No one is really talking about this and 2. $UNI has quietly been performing decently.

However, $UNI actually weirdly outperformed in July off no news, and very little activity on related accounts etc - but there was some weird wallet activity:

1. This wallet: 0x3bbd4947df4e1bd80d130ddcfa9b54f1b03a1a8d ( was one of the main reasons for the pump, as they seemed to twap purchase ~$50m of spot $UNI the last few weeks. @zeedxbt managed to track it back to a large Chinese fund: [Zeed was a huge help in this]

2. Last year, A16z tanked a proposal in the Uniswap forums and it raised broader debates about decentralization and influence in Uniswap governance - all because of HOW MUCH INFLUENCE A16z have.

And weirdly enough, a few days ago a16z unstaked 20m of $UNI (In June, a16z also undelegated 20M UNI across several addresses. Some of those delegates had been key in recent votes) - this obviously decreases their governance substantially

Why did they do this? In anticipation of another proposal? A fee switch proposal? added point: *the foundation call was linked above was also freaking out about it and their voting power*

In 2025 so far:

• 6 of 13 proposals passed with <10% margin

• 11 of 13 cleared quorum by <20%

• Just 2 proposals had a safe buffer

On top of that: Uniswap is going to monetize via partnerships with uni v4 hooks / fee splits. They want 30% of uniswap v4 orderflow going through hooks (h/t @AgentChud).

By capturing value from new services (via hooks) instead of reducing LP fees, Uniswap can earn revenue without directly harming LP incentives. The 30% orderflow target ensures it’s material enough to matter, and partnerships mean the ecosystem builds useful hooks that traders actually want to use.

Everything just seems a little more structured and "professional" (?) on their end. There are numerous things that can and will hinder Uniswap etc in the coming weeks/months - so this is not so much directional thinking re $UNI.

Incredibly cringe that I wrote a full piece on Uniswap in 2025, but Im bored and just jotting down some findings. Big big shoutout to @zeedxbt for helping in this - give him a follow.

38.43K

tumilet reposted

Spent the weekend killing bugs and shipping improvements

✅ UI upgrades suggested by @capynaut

✅ Index performance edge cases by @tricil and @ProlabCH

✅ Index creation issue haunting us for 3 months thanks to @100kcryptoMan

✅ Index age and last rebalance showing incorrect formats

Also, we have been slowly deprecating the market caps as an index metric, instead we will continue to us BPS all around

More to come this week, plans:

- @indexy_xyz July Report: Product, progress and what’s next

- Discord roll out

- “New things” undergoing testing/final reviews

- Power quants will get beta access

3.59K

tumilet reposted

A new era for onchain access is here.

With @coinbase Dex and @base unlocking trading for thousands of decentralized projects, the need for better indexes, smarter portfolios, and powerful transactional systems has never been greater.

If you just found Indexy through the new Coinbase Dex, here’s a quick overview:

Available on the web and as a Base Mini App, Indexy lets you navigate, track, and create crypto indexes — helping anyone discover and diversify in the fast-growing onchain world.

Created by @Kaloh_nft, a data scientist and longtime crypto markets writer, Indexy was built to spot what matters. The team is growing, uniting data, finance, and crypto enthusiasts on the same mission.

In just a few months, thousands of analysts have built 600+ indexes tracking 2,000+ assets across ecosystems like @clankeronbase, @zora, @virtuals_io, @RobinhoodApp

The onchain era is here — and it’s only the beginning

12.45K

tumilet reposted

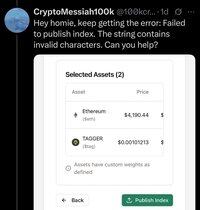

Napkin math on the potential impact @boros_fi could have on the revenues of @pendle_fi based on a reasonable market size Pendle could capture. The data points towards a potential revenue increase of 37% annually which is significant.

The 15% SAM assumption comes from the average of the DEX/CEX spot and DEX/CEX perp volume ratios. The 10% SOM assumption comes from looking at the market share Pendle has managed to capture for yield tokens. Around 8% of USDS and 12% of SyrupUSDC sits on Pendle. 30% of USDe also sits on Pendle but given the insane amount of looping happening around USDe, felt that skewed the data to the upside.

Let me know if I missed out on anything @PendleIntern and congrats @tn_pendle and team on the launch of Boros.

3.79K

tumilet reposted

Our friends at @AlliumLabs just shipped their Hyperliquid dashboard. We played a small role in giving feedback and helping iterate how the product evolved.

Builder codes are referral code mechanisms that pass on revenue to a developer for orders that settle on Hyperliquid. We have been studying the numbers to get an estimate of the size of the market and what happens when perpetuals products can be embedded anywhere.

Here are four key numbers that caught our attention:

1. Phantom accounts for ~49% of builder revenue

They say distribution is a moat, and few places make it as evident as Phantom's dominance of revenue generated on the exchange. With ~23k users interacting with Hyperliquid on any given day, Phantom accounts for close to half of all builder code revenue on most days.

They add ~500 new users each day, but these order sizes seem to be largely from retail users who trade with relatively high frequency.

2. Power Users Drive Volume

Compared to Phantom's ~3.4k active users (today), Insilico Terminal had ~150 users and BasedApp had 240 users. But each of those products had outsized impact on volume. Based currently accounts for 6% of volume, and Insilico does close to 35% on any given day.

The terminology for a "user" here may be flawed, as we don't entirely know how Insilico routes orders, but it helps to discern where the bulk of the volume originates from. While distribution helps rake in users, much of the volume today is with products that have power users.

(We are huge fans of the Terminal - and highly recommend using it)

3. Wallet Front-ends as Distribution

There has always been a hypothetical argument that wallet front ends are a great place for distribution, but one never had the numbers to aid that claim—until now. Allium's dashboards clarify that, on any given day, Hyperliquid sees close to ~400+ new users coming in from Phantom.

We speculate that, in the future, Phantom could negotiate for better fee or zero-fee models from products they integrate, as they have moats that emanate from the size of their distribution. It'd be interesting to see how this converts in consumer-adjacent segments like music, content, or gaming in the future.

4. Builder Codes Account for ~20% of Users

Imagine you had a primitive that bought in ~20% of your userbase. And it also gave ~25 billion in volume to your product. That's builder codes in a nutshell.

Builder codes are responsible for ~56k users on Hyperliquid across the 86 active products that have integrated them. For products - these codes are a new source of revenue. The estimated revenue per user on a product integrating builder code is $63. In other words, it allows people to focus on the distribution and have an easy avenue to monetise them.

If you head over to Allium's dashboard (linked below) - you can see a realtime stream of their markets and these figures updating in real time. It is the closest we have to one of the most transparent, open-markets that exist in the world today. It appears we've come a long way from the days of FTX.

Hyperliquid.

6.6K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable