Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

0/🚨 AI companies behave differently from traditional SaaS companies, and founders consistently ask us how AI companies are adapting and breaking out.

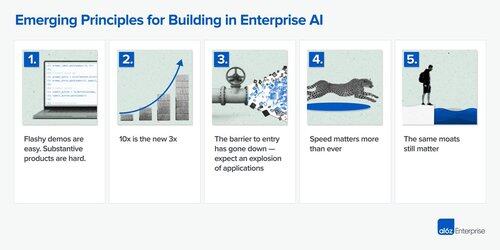

After talking to hundreds of AI companies over the past few years, we think that there are a few emerging principles for building enduring enterprise AI businesses 👇

1/ Flashy demos are easy. Substantive products are hard. 💻

It used to be popular to say that all AI software was a "GPT wrapper", implying that it was trivial to build and would easily get subsumed by the model providers.

We think that that couldn’t be more wrong. The best enterprise AI companies have incredible technical and product depth; they stay extremely close to SOTA research, chain different models together based on performance speed and cost, run sophisticated evals, and solve a long tail of issues required to make AI work in production. They also often have substantial forward-deployed efforts to make sure their products are successful within the unique context of their customers.

This means that AI companies have substantially more software and GTM lift than a simple API call could provide, and much more depth than a flashy demo online could manage.

2/ It takes more than ever to break out: 10x is the new 3x. 🚀

Hitting $1m ARR in 12 months used to be the north star metric for SaaS companies, but AI companies blow that out of the water.

Research by @stripe shows that AI companies are hitting $5m in ARR at dramatically faster rates, and my colleagues @omooretweets and @mandrusko1 have crunched our internal @a16z data and revealed that we've seen more companies hit $2-5m in their first year than ever before.

We think this acceleration is because 1) enterprises clearly see the value of AI and actively seek it, thus pulling forward sales cycles, and 2) AI contracts often replace labor instead of software and are thus larger than previous SaaS contracts were.

3/ The barrier to entry has gone down: expect a flood of applications. 🌊

The cost of compute is plummeting, and agentic IDEs like @cursor_ai + text-to-app platforms like @lovable_dev are making it easier to build software than ever before.

These two factors are changing the cost / effort equation for many markets and unlocking the ability to productize categories that were previously underserved by software. This ranges from personal software for markets of one (e.g., personal health trackers), to the long tail of workflows / internal tools in an enterprise that are currently glued together and maintained by humans or brittle RPA solutions.

We think software will begin to eat into even more workflows over time and that any workflow that can be software, will eventually become software.

4/ Speed matters more than ever. 🏃

There are dozens of companies competing in every category today. To break out, speed and momentum matter more than ever.

Companies like @cursor_ai @DecagonAI and @elevenlabsio have leveraged early momentum to become the premier brand in their categories, which has allowed them to recruit top talent, widen product surface area, land major customers, achieve rapid revenue growth, and establish brand dominance — often before fast followers have had a chance to adequately respond.

In a world where every category is crowded with many players, there is no substitute for shipping fast.

5/ To sustain that early advantage, moats still matter. 🏰

Pure shipping velocity enables companies to break out, but companies need to sustain that advantage. AI itself is not a moat: it is a way to deliver value to customers. As my colleague @dhaber says, there's a difference between differentiation and defensibility, and moats still matter to build enduring products.

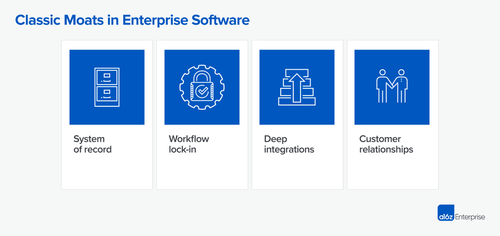

As of now, we've seen enterprise AI companies abide by the same moats as traditional enterprise software companies, namely systems of record, workflow lock-in, deep integrations, and customer relationships.

6/ This is one of the most exciting times to be a builder, as AI unlocks new markets and expands existing opportunities. These observations reflect what we’re seeing across AI startups today. Read the full post at

210,63K

Johtavat

Rankkaus

Suosikit