Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Commodity prices are up by 100% since 2020

But personal income has risen by only 25%

This Cost of Living gap is unsustainable…

A thread 🧵

2/ For the 1st time in over a decade, these 2 lines are moving in opposite directions.

This highlights exactly what’s wrong with today’s economy.

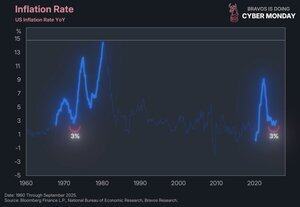

3/ The blue line shows the US inflation rate.

And the black line shows the index of the price of key commodities, like oil, wheat, natural gas, soybeans, coffee, etc.

The commodity prices are roughly 50% higher than before the pandemic, while inflation has come back down to 3%.

4/ On one hand, official data suggests inflation has cooled back down to reasonable levels.

On the other, the prices of essential raw materials still remain above the pre-2020 levels:

- Milk went from $3 to $4.

- Eggs jumped from $1.50 to $4.

- New cars rose from $37,000 to $49,000.

- Avg. home price surged from $320,000 to $420,000.

5/ The inflation rate shown here measures annual price changes.

But it doesn’t capture the real problem of prices still remaining too high.

What concerns most people is that these elevated prices might begin accelerating again.

The yearly inflation rate is currently at around 3%.

6/ Back in 1971, a similar pattern appeared:

Inflation initially cooled —> stopped at around 3% —> surged into one of the highest inflation waves on record.

7/ Between 1971 and 1982, the price of a home went from $20,000 to $70,000, more than 3x.

Gasoline at the pump went from $0.30 a gallon to $1.20, effectively 4x.

If this same scenario were to take place again, it would completely bury the average American.

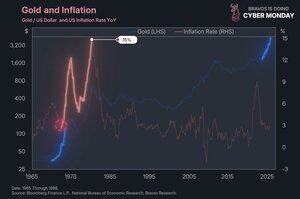

9/ Gold, the most widely recognized hedge against inflation, has more than 2X in the last 2 years.

And this is exactly what gold did in 1971.

When you put inflation rate on top, you see that gold moved sharply higher just before inflation rose from 3% to 15%.

Many investors consider today’s surge in gold as a signal that inflation could potentially rise again.

10/ Indeed, the most recent inflation report shows that the price of bananas are up 7% over the past year, beef and veal are up 14.7%, and coffee is up by 18.9%.

Now, Tariffs have likely played a significant role in these massive price increases.

But with so many everyday items rising by double digits, many are wondering how the official US inflation rate can still sit at just 3%?

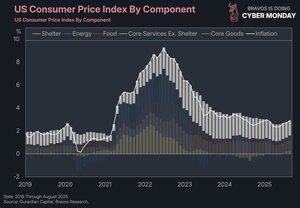

11/ The answer becomes clear when breaking the CPI into its different components.

Goods inflation has risen, partly due to tariffs.

But goods are a relatively small share of the CPI and rarely drive the overall inflation rate.

12/ The largest component of the CPI is shelter.

Shelter inflation continues to contribute meaningfully to the overall figure and played a major role in keeping inflation elevated over the last 3 years.

But more recently, its contribution has gradually declined from the levels that were seen in 2023.

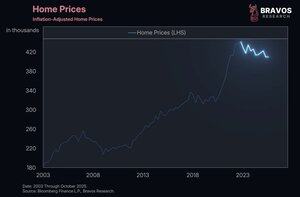

13/ This becomes clearer when we look at the inflation-adjusted home prices, which have been trending lower for the last 2 years.

Home prices are still well above pre-pandemic levels, but the downward trend is what’s easing inflation.

And for inflation to reaccelerate, home prices would need to start rising again, which doesn’t appear likely right now.

14/ This is the average mortgage rate in the US that has been shifted forward by a 1.5 years.

Interest rates have by far the biggest influence on the price of homes.

When mortgage rates rise, home prices tend to fall about 1.5 years later.

When rates fall, home prices rise after 1.5 years, as more people are able to purchase homes.

15/ When you invert mortgage rates, the relationship becomes almost a mirror image.

Today’s rates point to continued softness in home prices until at least early 2027.

This implies that shelter inflation is unlikely to pick up until mortgage rates decline, which hasn’t happened yet.

But the category that drives significant changes in inflation isn’t shelter, it’s energy.

17/ If the price of gasoline at the jumps up by 50%, it costs more to transport and manufacture goods, but it also for people to move around.

So both goods and services are influenced by the price of energy.

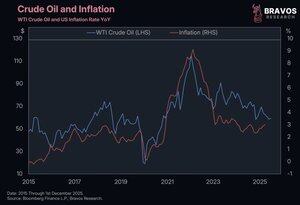

This is why inflation and oil prices look like mirror images of each other.

Oil’s volatility and broad influence means that inflation data is closely tied to oil price movements.

Right now, oil prices are trending lower.

60.22K

Top

Ranking

Favorites