Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

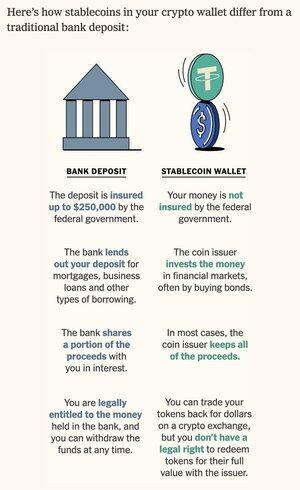

Putting aside the gross misrepresentation here of the regulatory requirement to hold cash and cashlike assets (short-term US govt debt, among the safest and most liquid assets out there) as "invest[ing] the money in financial markets, often by buying bonds" --

I find it the height of irony that the NYT says that bank deposits are better than stablecoins because they share *some* (~.01%) interest with depositors, and yet any argument that, perhaps, stablecoin issuers should be permitted to pass on interest to tokenholders is taboo. Can't have it both ways here guys.

Top

Ranking

Favorites