热门话题

#

Bonk 生态迷因币展现强韧势头

#

有消息称 Pump.fun 计划 40 亿估值发币,引发市场猜测

#

Solana 新代币发射平台 Boop.Fun 风头正劲

Jonah Lupton

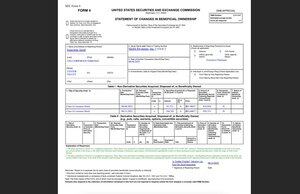

周五下午,$TMDX 提交了一份 Form4,显示他们的创始人(Waleed)购买了价值 200 万美元的股票。

就在几分钟前,$FOUR 提交了一份 Form4,显示他们的创始人(Jared)在过去两个交易日购买了价值 1630 万美元的股票。

今天 $TMDX 上涨了 11.1%

让我们看看 $FOUR 明天在这个消息下会有什么表现。

顺便说一下,我在过去一周将我的 $FOUR 持仓增加了大约 60%。

$FOUR 现在是我第三大持仓,仅次于 $TMDX 和 $APP。

$FOUR 在过去一年进行了几次收购,我相信这些收购将在未来几年内带来回报。这些交易不仅帮助他们扩展到数十个新市场(通过 GlobalBlue),而且还使他们接触到超过 400,000 家商户。

$FOUR 不仅在中等增长率的情况下有机增长,而且还进行增值的并购,并且在未来几年与这些新商户之间有巨大的交叉销售/追加销售机会。

自第二季度财报以来,$FOUR 的股价已经变得过于便宜。

即使你使用他们的完全稀释股本并包括现金/债务,企业价值也在 90 亿美元左右。

我相信 $FOUR 明年至少会实现 13 亿美元的 EBITDA,可能高达 14 亿美元。

这意味着 $FOUR 可能以低于 7 倍 2026 年的企业价值/EBITDA 交易,这对于中等增长率的有机增长以及增值的并购、成本协同和将这些新商户纳入他们的全栈产品(硬件、软件、支付)来说简直是疯狂的。

$TOST 是一家优秀的公司,增长率更高,但他们在销售和市场营销上的支出也远远高于 $FOUR,而 $FOUR 则利用他们的现金/债务/股票进行增值的并购。

$TOST 目前以 30 倍 2026 年的企业价值/EBITDA 交易,这与 $FOUR 的 7 倍 2026 年的企业价值/EBITDA 相比显得非常昂贵。

我认为 $FOUR 目前在当前价格下是最具吸引力的金融科技公司,并且应该成为这个倍数下的收购目标。

如果我遗漏了什么,请随时纠正我... @rookisaacman @TomSmith839 @jevgenijs @BourbonCap @MMMTwealth @FundasyInvestor @cp_option @SanCompounding 或任何其他关注 $FOUR 的人。

感谢阅读 :)

21.4K

随着 $TMDX 季节性疲软的结束,他们在过去两天平均每天有 37 次航班。预计在第三季度下半段会有更多的大航班日,然后是强劲的第四季度。

我仍然预计在 2025 年的收入将超过 6.3 亿美元,在 2026 年的收入将超过 8.2 亿美元。

我认为 $TMDX 在 2025 年的每股收益(eps)将达到 2.70 到 3.00 美元,在 2026 年的每股收益将达到 4.20 到 4.60 美元。

根据我对 2025/2026 年每股收益的中间估计,$TMDX 目前的交易价格为 2026 年每股收益的 26 倍,今年每股收益增长 180%,明年每股收益增长 55%。

$TMDX 目前价格低估了 40-50%。

$TMDX 在接下来的 12-18 个月内有 100% 的上涨空间。

仍然是我最大的持仓,短期内没有计划减持。

Jonah Lupton8月1日 04:02

As many of you know, $TMDX had another very strong earnings report yesterday afternoon. Revenues up 10% QoQ and 38% YoY however it was the earnings that really crushed it... with EPS up 31% QoQ and 163% YoY.

Two best things about the Q2 earnings report was net income margins coming in 22% vs 10% a year ago and the fact they raised full year guidance from 30% to 35%.

July flight data was soft (just like last year) but I fully expect August and September to be better followed by a very strong Q4 (just like last year).

The fact that $TMDX raised guidance means they also expect the last 5 months of the year to be strong and knowing how Waleed thinks, they will probably raise again with Q3 earnings and then beat that number by 3-5% so I fully expect $TMDX will do $630M+ for the full year which is 43% YoY.

$TMDX has already started getting approvals on OCS 2.0 trials which could start in Q4 however $TMDX management said none of those revenues were included in the new guidance.

Through the first half of the year $TMDX has net income margins of 20.1%, coming into the year analysts were looking for around 12% so it's been a huge upside surprise.

if $TMDX can maintain 20% NIMs through the back half of the year, then they could do $3.70 in eps for the full year. Coming into Q2 earnings the analysts were looking for $1.70 for the full year so $TMDX might beat that number by more than 100%, just like they beat Q2 eps estimates by 114%

This means, even with $TMDX up 11.4% today, the stock might only be trading at 32x 2025 eps with eps going 266% YoY (they did $1.01 eps last year)

Looking forward, with several important tailwinds, I think $TMDX could do another 30% revenues next year depending on size of trials and revenues from European expansion (Europe is 45% of global organ transplant market) and I think net income margins could expand another 150 bps to 21.5% (assuming they finish this year around 20%) which would put non-GAAP eps in 2026 at approx $5.15 per share which means $TMDX might only be trading at 23x 2026 eps

Very possible my numbers are too conservative because $TMDX continues to surprise me over and over again with their execution and efficiency.

$TMDX is still my largest position and I added to it yesterday before the close at $106 and then AH at $114 and again today on the morning dip.

My conviction has never been stronger and I firmly believe $TMDX will be a $250 stock in the next 12-18 months as they continue to execute at a high level.

Also worth nothing $TMDX still has a 24% short interest so it's possible the shorts will need to start covering their 8M shares (8 days to cover)

96.7K

祝贺所有 $RDDT 的股东……这一季度表现惊人,前景也非常乐观。

3 个月前,$RDDT 预测第二季度收入为 4.2 亿美元,EBITDA 为 1.2 亿美元。最终报告的数字分别为 5 亿美元和 1.67 亿美元。第三季度的指引同样令人印象深刻。

每位分析师都需要提高他们对 2025/2026 年的预估和 12 个月的目标价。

$RDDT 现在是我第三大持仓,仅次于 $TMDX 和 $APP。

根据我对未来 12 个月的估算,$RDDT 的公允价值为 232 美元,这对于一家年增长 78% 且 EBITDA 利润率为 33% 的公司来说是保守的,预计将继续超出预期并提高指引。

非常看好这次财报电话会议,$RDDT 在产品改进和通过广告及数据许可实现用户货币化方面仍处于早期阶段……国际扩张也是未开发的增长空间。

35.85K

热门

排行

收藏

链上热点

X 热门榜

近期融资

最受认可