Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Jonah Lupton

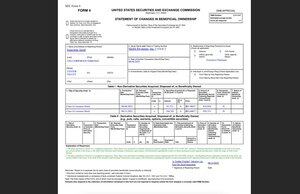

Friday afternoon $TMDX filed a Form4 showing that their Founder (Waleed) bought $2M of stock.

Just a few minutes ago, $FOUR filed a Form4 showing their Founder (Jared) bought $16.3M of stock the past two trading days.

$TMDX was up 11.1% today

Let's see what $FOUR does tomorrow on this news.

FWIW, I increased my $FOUR position by approx 60% over the past week.

$FOUR is now my 3rd largest position behind $TMDX and $APP.

$FOUR has done several acquisitons over the past year that I believe will pay off over the next few years. These transactions have not only helped them expand into dozens of new markets (through GlobalBlue) but it's opening them up to 400,000+ merchants.

Not only is $FOUR growing organically in the mid teens but they doing accretive M&A and have a huge cross-sell / up-sell opportunity with these new merchants over the next few years.

$FOUR has gotten way too cheap since Q2 earnings.

Even if you use their fully diluted share count and include cash/debt, the enterprise value is around $9 billion.

I believe $FOUR does at least $1.3B of EBITDA next year, perhaps as much as $1.4B.

This means $FOUR is likely trading below 7x 2026 ev/ebitda which is just insane for organic growth in the mid teens plus accretive M&A, cost syngeries and cross-selling those new merchants into their full stack offering (hardware, software, payments).

$TOST is a great company with better growth rates but they're also spending way more on sales & marketing whereas $FOUR is using their cash/debt/stock to do accretive M&A.

$TOST is currently trading at 30x 2026 ev/ebitda which seems really expensive compared to $FOUR at 7x 2026 ev/ebitda

I think $FOUR is the most attractive fintech right now at current prices and should be an acquisiton target at this multiple.

Feel free to correct me if I missed anything here... @rookisaacman @TomSmith839 @jevgenijs @BourbonCap @MMMTwealth @FundasyInvestor @cp_option @SanCompounding or anyone else that follows $FOUR closely.

Thanks for reading :)

28,85K

As we come to the end of seasonal weakness for $TMDX, they’re averaging 37 flights per day over the past two days. Expect more big flights days in the second half of Q3 and then strong Q4.

I’m still looking for $630M+ revenues in CY2025 and $820M+ revenues in CY2026.

I think $TMDX will do $2.70 to $3.00 eps in CY2025 and $4.20 to $4.60 eps in CY2026.

At the midpoints of my CY2025/2026 eps estimates, $TMDX is currently trading at 26x 2026 eps with 180% eps growth this year and 55% eps growth next year.

$TMDX is 40-50% undervalued at current prices.

$TMDX has 100% upside over next 12-18 months.

Still my biggest position and not planning on trimming anytime soon.

Jonah Lupton1.8. klo 04.02

As many of you know, $TMDX had another very strong earnings report yesterday afternoon. Revenues up 10% QoQ and 38% YoY however it was the earnings that really crushed it... with EPS up 31% QoQ and 163% YoY.

Two best things about the Q2 earnings report was net income margins coming in 22% vs 10% a year ago and the fact they raised full year guidance from 30% to 35%.

July flight data was soft (just like last year) but I fully expect August and September to be better followed by a very strong Q4 (just like last year).

The fact that $TMDX raised guidance means they also expect the last 5 months of the year to be strong and knowing how Waleed thinks, they will probably raise again with Q3 earnings and then beat that number by 3-5% so I fully expect $TMDX will do $630M+ for the full year which is 43% YoY.

$TMDX has already started getting approvals on OCS 2.0 trials which could start in Q4 however $TMDX management said none of those revenues were included in the new guidance.

Through the first half of the year $TMDX has net income margins of 20.1%, coming into the year analysts were looking for around 12% so it's been a huge upside surprise.

if $TMDX can maintain 20% NIMs through the back half of the year, then they could do $3.70 in eps for the full year. Coming into Q2 earnings the analysts were looking for $1.70 for the full year so $TMDX might beat that number by more than 100%, just like they beat Q2 eps estimates by 114%

This means, even with $TMDX up 11.4% today, the stock might only be trading at 32x 2025 eps with eps going 266% YoY (they did $1.01 eps last year)

Looking forward, with several important tailwinds, I think $TMDX could do another 30% revenues next year depending on size of trials and revenues from European expansion (Europe is 45% of global organ transplant market) and I think net income margins could expand another 150 bps to 21.5% (assuming they finish this year around 20%) which would put non-GAAP eps in 2026 at approx $5.15 per share which means $TMDX might only be trading at 23x 2026 eps

Very possible my numbers are too conservative because $TMDX continues to surprise me over and over again with their execution and efficiency.

$TMDX is still my largest position and I added to it yesterday before the close at $106 and then AH at $114 and again today on the morning dip.

My conviction has never been stronger and I firmly believe $TMDX will be a $250 stock in the next 12-18 months as they continue to execute at a high level.

Also worth nothing $TMDX still has a 24% short interest so it's possible the shorts will need to start covering their 8M shares (8 days to cover)

96,71K

Only one reason CEO’s buy their own stock 🚀

$TMDX still my largest position followed by $APP $RDDT $ALAB $FOUR

Bourbon Capital9.8. klo 04.43

$TMDX CEO has just reported purchasing $1.9 million of the company's stock

Lets go $200 is coming

79,66K

$ALAB not getting enough attention for their blowout Q2 earnings report

Q2 revs up 149.7% YoY with 40.6% net income margins

Everyone talking about $PLTR rule of 40... well ALAB's rule of 40 is 2x higher... probably not another publicly traded company with better fundamentals right now than $ALAB

I added to my $ALAB position after hours... now my 5th largest position

$ALAB Q3 guidance also very strong and they'll probably crush those numbers again.

129,88K

Congrats to all the $RDDT shareholders… monster quarter and monster guidance.

3 months ago $RDDT guided Q2 revs to $420M and Q2 EBITDA to $120M. They ended up reporting $500M and $167M respectively. Q3 guide was equally impressive.

Every analyst will need to raise their 2025/2026 estimates and 12-month price targets.

$RDDT now my third largest position behind $TMDX and $APP.

$RDDT fair value is $232 according to my next 12 month estimates and that’s conservative for a company growing 78% YoY with 33% EBITDA margins that will continue to beat and raise.

Very bullish earnings call, still early innings for $RDDT in terms of product improvements and user monetization through advertising and data licensing… also international expansion is untapped white space for growth.

35,87K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin