Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

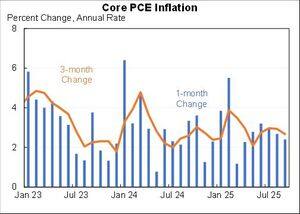

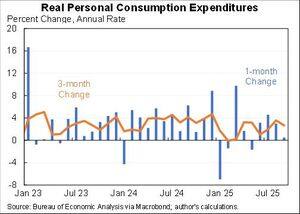

Core PCE inflation. Annual rates:

1 month: 2.4%

3 months: 2.7%

6 months: 2.7%

12 months 2.8%

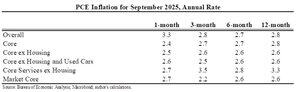

Full set of numbers.

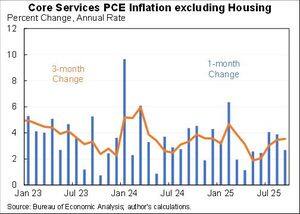

What leaps out is how low housing inflation was in September, something we already saw in the CPI. I wouldn't expect that to last.

As a result core PCE services excluding housing is continuing to rise.

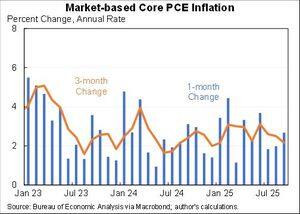

BTW, I've stressed that market core is better to look at than overall. It had been higher than regular core in recent months but that reversed in September. And given what happened in the market, likely stay reversed in October too.

But overall most of the inflation came from the durable goods side. We're well off the pre-tariff trend for goods prices, consistent with passthrough from tariffs. Which is good news from the Fed's perspective because that's more likely to be transitory.

On the real side of the economy, very little growth of consumer spending in September. But I wouldn't worry much--overall has been very strong. Based on these numbers consumer spending grew at a 2.7% annual rate in Q3.

In sum, inflation is 0.8pp above the Fed's target. Consumer spending is consistent with Q3 GDP growth at 3%+ annual rate. Add to that fiscal expansion, wealth effect from asset price increases & the possibility of a bubble, and I just don't get why the Fed is cutting next week.

8.72K

Top

Ranking

Favorites