Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

I wanted to give everyone something meaningful, a gift…

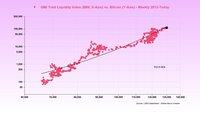

This comes from Global Macro Investor (GMI) and a deep, long-running body of research developed by @RaoulGMI and myself.

Many of you already know The Everything Code, which is our framework for understanding the macro landscape and why major central banks are debasing their currencies to manage aging demographics and overwhelming debt loads.

I call this a gift because these four charts, while only scratching the surface of The Everything Code, give you the big-picture context you actually need in moments like this.

They stop you from getting lost in every Bitcoin pullback and explain why Raoul and I never panic, even when, to borrow one of his expressions, everyone’s acting like monkeys throwing poo at each other.

Once you understand The Everything Code, you stop trading short-term noise and expand your time horizon. You cannot unsee it.

The starting point is what we call The Magic Formula:

GDP growth = population growth + productivity growth + debt growth.

Population growth and productivity growth have been falling for decades. Debt growth is the only thing filling the gap.

The private sector has been deleveraging since 2008, mainly households, but debt levels are still around 120% of GDP. The public sector sits at roughly the same level.

Here’s the problem…

If the government is running debt at 100% of GDP and the private sector is sitting on another 100%, and for simple math we call rates 2% even though they are really closer to 4%, then the entire 2% trend growth of the economy is being consumed by servicing private-sector debts. That is a completely unproductive use of GDP. And then there’s the issue of public-sector debts. There’s just not enough organic growth to service the existing debt load.

To understand why this dynamic persists, you need demographics.

Birth rates peaked in the late 1950s and have been declining ever since. This shows up about sixteen years later in the labor force participation rate as each generation enters the workforce (chart 1).

That means the labor force participation rate is not going to rise any time soon. It is set to keep drifting lower. This is a structural problem.

...

Top

Ranking

Favorites