Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

10x Research

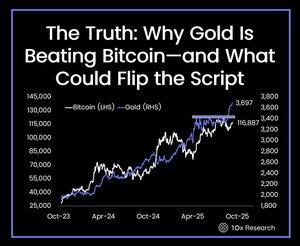

Totuus: Miksi kulta voittaa Bitcoinin – ja mikä voisi kääntää käsikirjoituksen

Markkinat muuttuvat tavoilla, joita jopa kokeneiden kauppiaiden on vaikea selittää. Yksi voimavara kilpailee eteenpäin, toinen jäljessä, ja silti molempien oletetaan vastaavan samoihin voimiin. Kommentaattorit heittelevät ympäriinsä yksinkertaisia nimikkeitä – "suoja", "turvasatama", "arvon säilyttäjä" – mutta todellisuus sen alla on paljon monimutkaisempi. Se, mikä näyttää samanlaiselta pinnalla, osoittautuu tarkemmin tarkasteltuna hyvin erilaisilla moottoreilla. Vaikutukset sijoittajiin ovat valtavat.

Viime kuukausien aikana on muodostunut voimakas ero. Jotkut uskovat, että tämä on väliaikainen pilkahdus, toiset ajattelevat, että se merkitsee uuden syklin alkua. Useimmat voivat olla samaa mieltä siitä, että vanha pelikirja ei enää selitä näkemiämme liikkeitä. Tutut kertomukset, joihin kauppiaat ovat luottaneet vuosia, ovat hajoamassa. Jos käsittelet näitä omaisuuseriä keskenään vaihdettavina, saatat menettää yhden tämän syklin tärkeimmistä käännekohdista.

Sitä, mitä nyt tapahtuu, ei voida pelkistää yhteen otsikkoon. Fedin pehmeämmällä asenteella, muuttuvilla korko-odotuksilla ja dollarin heikkoudella on merkitystä – mutta ne eivät selitä, miksi yksi markkina nousee, kun taas toinen kamppailee saadakseen tarjouksen. Jotain muuta on tekeillä. Kaaviot vahvistavat sen. Virrat vahvistavat sen. Ja silti useimmat sijoittajat etsivät väärästä paikasta. Kun ymmärrät, mikä oikeastaan ohjaa kutakin omaisuutta, huomaat, miksi toinen on juossut eteenpäin – ja miksi toinen saattaa vain odottaa oikeaa kipinää.

Tiedot kertovat tarinan, joka on yhtä aikaa ilmeinen ja piilotettu. Korrelaatiot, joita monet analyytikot mainitsevat "todisteina", näyttävät hyvin erilaisilta, kun loitonnat. Tutkimuksessa ja mediassa laajalti siteeratut likviditeettimittarit ovat harhaanjohtavampia kuin useimmat ymmärtävät. Ja muuttuja, jolla on eniten merkitystä, piileskelee näkyvissä – tarpeeksi hienovarainen, jotta se voidaan sivuuttaa, mutta tarpeeksi voimakas selittääkseen tämän päivän eron. Niille, jotka huomaavat sen aikaisin, asetelma on poikkeuksellinen. Niille, jotka eivät tiedä sitä, riskinä on väärä sijoittaminen täsmälleen väärään aikaan.

Kyse ei ole vain lyhytaikaisesta kaupankäynnistä. Kyse on sen ymmärtämisestä, miten kaksi nykyaikaisten markkinoiden tärkeintä suojausta todella toimii – ja miksi ne eivät aina toimi yhdessä. Jos olet koskaan miettinyt, miksi heikentymissuojana mainostettu omaisuuserä ei nouse, kun raha tuntuu löysältä, tai miksi toinen omaisuuserä nousee marginaalisilta vaikuttavien poliittisten muutosten vuoksi, tämä on tilaisuutesi ymmärtää. Mekaniikalla on merkitystä, ja ne ovat usein ristiriitaisia. Kun näet ne, on vaikea tarkastella markkinoiden liikkeitä samalla tavalla.

Koko raportti erittelee tällä hetkellä tärkeimmät erot käyttämällä historiallisia tietoja, teknisiä signaaleja ja makrokontekstia. Se näyttää, mitä narratiivit menevät pieleen, missä sokeat pisteet ovat ja mikä voi kääntää käsikirjoituksen tulevina kuukausina. Vapaat lukijat näkevät vain pinnan. Paljastaaksesi tekijät, jotka muovaavat yhtä vuoden tärkeimmistä markkinaeroista, sinun on sukeltaa syvemmälle.

Lue koko raporttilinkki kommenttiosiosta...

4,16K

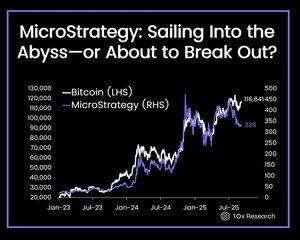

MicroStrategy: Purjehditus kuiluun – vai murtautumassa?

@MicroStrategy

Miksi tällä raportilla on merkitystä?

Toukokuusta lähtien meillä on ollut laskeva näkemys MicroStrategysta ja odotamme laajempaa kesän konsolidaatiota ja volatiliteetin vähenemistä.

Tämä skenaario on suurelta osin toteutunut, ja osakkeet ovat pudonneet 400 dollarista 330 dollariin (-17,5 %).

Tämä 330 dollarin taso oli alkuperäinen alaspäin suuntautuva tavoitteemme, kuten 18. elokuuta julkaistussa raportissamme esiteltiin, ja se voi laajentua kohti 300 dollaria.

Samaan aikaan Digital Asset Treasury (DAT) -teema on kypsynyt pisteeseen, jossa monet yritykset käyvät nyt kauppaa lähellä nettoarvoaan, mikä tekee pääoman hankinnasta yhä monimutkaisempaa.

Erityisesti pienemmillä toimijoilla ei ole riittävää mittakaavaa päästä käsiksi kaikkiin rahoitustuotteisiin, mukaan lukien perinteiset velkamarkkinat.

Keskeinen kysymys on, voivatko nämä rahoitusyhtiöt koskaan enää saada merkittävää nettoarvopreemiota – ja merkitseekö tämä teeman loppua.

Uskomme, että tämä voi olla kriittinen käännekohta, ja meillä on mielessämme useita strategioita sen kaupankäynnille, kuten selitämme alla.

Katso koko raportti:

89

Bitcoin, Fed ja 120 000 dollarin kysymys

Bitcoin on +24 % vuoden alusta, mutta monet kauppiaat ovat edelleen turhautuneita.

Toisin kuin osakkeet – jotka nousevat tasaisesti jatkuvien virtojen myötä – krypto näyttää liikkuvan räjähdysmäisesti, usein sidottuna yhteen katalyyttiin.

Turhautuminen johtuu siitä, että kaipaa niitä jyrkkiä nousuliikkeitä, jotka ilmestyvät tyhjästä.

Siksi sen ymmärtäminen, mikä todella ohjaa näitä liikkeitä, on tärkeämpää kuin koskaan.

Tällä viikolla kaikkien katseet kohdistuvat Fediin. Jotkut väittävät, että koronlasku on kipinä, joka lopulta nostaa Bitcoinin yli 120 000 dollarin.

Toiset varoittavat, että se voi olla klassinen "myy uutiset" -hetki.

Todellisuus, kuten aina, on monimutkaisempi.

Sisäänvirtaukset, asemointi, kausiluonteisuus ja jopa huomiotta jääneet signaalit, kuten luottomarginaalit ja oma Ahneus ja pelko -mallimme, maalaavat kiehtovan kuvan – sellaisen, joka voi yllättää monet kauppiaat.

Historia tarjoaa vihjeitä. Viime vuonna Fedin yllätysleikkaus tuotti välittömän rallin... se haihtui melkein yhtä nopeasti.

Viikkoja myöhemmin Bitcoin järjesti kuitenkin paljon voimakkaamman läpimurron.

Kausivaihtelut, likviditeetin muutokset ja markkinarakenne vaikuttivat kaikkiin.

Sama dynamiikka saattaa olla pelissä nyt, mutta kun panoksena on vielä suurempia virtoja ja riskivarat kallistuvat nousuun, vaikutukset ovat paljon suuremmat.

Optiomarkkinat kertovat jo omaa tarinaansa.

Treidaajat, jotka olivat laskevassa asemassa vain muutama päivä sitten, ovat nyt kääntymässä nousuun FOMC-kokoukseen. Puhelut ovat rikkaita verrattuna myyntiin.

Volatiliteetti on sopeutumassa.

Mutta syvempi kysymys on edelleen: ovatko he aikaisia – vai vielä jäljessä?

Mutta on yllättävä tekijä, joka on Bitcoinille jopa voimakkaampi kuin mitä Fed tekee:

2,48K

Johtavat

Rankkaus

Suosikit