Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Winter Soldier ❄️🙋🏻♂️

🦾 On-chain researcher with a S̶o̶v̶i̶e̶t̶ Wakanda metal arm

Golden Degen’s bodyguard

Billions are spent every year on redundant on-chain computation.

@boundless_xyz, built by @risczero, flips that model:

• Offload heavy compute → prove off-chain with ZK → verify cheaply on-chain

• Costs drop from $1,000s to <$30 per job

• Apps from DeFi to rollups to bridges can scale while staying secure

Backed by $52M+, with a live mainnet beta (400k+ users, 30B+ proofs verified).

1,48K

🚨 Mainnet signal for @union_build

• $U token deployed on Ethereum mainnet: 10B minted

📜 Contract: 0xba5eD44733953d79717F6269357C77718C8Ba5ed

• Core launch systems in place, mainnet looking close

Union is building a ZK-powered interoperability L1 so rollups, L1s & appchains can pass assets, messages & intents in <1s, without bridges, oracles, or multisigs. Backed by $16M from @GumiCryptos, @LonghashVC, Galileo, Semantic Ventures.

1,4K

Winter Soldier ❄️🙋🏻♂️ kirjasi uudelleen

Sapien Capital, @SeiNetwork's DeSci investment arm, just recruited a Biopharma veteran to advise Sei’s $65M Open Science Fund.

Here’s everything you need to know in 5 minutes about the movement:

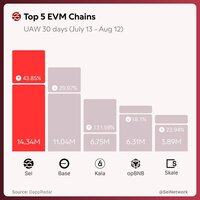

As you all know, Sei is gradually gaining traction with narratives like RWA, DeFi, GameFi, stables, and more.

It’s the product of focused execution toward one goal, MAKING MARKETS MOVE FASTER.

The growth is clear:

• #1 EVM chain by MAW, over Base and BNB

• 1M+ DAW and ATH in daily transactions

• 100K+ daily gaming transactions

• $1.53B DEX volume in July (ATH)

But they can’t keep dwelling on past glory. New frontiers are needed.

One of them is DeSci, which is still undervalued, but with the potential to make @SeiNetwork the infra rails for the future of scientific collaboration in longevity, biotech, and other frontier research domains.

To achieve this ambitious goal, there’s a need for a great recruit, which is where Dr Michael Baran comes in.

Dr Michael Baran, Partner at Pfizer Ventures, is joining as a strategic advisor to shape the investment strategy for the $65M Open Science Fund and guide Sei’s DeSci vertical. His remit is to turn proof-of-concept projects in decentralized funding, community-led data ownership, and tokenized research participation into sustainable ventures that can solve real bottlenecks in drug development and translational science.

In case you don’t know, Pfizer Ventures has already engaged with DeSci through VitaDAO, so this is not a random leap. It is part of a longer strategic interest in decentralized science models.

Decentralized Science has promised to free science from centralized funding bodies and glacial publication cycles, but much of the movement is still stuck in proof-of-concept mode. As put it, Baran’s arrival “is a signal that the grown-ups have arrived.” He brings a track record from biopharma investment and R\&D, bridging the gap between crypto-native ideals and the operational realities of drug development, especially in longevity where timelines are measured in decades and budgets in billions.

The lofty goal here is flipping Eroom’s Law, making drug discovery faster rather than slower. Without infrastructure for large-scale coordination, transparent funding, and interoperable data, that goal risks being just another slogan.

But guess what? Nothing is impossible, so @SeiNetwork's architecture, paired with Sapien Capital’s focus on longevity, makes this an experiment worth watching closely. It may even mark the start of DeSci 2.0, where theory meets execution.

Eleanor Davies, Sapien Capital’s Global DeSci Lead, said: “Michael has an unmatched perspective that will contribute to the scalability and institutional adoption of DeSci. We’re here to build beyond the bubble, and realize the full potential that crypto has in the sciences.” She added, “His experience in the industry, and as a DeSci advocate from day one, makes him the ideal partner for success in the DeSci V2 on Sei. We’re still early, and there’s a lot of potential. We’re thrilled to welcome him into the fold as we make Sei the go-to destination for DeSci and frontier technologies.”

Longevity research faces what Davies calls “a Gordian knot of inefficiencies” from capital formation and talent coordination to clinical trial data access and consistent quality management. “It can take decades to bring therapeutics to patients, and we don’t have time for this.”

The Open Science Fund aims to reduce barriers in underfunded fields like longevity, giving under-resourced but highly capable entrepreneurs access to funding, a high-caliber ecosystem, and faster progress. Sei’s infrastructure enables fast finality for milestone funding, parallel processing for massive aging datasets, and permissionless coordination so a computational biologist in one country can work with a clinician in another at internet speed, not institutional pace.

Baran summed it up simply: “Science moves at the speed of collaboration, but our infrastructure hasn’t caught up. Sei represents the first blockchain capable of supporting the computational demands and coordination requirements that research actually needs. There’s a huge opportunity to expedite the sciences that simply wasn’t feasible before.”

So there you have it, if you're still fading Sei, it's better you stop because...

DeSci is about to move faster on SEI. ($/acc)

50,33K

🚨 ETH ATH Watch 🚨

As of Aug 13, $ETH is trading $4.3K–$4.4K — just shy of its Nov ‘21 ATH of ~$4.89K.

Up +65% in 30 days, with ETF inflows, tech upgrades, and a supply squeeze fueling momentum.

1⃣Institutional flows

📍Spot ETH ETFs (BlackRock, Fidelity) pulled in $1.25B in 19 days — biggest buy wave since 2017

📍July alone: +2.7M ETH added by institutions

📍Treasuries like SharpLink now hold more ETH than the Ethereum Foundation

📍Staking ETF approval could unlock yield-on-ETH for pensions & funds

2⃣ Tech upgrades + usage

📍Proto-Danksharding (EIP-4844) = cheaper L2 txs, faster scaling

📍Aug 5: 1.74M daily txs = new ATH

📍ETH = 55% of crypto TVL, 40%+ USDT, 75%+ USDC

10 years uptime, deflationary since EIP-1559

3⃣ Regulation + supply squeeze

📍GENIUS Act + SEC “Project Crypto” favor PoS chains

📍30% of ETH staked = less liquid supply

📍Exchange reserves at multi-year lows

📍RWAs (USTs, private credit) mostly tokenized on ETH

4⃣ Sentiment shift

📍Broke $4K → shorts squeezed → vertical move setup

📍Open interest ATH

📍From “ETH is dead” → “ETH to $10K+” calls

📍Seen as the most hated rally turning into a regime change

TL;DR:

Institutional demand, real on-chain usage, and supply pressure are aligning for ETH’s first new ATH in nearly 4 years.

Not financial advice — but the ETH chart might be. 📈

8,3K

infofi has changed how we see the market — pros, cons, and all.

and yeah, Yap gets its fair share of controversy (bots everywhere), but you can’t deny it’s a smart, powerful marketing tool.

since @KaitoAI Yaps, I’ve found gems like @cysic_xyz , @anoma , @union_build , @TheoriqAI , @SonicLabs way earlier.

what’s your best find? drop it below 👇

2,1K

✅@cysic_xyz is now open to public

Cysic started as a ZK hardware accelerator and is building a full-stack decentralized compute network.

Their new public release, Cysic AI, is an agent swarm framework that can spot trends, mint tokens, and launch on Pump, with verifiable outputs via ZK proofs.

It’s an interesting bridge between AI, DePIN, and on-chain automation.

Cysic12.8. klo 03.00

No invite code? No problem.

Cysic AI is now open for everyone to try.

Spot trends, mint tokens, and launch on Pump - the AI agent swarm handles it all in real time.

Try it yourself:

19,38K

30d revenue for my fave protocols (Jul 13 - Aug 11, 2025):

Hyperliquid @HyperliquidX - $100.6m

Lido @LidoFinance - $80.1m

Ethena @ethena_labs - $74.3m

Aerodrome @AerodromeFi - $70m

Jito @jito_sol - $44.9m

Curve @CurveFinance - $22m

GMX @GMX_IO - $10.3m

Pendle @pendle_fi - $4.5m

Annualized figures may vary with market shifts. Solid DeFi cash flow!

#DeFi #Crypto

22,52K

Bitcoin is the largest crypto asset, but >90% of it sits idle, earning nothing.

@Lombard_Finance (founded 2024 by @JacobPPhillips, ex-Polychain & Perennial, and a team from Coinbase, Ripple, Maple, Argent) is building onchain BTC capital markets, bridging BTC to 12+ DeFi ecosystems while preserving security & self-custody.

4,44K

Winter Soldier ❄️🙋🏻♂️ kirjasi uudelleen

Okay, hear me out on something that's been bugging me about how we talk about @StoryProtocol & @campnetworkxyz...

Everyone's treating this like some crypto death match, but I think we're completely missing the point. These aren't competitors - they're literally building two halves of the same dream. Let me explain... 👇

Here's what I see happening:

Story Protocol got the boring (but crucial) stuff locked down. They raised $143M from a16z, got Grayscale to launch a trust, and they're out here talking to Fortune 500 companies about "programmable IP licensing."

Honestly? Good for them. Someone needs to do the heavy lifting with the suits.

Meanwhile, Camp Network raised $30M and said "screw the corporate speak, let's make this fun." They turned their blockchain into an adventure game where people actually WANT to participate. Their testnet is doing 130k swaps because... people are having fun using it.

And here's the thing I realized:

We NEED both of these approaches. Like, desperately.

You can't onboard your mom to IP blockchain with Story's technical documentation. But you also can't convince Disney to tokenize their IP catalog with Camp's tent emojis.

Think about it like this:

Story = Building the financial rails that make IP tradeable

Camp = Building the UX that makes people want to use those rails

That's not competition. That's literally how every successful tech ecosystem works.

Personal example:

I'm a content creator. If I want to tokenize my newsletter, I need:

- Legal framework for licensing (Story)

- Easy tools that don't make my brain hurt (Camp)

- Institutions that will actually buy/trade my IP (Story)

- A community that gets excited about creating with me (Camp)

See? I need BOTH.

What really convinced me:

Story's institutional focus is legitimizing the entire space. When Grayscale launches an IP blockchain trust, that's not just good for Story - that's good for everyone building in IP.

Camp's community approach is solving the adoption problem. Getting 130k testnet swaps isn't just good for Camp - it's proving there's real demand for IP tools.

The math is simple:

More legitimacy = more institutional money flowing in

More user adoption = bigger market for everyone

Bigger market = higher valuations across the board

Look, I've been in crypto long enough to know that the best opportunities aren't about picking the "winner." They're about spotting entire sectors before they explode.

Remember when we argued about which DeFi protocol would "win"? Plot twist: they ALL won because DeFi as a category won.

Same thing is happening here with IP blockchain.

My honest take:

Instead of asking "Story or Camp?" I'm asking "How do I position myself in the IP blockchain revolution?" Because that $80 trillion market they keep talking about? It's real, and it's not going to just one project.

Story will onboard the enterprises. Camp will onboard the creators. Together they'll onboard the world.

And honestly? After watching both their Twitter strategies, I'm here for it. Story keeps it professional, Camp keeps it fun, and somehow it all just... works.

1,61K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin