Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Cato_KT

Globaalit markkinat 8. syyskuuta:

1. Kulta nousi päivän aikana 1,3 % ja noteerasi 3 633 dollaria unssilta,

2. Raakaöljyn kansainvälinen hinta nousi 1,01 % 66,16 dollariin tynnyriltä,

3. Yhdysvaltain dollari-indeksi jatkaa laskuaan, tällä hetkellä 97,42,

4. Yhdysvaltain pitkäaikaisten joukkovelkakirjojen tuotto laski, kun 30 vuoden pitkäaikaisten joukkovelkakirjojen tuotto laski lähes 1,5 % ja Yhdysvaltain 10 vuoden valtionlainojen tuotto laski 0,66 %.

5. Yhdysvaltain osakkeet avautuivat korkealle, Nasdaq putosi takaisin uuden huipun jälkeen ja koko Yhdysvaltain osakemarkkinat osoittavat tällä hetkellä suurta volatiliteettia.

6. VIX-indeksi on optimistisessa vaiheessa lähellä 15,4:ää

Arvioida:

Työllisyystietojen nykyisen laskun myötä syys- ja lokakuun koronlaskun todennäköisyys kasvaa edelleen, ja markkinat odottavat löyhempiä korkomarkkinoita.

Kulta ja Yhdysvaltain pitkäaikaiset joukkovelkakirjat nousivat, dollari laski ja osakemarkkinat nousivat, ja on huomattava, että koronlaskujen odotuksissa, onko tämän viikon 10 ja 30 vuoden joukkovelkakirjahuutokaupat edelleen kuumia, on lyhyt huolenaihe.

Raakaöljyn hinnan vaihtelut johtuvat edelleen geopoliittisista tekijöistä. Se on tällä hetkellä optimistisessa vaiheessa.

Cato_KT9 tuntia sitten

Markkinatiedot 8. syyskuuta:

1. Markkina-arvo on elpynyt merkittävästi markkinoiden yleisen nousun myötä, mutta altcoinin kasvuvauhti on itse asiassa ilmeisempi, kun taas #Bitcoin #ETH on jäljessä lyhyellä aikavälillä ja lyhyen aikavälin markkinoiden riskinottohalukkuus on muuttunut optimistiseksi.

2. Kaupankäyntivolyymipari ei kasvanut lauantaina, ja markkina-aktiivisuus elpyi maanantaina, ja altcoin-kaupankäyntivolyymi kasvoi ilmeisimmin, jota seurasi ETH

3. Markkinoilla säilytetyt varat vähenivät 100 miljoonalla, yhteensä 289,6 miljardia

4. USDT: Virallisen verkkosivuston tiedot osoittavat, että markkina-arvo on 168,873 miljardia, mikä on 0,02 miljardia enemmän kuin lauantaina, ja Aasian markkinat ovat keskeyttäneet pääomavirrat tällä viikolla.

5. USDC: Datasivusto osoittaa, että markkina-arvo on laskenut 64 miljoonalla, ja varojen virtaus Yhdysvaltoihin on myös keskeytetty kahdeksi peräkkäiseksi viikoksi.

Arvioida:

Tämänhetkisistä markkinatiedoista päätellen vaikka markkinoiden likviditeetti on elpynyt lyhyellä aikavälillä ja myös riskinottohalukkuus on parantunut, mielestäni meidän on oltava valppaina, erityisesti maanantaina jäljittelijän "liiallinen" optimismi, johon liittyy pääomavirtojen keskeyttäminen Aasiassa ja Yhdysvalloissa, mikä on kyseenalaistamisen arvoista.

Lisääntynyt kaupankäynti + aktiiviset kopiot + pääomavirtojen keskeyttäminen, on vaikea olla epäilemättä, että jotkut kopioijat käyttävät tilaisuutta hyväkseen lähettääkseen, joten kokonaisuus on edelleen hieman varovaisempi kopioiden suhteen, yhdistettynä edelliseen markkinavaiheeseen, #BTC trendi ei ole vielä saavuttanut käännevaihetta ja superpositio on laskemassa korkoja, jos se on edelleen 25 peruspisteen koronlasku, millaista markkinapalautetta Sell the news tuo?

8,72K

Nykyisillä makromarkkinoilla on kaksi päätarinaa:

1. Japanin pääministeri Shigeru Ishiba ohjasi tuolloin markkinoita vähentämään Japanin mahdollisuutta jatkaa korkojen laskua lokakuussa, ja jeni heikkeni, mikä oli hyvä Yhdysvaltain dollarin omaisuuserille.

2. Bescent julkaisi viikonloppuna odotuksen 800 000 maatalouden ulkopuolisen palkkasumman tietojen tarkistamisesta alaspäin vuodelle 2024, työllisyys voi olla heikompi kuin mitä tällä hetkellä havaitsemme, ja markkinat ovat lisänneet 25 BP:n laskun todennäköisyyttä syys- ja lokakuussa.

Nämä kaksi narratiivia ovat väliaikaisesti lisänneet Yhdysvaltain dollarin omaisuuseriä ja riskimarkkinoita, mutta markkinoilla piilevistä vaaroista ollaan edelleen huolissaan, ja tämän viikon avainasia on vielä nähdä, saavatko inflaatio- ja työllisyystiedot markkinat menettämään luottamuksensa Yhdysvaltain talouteen!

Cato_KT19 tuntia sitten

8. syyskuuta - 12. syyskuuta makrotapahtumat:

Tämän viikon makroteema: Fedin valvonta, inflaatioviikko, työllisyystietojen tarkistus alaspäin, Yhdysvaltain pitkäaikaisten joukkovelkakirjojen huutokauppa!

Tiistai, 9. syyskuuta,

22:00, Yhdysvaltojen maatalouden ulkopuolisten palkkasumman vertailuarvon muutoksen alustava arvo vuonna 2025 (10 000 henkilöä)

Tulkinta: Tämän viikon keskeiset tiedot, maatalouden ulkopuolisten palkkojen vertailuarvon muutos, lasketaan kahdesti vuodessa, mikä on viime vuoden työllisyyshistoriatietojen tarkistus, jonka alkuperäinen arvo on syyskuussa ja lopullinen arvo seuraavan vuoden helmikuussa. Viikonloppuna Bencent on sanonut, että työllisyystietoja saatetaan tarkentaa alaspäin 800 000:lla, mikä ylittää selvästi nykyiset odotukset, ja jos tiedot ovat linjassa, se tarkoittaa, että työllisyystilanne vuonna 2024 on kiihdyttänyt laskuaan, ja yhdistettynä viimeaikaiseen työllisyystilanteeseen työllisyystietojen kriisin tunne kasvaa entisestään.

Keskiviikko, 10. syyskuuta,

20:30 Yhdysvaltain elokuun PPI-tiedot,

Tulkinta: Alun perin PPI-tiedot julkistettiin kuluttajahintaindeksitietojen julkaisemisen jälkeen, jotta markkinat näkivät syvästi tarjontapuolen inflaatiopaineen markkinoilla, mutta tämä kuukausi on erityinen, PPI julkaistiin ennen kuluttajahintaindeksiä, ja tällä hetkellä odotetaan PPI:n pysyvän ennallaan vuodentakaiseen verrattuna ja heikkenevän merkittävästi kuukausittain. Jos seurantatiedot kuitenkin osoittavat, että inflaatio tapahtuu kuluttajapuolella, se voi laukaista kuluttajapuolen paineen riskin eli kulutuksen hidastumisen ja stagflaation!

22:00 Heinäkuun tukku- ja vähittäismyyntitiedot

Tulkinta: Tiedot ovat markkinoiden kysyntäpuolen johtava signaali, joka osoittaa pääasiassa yrityshankintojen tason, tiedot osoittavat yritysten hankintojen ja varaston paineen, jos tiedot nousevat, se osoittaa, että yrityshankinnat ovat lisääntyneet, mikä tarkoittaa, että kuluttajapuoli on vahva, päinvastoin, yritysten varastopaine on suurempi ja kulutus hidastuu

Tiedot ovat kuitenkin heinäkuun tietoja, jotka ovat hieman jäljessä, mutta jos tiedot eivät ole hyviä, se voi saada markkinat odottamaan kulutusvoiman laskua elokuussa.

Torstai, 11. syyskuuta,

01:00 Yhdysvaltain 10 vuoden valtion joukkovelkakirjalainojen huutokauppa

Tulkinta: Viime viikolla maailmanlaajuinen pitkäaikaisten joukkovelkakirjojen myynti toi markkinoille lyhyellä aikavälillä paineita, ja tämän viikon Yhdysvaltain 10 vuoden joukkovelkakirjahuutokaupassa korot laskivat riippuen markkinoiden kysyntätilanteesta ja siitä, laajeneeko joukkovelkakirjamarkkinoiden riskialttius.

20:30 Yhdysvaltain kuluttajahintaindeksin tiedot elokuussa

Tulkinta: Tällä hetkellä inflaation odotetaan elpyvän, mutta markkinat ovat viime aikoina käyneet työmarkkinoiden riskihuolissa, eikä syyskuun koronlaskun todennäköisyydestä toistaiseksi tarvitse olla huolissaan, mutta luottamusta koronlaskuihin on mahdollista heikentää asianmukaisesti

Mutta tämän viikon painopiste on siinä, että kun inflaatio elpyy ja työllisyystiedot ovat niin synkkiä, voiko Fedin syyskuun koronlasku tehokkaasti välttää taloudelliset riskit? Se on keskustelun pointti. Jos et ole varovainen, stagflaatiotaantuman mahdollisuus kasvaa huomattavasti, jos markkinat odottavat sitä.

Siksi tämän viikon kuluttajahintaindeksi on tämän viikon makrotietojen suurin riskipiste.

Perjantai, 12. syyskuuta,

01:00 30-vuotinen Yhdysvaltain valtiovarainministeriön huutokauppa

Tulkinta: Yhdysvaltain 10-vuotisen valtiovarainministeriön huutokaupan mukaisesti se riippuu siitä, aiheuttaako 30 vuoden pitkäaikaisten joukkovelkakirjojen huutokauppa huolta maailmanlaajuisten joukkovelkakirjamarkkinoiden myynnin jälkeen.

Yleinen yhteenveto:

Maatalouden ulkopuolisten palkkatietojen jyrkän mukauttamisen edessä työmarkkinoiden luottamus joutuu koetukselle, ja inflaatiotietojen vaikutus on tulevaisuudessa, tämän viikon painopisteenä on, kuinka välttää markkinoiden stagflaation ja taantumahuolien laukaiseminen.

Miten markkinoiden pitäisi reagoida 10 vuoden ja 30 vuoden joukkovelkakirjamarkkinoiden huutokauppaan, jos joukkovelkakirjamarkkinoiden huutokauppa on selvästi heikko

Tällä hetkellä on monia riskipisteitä, ei paljon hyviä puolia, tämä viikko on miinanraivausvaihe, askel askeleelta, markkinat toipuvat sentimentaalisesti.

Toinen asia, Fedin valvonta!

Viime viikonloppuna Yhdysvaltain senaatti muutti lakiesitystä väliaikaisesti nopeuttaakseen presidentin nimitys- ja nimitysprosessia, mikä tarkoittaa, että Trumpin ehdokkaan Stephen Millanin vahvistusprosessia, jonka oli alun perin tarkoitus tapahtua seuraavan yhden tai kahden viikon aikana, nopeutetaan.

Senaatin vahvistusprosessille ei tällä hetkellä ole keskeistä aikataulua, mutta se, että senaatti voi muuttaa sääntöjä prosessin nopeuttamiseksi, näyttää saavan paljon tukea, mikä lisää huomattavasti Milanin hyväksyttävyyttä, ja tämä viikko saattaa olla painopiste.

Kokonaisarvio:

Ennen 17. syyskuuta pidettävää ohjauskorkokokousta viimeiset kaksi viikkoa eivät ole olleet kovin hyviä, kaikenlaista dataa, kaikenlaisia uutisia, kaikenlaisia analyyseja ja markkinaohjeita, tällä hetkellä nähdä enemmän, kuunnella enemmän ja liikkua vähemmän!

13,9K

8. syyskuuta - 12. syyskuuta makrotapahtumat:

Tämän viikon makroteema: Fedin valvonta, inflaatioviikko, työllisyystietojen tarkistus alaspäin, Yhdysvaltain pitkäaikaisten joukkovelkakirjojen huutokauppa!

Tiistai, 9. syyskuuta,

22:00, Yhdysvaltojen maatalouden ulkopuolisten palkkasumman vertailuarvon muutoksen alustava arvo vuonna 2025 (10 000 henkilöä)

Tulkinta: Tämän viikon keskeiset tiedot, maatalouden ulkopuolisten palkkojen vertailuarvon muutos, lasketaan kahdesti vuodessa, mikä on viime vuoden työllisyyshistoriatietojen tarkistus, jonka alkuperäinen arvo on syyskuussa ja lopullinen arvo seuraavan vuoden helmikuussa. Viikonloppuna Bencent on sanonut, että työllisyystietoja saatetaan tarkentaa alaspäin 800 000:lla, mikä ylittää selvästi nykyiset odotukset, ja jos tiedot ovat linjassa, se tarkoittaa, että työllisyystilanne vuonna 2024 on kiihdyttänyt laskuaan, ja yhdistettynä viimeaikaiseen työllisyystilanteeseen työllisyystietojen kriisin tunne kasvaa entisestään.

Keskiviikko, 10. syyskuuta,

20:30 Yhdysvaltain elokuun PPI-tiedot,

Tulkinta: Alun perin PPI-tiedot julkistettiin kuluttajahintaindeksitietojen julkaisemisen jälkeen, jotta markkinat näkivät syvästi tarjontapuolen inflaatiopaineen markkinoilla, mutta tämä kuukausi on erityinen, PPI julkaistiin ennen kuluttajahintaindeksiä, ja tällä hetkellä odotetaan PPI:n pysyvän ennallaan vuodentakaiseen verrattuna ja heikkenevän merkittävästi kuukausittain. Jos seurantatiedot kuitenkin osoittavat, että inflaatio tapahtuu kuluttajapuolella, se voi laukaista kuluttajapuolen paineen riskin eli kulutuksen hidastumisen ja stagflaation!

22:00 Heinäkuun tukku- ja vähittäismyyntitiedot

Tulkinta: Tiedot ovat markkinoiden kysyntäpuolen johtava signaali, joka osoittaa pääasiassa yrityshankintojen tason, tiedot osoittavat yritysten hankintojen ja varaston paineen, jos tiedot nousevat, se osoittaa, että yrityshankinnat ovat lisääntyneet, mikä tarkoittaa, että kuluttajapuoli on vahva, päinvastoin, yritysten varastopaine on suurempi ja kulutus hidastuu

Tiedot ovat kuitenkin heinäkuun tietoja, jotka ovat hieman jäljessä, mutta jos tiedot eivät ole hyviä, se voi saada markkinat odottamaan kulutusvoiman laskua elokuussa.

Torstai, 11. syyskuuta,

01:00 Yhdysvaltain 10 vuoden valtion joukkovelkakirjalainojen huutokauppa

Tulkinta: Viime viikolla maailmanlaajuinen pitkäaikaisten joukkovelkakirjojen myynti toi markkinoille lyhyellä aikavälillä paineita, ja tämän viikon Yhdysvaltain 10 vuoden joukkovelkakirjahuutokaupassa korot laskivat riippuen markkinoiden kysyntätilanteesta ja siitä, laajeneeko joukkovelkakirjamarkkinoiden riskialttius.

20:30 Yhdysvaltain kuluttajahintaindeksin tiedot elokuussa

Tulkinta: Tällä hetkellä inflaation odotetaan elpyvän, mutta markkinat ovat viime aikoina käyneet työmarkkinoiden riskihuolissa, eikä syyskuun koronlaskun todennäköisyydestä toistaiseksi tarvitse olla huolissaan, mutta luottamusta koronlaskuihin on mahdollista heikentää asianmukaisesti

Mutta tämän viikon painopiste on siinä, että kun inflaatio elpyy ja työllisyystiedot ovat niin synkkiä, voiko Fedin syyskuun koronlasku tehokkaasti välttää taloudelliset riskit? Se on keskustelun pointti. Jos et ole varovainen, stagflaatiotaantuman mahdollisuus kasvaa huomattavasti, jos markkinat odottavat sitä.

Siksi tämän viikon kuluttajahintaindeksi on tämän viikon makrotietojen suurin riskipiste.

Perjantai, 12. syyskuuta,

01:00 30-vuotinen Yhdysvaltain valtiovarainministeriön huutokauppa

Tulkinta: Yhdysvaltain 10-vuotisen valtiovarainministeriön huutokaupan mukaisesti se riippuu siitä, aiheuttaako 30 vuoden pitkäaikaisten joukkovelkakirjojen huutokauppa huolta maailmanlaajuisten joukkovelkakirjamarkkinoiden myynnin jälkeen.

Yleinen yhteenveto:

Maatalouden ulkopuolisten palkkatietojen jyrkän mukauttamisen edessä työmarkkinoiden luottamus joutuu koetukselle, ja inflaatiotietojen vaikutus on tulevaisuudessa, tämän viikon painopisteenä on, kuinka välttää markkinoiden stagflaation ja taantumahuolien laukaiseminen.

Miten markkinoiden pitäisi reagoida 10 vuoden ja 30 vuoden joukkovelkakirjamarkkinoiden huutokauppaan, jos joukkovelkakirjamarkkinoiden huutokauppa on selvästi heikko

Tällä hetkellä on monia riskipisteitä, ei paljon hyviä puolia, tämä viikko on miinanraivausvaihe, askel askeleelta, markkinat toipuvat sentimentaalisesti.

Toinen asia, Fedin valvonta!

Viime viikonloppuna Yhdysvaltain senaatti muutti lakiesitystä väliaikaisesti nopeuttaakseen presidentin nimitys- ja nimitysprosessia, mikä tarkoittaa, että Trumpin ehdokkaan Stephen Millanin vahvistusprosessia, jonka oli alun perin tarkoitus tapahtua seuraavan yhden tai kahden viikon aikana, nopeutetaan.

Senaatin vahvistusprosessille ei tällä hetkellä ole keskeistä aikataulua, mutta se, että senaatti voi muuttaa sääntöjä prosessin nopeuttamiseksi, näyttää saavan paljon tukea, mikä lisää huomattavasti Milanin hyväksyttävyyttä, ja tämä viikko saattaa olla painopiste.

Kokonaisarvio:

Ennen 17. syyskuuta pidettävää ohjauskorkokokousta viimeiset kaksi viikkoa eivät ole olleet kovin hyviä, kaikenlaista dataa, kaikenlaisia uutisia, kaikenlaisia analyyseja ja markkinaohjeita, tällä hetkellä nähdä enemmän, kuunnella enemmän ja liikkua vähemmän!

Cato_KT1.9. klo 09.05

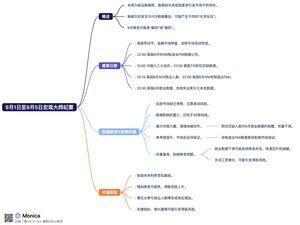

1. syyskuuta - 5. syyskuuta Macro Master -pöytäkirjat:

Tämä viikko on työllisyystietoviikko, näennäisesti yksinkertaiset tiedot, yhdistettynä erilaisiin muihin tietotekijöihin, laukaisevat erilaisia markkinasuuntautumisia

Varsinkin Powellin Jackson Holen konferenssissa pitämän puheen jälkeen, joka on asetettu viime perjantain PCE-tietojen päälle, tämän viikon työllisyystiedot tuottavat erilaisen "kemiallisen reaktion"

Mikä kaava, mikä suhde, vaikutus on erilainen, onko syyskuun koronlasku "vastalääke" vai "myrkky", tällä viikolla on selkeämpi suunta

Kun "suurten ei-maataloustietojen" luottohyväksyntä on heikentynyt, odottaa varmistusta, aiheuttaako "pienet ei-maataloustiedot" herkän reaktion markkinoilla!

Maanantai, 1. syyskuuta,

Vapunpäivänä Yhdysvalloissa suurin osa rahoitusmarkkinoista on keskeytetty, ja kryptomarkkinat putoavat alhaisemman likviditeetin vaiheeseen, joten sinun on kiinnitettävä huomiota!

Tiistai, syyskuun 2. päivä,

22:00 Yhdysvaltain ISM-teollisuuden ostopäällikkötiedot elokuulta julkaistiin

Keskiviikkona 3. syyskuuta.

10:00 Kiinan kansantasavalta juhlistaa "Kiinan kansan vastarintasodan voiton 80-vuotispäivää Japanin hyökkäystä ja maailman antifasistista sotaa vastaan", 93. kansallinen paraati!

22:00 Yhdysvaltain avoimet työpaikat heinäkuussa

Torstai, 4. syyskuuta,

20:15 Yhdysvaltain ADP-työllisyys elokuussa

22:00 US elokuu ISM:n ei-teollisuuden PMI

Perjantai, 5. syyskuuta,

20:30 USA:n työllisyystiedot elokuulta, mukaan lukien työttömyysaste ja suuret maatalouden ulkopuoliset palkkatiedot

Tietojen tulkinta ja iskupaino:

1. Maanantaina, vapunpäivänä Yhdysvalloissa, kryptomarkkinoilta puuttuu rahoitusmarkkinoiden referenssejä, ja volatiliteettiriskeihin tulisi kiinnittää huomiota alhaisen likviditeetin vaiheessa

2. Tiistain ISM-teollisuuden PMI, tietojen vaikutuspaino on pieni, vaikka odotus on korkeampi kuin edellinen arvo, mutta se on edelleen alle 50 nousu- ja laskuviivan, mikä elvyttää Yhdysvaltain teollisuutta, Trumpin vastuu on "kaukana"!

3. Kiinan 93. sotilasparaati keskiviikkona osoittaa maailmalle Kiinan voiman ja vahvistaa geopoliittista yhteistyötä voimamielenosoitusten avulla.

1) Heinäkuun avoimien työpaikkojen määrä on esimakua elokuun työllisyystiedoista, eikä painoarvo ole suuri.

4. Torstain pienet maatalouden ulkopuoliset palkkatiedot, alun perin pienet maatalouden ulkopuoliset palkkatiedot ja suuret maatalouden ulkopuoliset palkkatiedot suistuivat raiteiltaan yli kahdeksi vuodeksi, mutta koska suurten maatalouden ulkopuolisten palkkatietojen aitous on äskettäin kyseenalaistettu, useat laitokset sanoivat keskittyvänsä viittaamaan pieniin maatalouden ulkopuolisiin palkkatietoihin, mutta markkinoiden vaikutus pienten maatalouden ulkopuolisten palkkatietojen tietoihin voidaan todentaa tällä viikolla.

1) Teollisuuden ulkopuoliset PMI:t eli palvelualojen tiedot, jos tietoero ei ole suuri, vaikutus markkinoihin ei ole suuri, jos tietoero on suuri, se aiheuttaa markkinavaihteluita. Palveluala on tällä hetkellä Yhdysvaltojen pilarisektori, mutta myös tärkein BKT:n kasvua tukeva tekijä, tiedot ovat hyviä, mikä osoittaa, että Yhdysvaltain talous on hyvä, mutta se aiheuttaa huolta inflaatiosta, loppujen lopuksi aiemmat inflaatiotiedot osoittavat palvelualan inflaation tahmeuden, huonot tiedot, vaikka se heikentää inflaatiohuolia, mutta aiheuttaa huolta talouden heikkenemisestä.

5. Perjantaina työttömyysaste ja maatalouden ulkopuoliset palkkatiedot, tämän viikon korkeimmat painotiedot, yksittäisten työllisyystietojen lasku edistää koronlaskujen vauhtia, jos työllisyystiedot elpyvät nopeasti, se hidastaa koronlaskujen vauhtia mahdollisimman pian, mutta jos työllisyystiedot yhdistetään muihin tietoihin, tapahtuu erilainen "kemiallinen" reaktio

Nykyiset työllisyystiedot, työttömyysaste, maatalouden ulkopuoliset palkkasummat ja palkkojen nousu ovat kaikki keskittyneitä, varsinkin jos tiedot ovat nykyisten odotusten mukaisia, palkkojen noususta voi tulla ensisijainen prioriteetti

1) Vakaa talouskasvu + tahmea inflaatio + vakaa työllisyys/kasvu heikentää tulevaa korkokeventämisreittiä, mutta se ei vaikuta merkittävästi syyskuun koronlaskuun.

2) Vakaa talouskasvu + tahmea inflaatio + työllisyyden laskun jatkuminen laukaisee korkean inflaation ja työllisyyden laskun sekä kulutusodotusten heikkenemisen, ja nämä tiedot lisäävät merkittävästi koronlaskujen mahdollisuutta syyskuussa ja jopa odottavat korkojen keventämistä vuonna 2025. Korkea inflaatio + työllisyyden lasku / ostovoiman heikkeneminen voivat kuitenkin laukaista stagflaation riskin.

Jos korkoja lasketaan stagflaatiota odotettaessa, koronlaskut muuttuvat "vastalääkkeestä" "myrkyksi", ja meidän on oltava valppaina!

3) Työttömyysasteen kasvu yhdistettynä maatalouden ulkopuolisiin palkkatietoihin on tarpeen erottaa työttömyysasteen kasvun syy, onko se työllistyvien määrän väheneminen vai yritysten tarjoamien työpaikkojen lisääntyminen, edellinen ei ole hyvä työllisyystietojen kannalta ja jälkimmäinen on hieman lievä.

4) Palkkojen nousu tässä työllisyystietojen ryhmässä on avainasemassa, jos työllisyystiedot ovat odotusten mukaisia, markkinat ovat hyväksyttävät, mutta jos palkkojen nousu on hidasta tai jopa laskevaa, meidän pitäisi olla huolissamme "stagflaation" riskistä taloudessa tulevaisuudessa!

17,49K

Johtavat

Rankkaus

Suosikit