Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Gregoireljda.eth 🍍

Artificia docuit fames l current: loading

P&G reporting :

First year Beauty segment is doing -3.5% (from +3%)

Grooming went from 4% to 0.12%

Health care went from 12% to 1.7%

etc etc

GenEO = refinement of niches

AI is amazing for refinement, fuck generic products and long live the future

Long the picks and shovels

Gregoireljda.eth 🍍29.7.2025

Something which feels not discussed enough is how strong LLMs are at recommending niche and better products to generic high end

Out of my recurring buys, I have refined and specialised all my recurring buys IF I can purchase them online

224

Fastest growing defi app of the summer ?

Terminal Finance14.7.2025

Terminal has hit $100M in pre-deposits in 2 weeks.

With @ethena_labs, @ether_fi and @pendle_fi already onboard, new protocols are joining soon.

9,52K

Babylon was built with dirt

Michael Dell 🇺🇸27.2.2021

I started @DellTech 37 years ago with $1000.

Revenues in 1984 were $6 million.

Last year's revenues were $94.2 billion.

Impossible is nothing.

150

You won't just be crossing the chasm, you'll be venturing in the unknown 🍍

nicola 💾⚛️11.7.2025

Alex and I are on a quest to understand how we can use cryptography beyond digital systems.

What are new trust building blocks that we can build with nature? how can we use cryptography to secure physical interactions?

I am so glad @ARIA_research is the home for this effort

153

@BIS_org i heard they do a better job than you

A7A55.7.2025

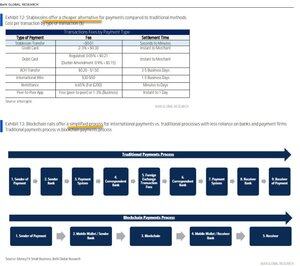

Stablecoin math ► BofA Global Research

• Transfer cost: < $0.01 vs. $0.20–$50 on legacy rails

• Finality: seconds vs. up to 5 days

• Process: 4 hops on-chain instead of 9 in the SWIFT maze

For merchants, exporters, and everyday users that difference isn’t cosmetic, it’s margin, cash-flow, and working capital.

A7A5 brings the same efficiency to regional flows. Move value, not paperwork.

#Stablecoins #BofA #A7A5

72

maintaining OSS finally means you get paid

and it doesn't need to be through a shitcoin airdrop 🍍

Merit Systems3.7.2025

Today, we’re introducing the Terminal.

Pay anyone and any project on Github.

212

It’s a lame move — nothing else to say

Free markets, fair competition and innovation is what serious entrepreneurs *should* stand for

Very disappointed by an entity I’ve respected for a long time

Nick van Eck26.6.2025

Pay to Play

Much has been made about how parts of the crypto industry operate under a “pay to play” model. This is extractive, harms consumers, and creates opacity in markets. Seemingly, that “pay to play” nature has now permeated the regulated intersection of stablecoins and custodians.

Last week an executive from @Anchorage reached out to me offering their “Genius Bill as a Service” product. I declined, stating we are in deep conversations on our own licensure, have been operating compliantly since inception and have deep expertise in regulated financial markets due to our team’s career experience and uniquely deep relationship with State Street and VanEck.

Following that conversation, Anchorage published a piece, “Anchorage Digital Publishes Stablecoin Safety Matrix, Enables Auto-Conversions to Safe Stablecoins.” In it, they state that Anchorage is delisting both USDC and AUSD for safety concerns, while publishing easily verifiable and known factual inaccuracies. Factual inaccuracies that they have known since our initial listing by Anchorage, corrected again by VanEck representatives before publication of the report, and then were still published and have yet to be retracted. “Specifically, we identified elevated concentration risks associated with their issuer structures—something we believe institutions should carefully evaluate.” Ironically, VanEck has served hundreds more institutional clientele for decades longer than Anchorage has existed. As of writing, VanEck manages more money than the aggregate asset value of all stablecoins in existence, with the exception of Tether.

In this report, Anchorage, failed to disclose their economic relationship with Paxos, the issuer of 3 of their top 4 rated stablecoins. Partners of Paxos (ie. Anchorage) earn a revenue share and basis point fee on mints of their stablecoins, and they have a unique preferred agreement where they get ALL of the revenue from those stables if they sit on the Anchorage platform. That relationship is clearly pertinent to potential customers who might read this report. The same Anchorage executive who reached out to me, confirmed two companies were planning to use their “Genius Bill as a Service” product. I surmise they are deemed “safe” stablecoins.

If Anchorage had just delisted USDC and AUSD to prioritize the stablecoins that they have an economic interest in, I would understand it as a business decision. Private businesses can and should act in their own interests.

But attempting to delegitimize AUSD and USDC for “security concerns”, while knowingly publishing false information, is unserious and bizarre.

So let me reiterate and categorize the errors about AUSD: State Street is the cash custodian and fund administrator of The Agora Reserve Fund. VanEck, a $100B+ asset manager, is the investment manager of The Agora Reserve Fund. Anchorage has known this since initial listing and that was confirmed again by VanEck representatives before publication. By their own matrix AUSD should receive a score similar to or better than USDG if the framework was applied uniformly.

I’m sure that Circle, the issuer of USDC, also has similar inaccuracies to correct and claiming that USDC is less safe than USDT, USDG, PYUSD, and USDP clearly belies their true intentions. Circle is a publicly traded company on the NYSE with many years of audited financials and transparency.

As the pioneers of the open-partner framework, Agora is constantly expanding our network of support. At Agora, we endeavor to always be the most transparent, customer driven, programmable money that serves a global customer base. We are underdogs, relish the fight, and will never pay to play.

Nick van Eck

CEO and Co-Founder of Agora

26,02K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin