Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

If you're a literate in DeFi you know how hard it is to provide concentrated liquidity in a tight range for a yield-bearing asset like sUSDe or wstETH

As the price of one asset moves up consistently you will get yield-derived impermanent loss

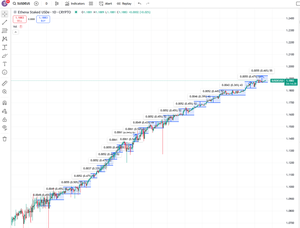

The image below shows how many times you would have to rebalance your LP during the last year if doing ~0.4% range around the price. At 10% underlying APR you'd have to rebalance ~20 times

It also means that a lot of the time (at the end of your ranges) a large of your position would be in the non-yield-bearing asset which would give you less base APR

And every time you'd have to move the range you'll have a small yield-derive IL, in addition to swap fees for buying back sUSDe to LP in the next range

This is difficult for all market participants, and leads to people adding wider LP ranges, which means we get sub-optimal onchain liqudity for many yield bearing assets

✅ Redeemable tokens

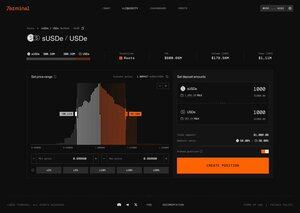

@Terminal_fi is a DEX that is building a solution for exactly this problem with "Redeemable Tokens". A token that wrap around a yield-bearing token, but peg their value to the non-yield-bearing counterpart

The Redeemable Token will gradually inflate in supply in line with the yield-bearing tokens price appreciation

This is best explained with an example.

Let's say we have sUSDe from @ethena_labs

If you deposited 100 sUSDe when price was $1 you'd mint 100 rUSDe.

Then price of sUSDe increased to $1.5

You'd be able to claim an additional $50 rUSDe for $150 in total

This means that rUSDe would be pegged 1:1 with USDe, but users can burn the rUSDe to get back sUSDe at the current sUSDe:USDe price

Because USDe is a non-yield-bearing stablecoin that means rUSDe is also a non-yield-bearing stablecoin

Sounds complex? Don't worry, its all abstracted away in the protocol and you as a user never have to see the rUSDe...

Top

Ranking

Favorites