Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

What is driving the drawdown in Bitcoin?

When you stop listening to Bitcoin pundits and start listening to what Bitcoin is saying about itself, then you will see the real truth

I am going to lay out the 3 major things you need to watch for Bitcoin right now 🧵

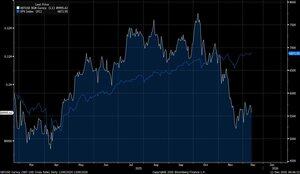

Bitcoin primarily has a positive correlation with risk assets. This is Bitcoin telling you that it has a high sensitivity to flows into risk assets (bottom panel shows correlation with SPX). Bitcoin speaks and doesn't need anyone to speak for it as a decentralized network.

Bitcoin has deviated from equity indices recently because it has a high sensitivity to changes in macro liquidity and the risk curve. What is driving this right now? This brings us to the second point.

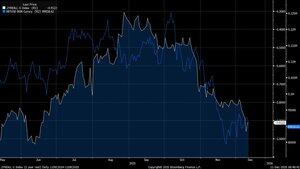

Second, Bitcoin is currently being driven by the changes in real interest rates. Even if the Fed cuts rates, the entire question is how is this input driving liquidity ON NET. The chart below shows 2 year real interest rates inverted with BTC overlaid. Notice the changes in real rates are moving in lockstep with BTC.

If you are trying to understand HOW real rates drive equities and risk assets, this is how they work:

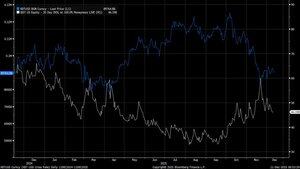

The third thing to watch is how positioning is pricing downside and pushing around hedging pressure.

Notice the implied volatility in IBIT has come down marginally as Bitcoin is consolidating. We are still seeing the Bitcoin proxy plays fall marginally, which shows how the market is accepting Bitcoin.

In simple terms, all of the people that hold all of the capital put up and take down risk across ALL BTC proxies at the same time. So we need to see BTC proxy plays OUTPERFORM Bitcoin for a durable move out the risk curve.

Watching all of the BTC-connected public equities will be key

As I will say over and over, if you truly believe in Bitcoin's decentralized ability, then you will listen to it. Bitcoin will tell you everything you need to know about it via the price.

👀

73.68K

Top

Ranking

Favorites