Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Today we are introducing the 📊 Pantera DATBoard 🧮

👉

DATs have exploded into mainstream conversation — but most analysis still revolves around a single number: mNAV.

We think that’s incomplete and DATs are heavily misunderstood.

A thread 🧵:

We believe the right framework to evaluate DATs is two-fold:

1️⃣ separate fundamental compounding from market sentiment

2️⃣ measure how management behaves in reflexive cycles.

1) Price movement shall be decomposed into independent factors — underlying crypto growth, crypto-per-share accretion, and sentiment multiple — this will help us see thru noises and track real value growth outside market condition.

2) DATs live and die by issuance discipline.

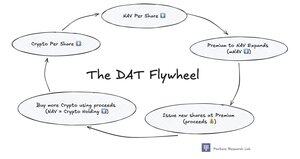

The “DAT flywheel” works only when companies raise capital cautiously at premiums to grow their crypto treasury, and defend per-share value when market sentiment drops below NAV.

And data can tell us who’s operating responsibly — and who’s diluting blindly.

There has undoubtedly been overhype around DATs. A DAT built on an underlying asset without real fundamental value is unlikely to sustain its own, and the dozens of DATs created for the same asset without differentiated treasury or asset-management strategy won’t fare much better.

Yet we believe DATs remain a meaningful financial innovation — enabling institutional investors to gain regulated exposure to digital assets with flexible yield strategies, while also serving as a second foundation for those assets to accrue value through disciplined, transparent capital formation.

Last but not least, shoutouts to great DAT trackers from @Blockworks_ @artemis @DefiLlama as the major inspiration, kudos to the fight in the same trenches with all these data challenges!

26.65K

Top

Ranking

Favorites