Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Oba

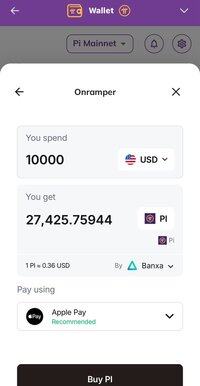

Pi previously launched a wallet that allowed direct fiat purchases through Banxa, leading to the emergence of spot whales and causing a rapid surge on July 28.

Now, Pi has introduced a second platform, TransFi, that offers fiat purchasing services.

The purpose of launching these two platforms is to serve users from different countries, as not everyone can use Banxa. Importantly, this time, TransFi is aimed at the European community.

TransFi is a platform providing fiat exchange services in Lithuania. Following the impact of Banxa, the current purchase price of Pi on TransFi is 0.1 higher than on exchanges. Yes, you read that right; the exchange price is currently 0.35, while TransFi's purchase price is 0.45.

Will this entry into the European fiat market lead to another wave of spot whale buying? Let's wait and see.

On-chain prices are generally rising. As previously explained, exchange prices are merely private contracts, similar to game prices within a private game; they cannot correspond to external fiat prices because they are private contract prices.

Therefore, there will currently be two types of prices, which may even be completely contradictory, creating a high premium space. When retail investors sell at exchange prices thinking they reflect on-chain Pi prices, they are voluntarily choosing to sell at a low price within someone else's private contract.

If the exchange price is 0.1 and the on-chain price is 0.5, and an investor chooses to sell at the exchange price of 0.1, that is their own business. We just need to wait for fiat exchanges to become more complete; once on-chain DeFi is launched, exchange prices will no longer be manipulable.

Currently, most retail investors, due to not knowing how to check on-chain prices, have no choice but to use exchange prices for pricing.

In reality, once someone launches an on-chain price K-line chart, it will reveal that the private contract prices on exchanges are all manipulated deceptive prices.

Once everyone knows to look at on-chain prices, exchange prices will quickly become obsolete.

Just like using USD, where the external price is pegged at 1:1 with USDT, why would anyone want to sell their USDT at 0.1 in a private contract?

This highlights the difference between on-chain prices and exchange private contract prices, which allows uninformed investors to be manipulated into selling at low prices.

Currently, the price of Pi must be based on the value of foreign exchange fiat on-chain conversion. Stop looking at exchange prices; you can sell to others at a price slightly lower than the on-chain price. Why would you want to sell at a low exchange price?

Manipulation by others is their business; we only use on-chain prices.

Withdraw Pi from exchanges to reduce the manipulation of borrowing whales in private contracts.

Oba22.7.2025

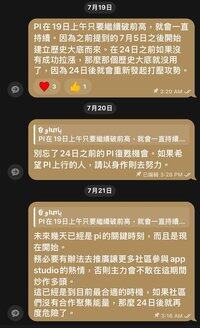

After PI mentioned the historical bottom mentioned earlier on the 19th, the most important speculation was mostly before the 24th. Now on the 22nd, it is pulling up one!

What is special this time is that as long as there is a rise in history, borrowing whales will quickly borrow millions of PI to sell and suppress.

However, this time, since the 19th, the borrowing whales have only repurchased and returned the currency, and the sellers are all retail investors who hold a large number of coins.

"And after pulling the market this morning, the borrowing whale borrowed 60 PI at 10 a.m., and it was all returned in less than four hours."

Whales definitely know what is going on with the PCT, otherwise they would not have dared to borrow a lot of money to suppress PI since this period of history

#PI

#pi

18,41K

Pi friends, hurry up and transfer your Pi to the exchange's staking balance, so we can see the price of 0.1 yuan faster.

The borrowing whales have already borrowed over ten million Pi from investors and sold them on the market.

Hurry up and stake all your Pi on the exchange to see 0.1 faster.

Whales are getting rich!

#PI

#pi

Oba2.8. klo 07.37

市場投資人不願重視借幣鯨魚一次借幣一百萬顆藍代替你拋售。

Market investors are reluctant to pay attention to borrowing whales who borrow 1 million LAN at once to sell on your behalf.

Just now, a borrowing whale seized the opportunity, borrowing 1.9 million PI from an exchange to sell on your behalf.

Yet, it’s clear the market will blame PCT for this issue again, and the bad actors will ultimately go unpunished. Because those staking on exchanges are complicit in the selling.

If community investors are unwilling to confront borrowing whales, they have no right to complain.

Should we demand that PCT ban exchanges from offering borrowing functions, and revoke their KYB status if they provide such functions?

If the community fails to consistently respond to countering whales, just wait for 0.1 to arrive.

在剛剛的借幣鯨魚逮到機會,從交易所一次借入190萬顆pi來代替你拋售。

然而可知市場又會將這個問題怪罪PCT,壞人終究不會受到懲罰。因為質押在交易所的人都是拋售的共犯。

如果社區投資人不願採取對抗借幣鯨魚,那麼就沒資格抱怨。

是否應要求PCT禁止交易所提供借幣功能,如果使用借幣功能應下架其KYB資格。

如果社區才不長期響應對抗鯨魚,就等著0.1的到來。

#PI

#pi

40,05K

市場投資人不願重視借幣鯨魚一次借幣一百萬顆藍代替你拋售。

Market investors are reluctant to pay attention to borrowing whales who borrow 1 million LAN at once to sell on your behalf.

Just now, a borrowing whale seized the opportunity, borrowing 1.9 million PI from an exchange to sell on your behalf.

Yet, it’s clear the market will blame PCT for this issue again, and the bad actors will ultimately go unpunished. Because those staking on exchanges are complicit in the selling.

If community investors are unwilling to confront borrowing whales, they have no right to complain.

Should we demand that PCT ban exchanges from offering borrowing functions, and revoke their KYB status if they provide such functions?

If the community fails to consistently respond to countering whales, just wait for 0.1 to arrive.

在剛剛的借幣鯨魚逮到機會,從交易所一次借入190萬顆pi來代替你拋售。

然而可知市場又會將這個問題怪罪PCT,壞人終究不會受到懲罰。因為質押在交易所的人都是拋售的共犯。

如果社區投資人不願採取對抗借幣鯨魚,那麼就沒資格抱怨。

是否應要求PCT禁止交易所提供借幣功能,如果使用借幣功能應下架其KYB資格。

如果社區才不長期響應對抗鯨魚,就等著0.1的到來。

#PI

#pi

65,72K

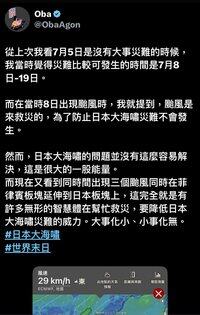

At that time, I thought that the appearance of three typhoons in Asia was a sign that an invisible intelligence was helping with disaster relief on the tectonic plate where the earthquake was rumored to occur on July 5th.

Later, I saw a future person appear at this time warning to be careful; he must be revealing some terrifying things.

As expected, the earthquake did not erupt in the South China Sea near Japan. If it weren't for these high-intelligence beings helping with disaster relief, billions of people might have already been gone from this world.

All signs indicated that the earthquake was redirected to a place affecting the fewest people, reducing the originally predicted 46-meter tsunami to only a 4-meter tsunami.

I am grateful to these invisible intelligences for giving us the opportunity to survive. I think humanity needs to do more; otherwise, disaster relief would be meaningless.

In Taiwan, many century-old temples dedicated to deities, especially those related to the sea, were destroyed during the typhoon. So many disasters have occurred, yet so many have never fallen.

These invisible intelligences are saving the lives of billions.

9922B821.7.2025

That was close, that was close. I came to pick up something I forgot. I managed to find it.

1,82K

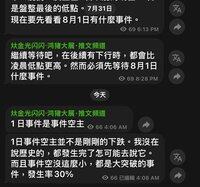

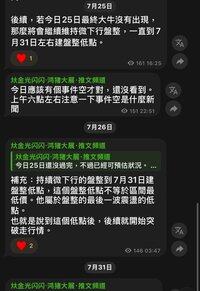

BTC has been mentioned since the article on the 31st to pay attention to the event on August 1st, and later it was noted in the early morning that the 1st is an event void.

Later, we could see that in the morning, the tariff news released by Trump caused BTC to hit a new low, and this influence will last until the evening.

However, this is not some unexpected major event, but rather something planned by the main players, so it remains in the consolidation zone.

#btc

Oba1.8. klo 01.27

I haven't posted about BTC in a long time, why?

Most of the analysis online is either bullish or bearish, gambling every day.

But here, I clearly stated on the 25th that it would be a slight downward consolidation until the 31st.

As you can see, the price has been moving along here. Whenever I mentioned long-term consolidation while out having fun, there was never any market movement.

I don't really care what others think about the market.

#BTC

13,68K

In the past, I started sharing a pi message with investors from April, urging them to collaborate within their communities to combat lending whales.

Later, GCV also recognized this matter and assisted in promoting it. However, the market has a very short memory; as long as no one takes over to do long-term promotion, ultimately, the demons will prevail.

Last night at 8 PM, I began mentioning the lending whales that would appear from midnight, and at 12 AM, I noted that the lending whales would show up between 6 AM and 9 AM.

Subsequently, we could see the whales starting to borrow nearly 1.8 million pi continuously at 6 AM to dump the market.

When whales dump, it is because investors, in pursuit of small staking profits, become accomplices in assisting the whales in suppressing the price.

Stop blaming investors for selling; it is not the investors selling, but you, who are staking, are assisting in suppressing pi. Blame yourself.

If investors do not establish a long-term consensus to promote not staking pi, then the lending whales will always sell on your behalf.

#PI

#pi

Oba4.5.2025

Whales borrowing PI are borrowing millions of PI at a time from the lending pool to sell them on your behalf.

Thank you to GCV for taking this issue seriously and actively promoting it.

Do not stake Pi on exchanges or use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

Thanks to GCV for also taking this issue seriously and promoting it.

Don't stake your PI on the exchange, and don't use your remaining coins, because whales are borrowing millions of PI at a time from the lending pool to sell them on your behalf.

You are bullish on PI and invest in PI in the hope that the price will rise in order to make a profit. However, the more you stake, the lower the price will be for you to be held down by the whales.

Most people think that the investment is long-term, and they expect the ecology to consume the cost of merchants for a long time to carry the price for you. Merchants are unable to resist long-term price losses, and will eventually withdraw completely, and the ecology will collapse.

Just as the price of PI is now lower than the electricity bill, then miners do not need to pay 1 yuan to the power plant to get 0.5 yuan of PI.

Smart people know that you can get 1pi by buying PI directly, why halve it yourself. As a result, the miners will also collapse and eventually the ecology will die.

Ways to fight whales:

1. Don't stake PI on exchanges. Don't use Remaining Coin Treasure to stake PI.

2. Clear the exchange's loan pool. The low yield of 1% APY is converted to 34% mining growth rate.

3. Whenever you see a whale borrowing PI and selling it from the data, it is an opportunity to buy at a low price. Let's agree to buy at a low price, pull up the price, and let the whale lose money.

#pi

67,7K

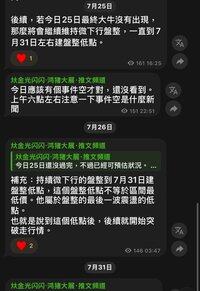

I haven't posted about BTC in a long time, why?

Most of the analysis online is either bullish or bearish, gambling every day.

But here, I clearly stated on the 25th that it would be a slight downward consolidation until the 31st.

As you can see, the price has been moving along here. Whenever I mentioned long-term consolidation while out having fun, there was never any market movement.

I don't really care what others think about the market.

#BTC

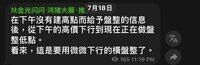

Oba27.7.2025

BTC has been mentioned since the 18th about undergoing a slight downward consolidation.

It has been said until today, the 27th, and the market trend has been observed, showing a slight downward consolidation, with the price still in the same position.

However, during this period, I believe everyone has felt that the various communities in the market have been very exciting. Big shorts are shorting, big longs are longing, liquidations are happening, and there are those who are regretting.

Is this the unpredictability of the world? No, this is the cycle of cause and effect.

#BTC

8,88K

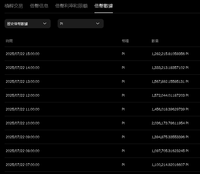

Since the launch of the Pi wallet, which allows direct purchases of Pi within the wallet, the subsequent trends in relation to foreign exchange conditions are as follows based on the logic mentioned earlier:

The attached chart shows the trends of EUR/USD and PI/USDT.

As mentioned earlier, since the wallet provides fiat liquidity, a decline is observed in the non-USD foreign exchange series, while an increase is related to Pi supply.

Thus, we can see a correlation in this downward trend.

Before 8 PM on the 30th, both reached their low points at the same time.

The timing of the high point at 2 AM and the low point at 3 AM on the 31st is also the same.

Subsequently, as we approach 9 AM on the 31st, the increase in Pi is related to the sum of foreign exchange and Pi buy orders, which is why Pi experienced a rise greater than EUR. This completely aligns with the speculative logic.

Why is it different after 9 AM on the 31st?

Because the increase is due to foreign exchange plus Pi, and since there are more buy orders for Pi, after the buy orders end, it will automatically balance the price based on the liquidity constant formula, thus the comparison from 3 PM to 1 PM is the same.

Conclusion: According to the logic from the previous article, it is very consistent that the decline is related to foreign exchange, while the increase is related to Pi supply, which is foreign exchange plus Pi buy orders.

It should be understood that this means whenever there is positive news about Pi, the trend will be very vigorous.

Some may raise a question: If the upward trend is vigorous, can the downward trend also be vigorous?

To clarify, the downward vigor is when Pi investors sell on the exchange, which reflects the exchange price. As explained in the previous article, the on-chain price is completely independent of the exchange; the exchange price is a private trading market, akin to the price of an in-game item, unrelated to on-chain currency or fiat.

A decline in exchange price will not affect the on-chain price, as there is no sell button on-chain; it is entirely based on a large foreign exchange reserve for liquidity.

#PI

#pi

Oba29.7.2025

To the vast number of pi users, I have a question for everyone:

What do you think about the following views?

1. The pi wallet can only purchase pi using fiat currency through card payments, while banza can be said to merely assist in selling pi and help investors from a hundred countries use their local fiat currencies to exchange for pi.

2. Therefore, when investors receive the pi sold on consignment,

banza receives fiat currency from a hundred countries, assists in converting it to USD, and then returns the USD to the suppliers providing pi.

3. Thus, it can be understood that the pi wallet generates its own on-chain price based on independent on-chain liquidity, which is unrelated to exchange prices.

4. Therefore, the pi wallet only has the function to purchase from an independent on-chain liquidity pool, which consists solely of fiat/pi. There is only a purchasing function, with no selling function. Hence, it can be inferred that the price fluctuations of pi come from foreign exchange. For example, pi/USD, pi/EUR, pi/RMB, pi/JPY, pi/AUD.

It is known that all foreign exchange is based on USD as the settlement benchmark, so it can be understood that since the wallet only has a purchasing function, the only way to cause a decline in the on-chain price of pi is through fluctuations in a basket of foreign exchange. However, the fluctuations in foreign exchange are very small, so any decline will also be very small.

On the other hand, the liquidity suppliers for pi seem to come from exchange supplies, but the exchange only supplies pi, which is unrelated to the price of pi within the exchange. Therefore, there will be two prices generated here: one is the on-chain price, and the other is the price of pi on the centralized exchange itself.

5. From the above, it can be understood that when all the on-chain pi is bought out and liquidity decreases, the constant liquidity multiplication formula will automatically balance the dual currency prices, resulting in an increase in the on-chain pi price.

*Here comes the question: How do you view the situation where the on-chain pi price and the exchange price may differ significantly?

Because the exchange price can be manipulated, but the on-chain pi price is based on a basket of fiat currencies, and there is no function to sell pi for fiat on-chain. There is also no pi/usdt pool on-chain. Therefore, the on-chain pi price is unlikely to drop significantly.

Have you ever thought about the scenario where the on-chain pi price is 0.45, while the exchange price is manipulated to 0.1?

What are your thoughts on this?

119,33K

To the vast number of pi users, I have a question for everyone:

What do you think about the following views?

1. The pi wallet can only purchase pi using fiat currency through card payments, while banza can be said to merely assist in selling pi and help investors from a hundred countries use their local fiat currencies to exchange for pi.

2. Therefore, when investors receive the pi sold on consignment,

banza receives fiat currency from a hundred countries, assists in converting it to USD, and then returns the USD to the suppliers providing pi.

3. Thus, it can be understood that the pi wallet generates its own on-chain price based on independent on-chain liquidity, which is unrelated to exchange prices.

4. Therefore, the pi wallet only has the function to purchase from an independent on-chain liquidity pool, which consists solely of fiat/pi. There is only a purchasing function, with no selling function. Hence, it can be inferred that the price fluctuations of pi come from foreign exchange. For example, pi/USD, pi/EUR, pi/RMB, pi/JPY, pi/AUD.

It is known that all foreign exchange is based on USD as the settlement benchmark, so it can be understood that since the wallet only has a purchasing function, the only way to cause a decline in the on-chain price of pi is through fluctuations in a basket of foreign exchange. However, the fluctuations in foreign exchange are very small, so any decline will also be very small.

On the other hand, the liquidity suppliers for pi seem to come from exchange supplies, but the exchange only supplies pi, which is unrelated to the price of pi within the exchange. Therefore, there will be two prices generated here: one is the on-chain price, and the other is the price of pi on the centralized exchange itself.

5. From the above, it can be understood that when all the on-chain pi is bought out and liquidity decreases, the constant liquidity multiplication formula will automatically balance the dual currency prices, resulting in an increase in the on-chain pi price.

*Here comes the question: How do you view the situation where the on-chain pi price and the exchange price may differ significantly?

Because the exchange price can be manipulated, but the on-chain pi price is based on a basket of fiat currencies, and there is no function to sell pi for fiat on-chain. There is also no pi/usdt pool on-chain. Therefore, the on-chain pi price is unlikely to drop significantly.

Have you ever thought about the scenario where the on-chain pi price is 0.45, while the exchange price is manipulated to 0.1?

What are your thoughts on this?

141,32K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin