Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Matt Walsh

Enjoyed chatting with @Joshua_Frank_ of @TheTieIO on today's show

On The Brink26.6.2025

In our latest episode @Joshua_Frank_ of @TheTieIO sat down with @MattWalshInBos to discuss crypto market intelligence, the buy-side landscape, The Canton Network and more

1,29K

Matt Walsh kirjasi uudelleen

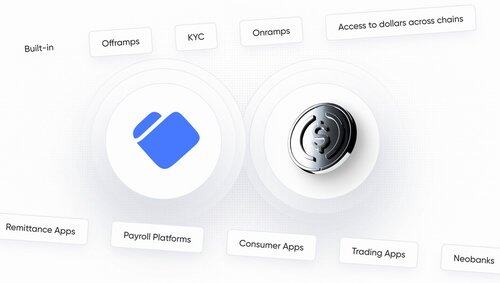

Today is an exciting day! We've been heads down at Dynamic and are excited to launch two new stablecoin initiatives:

1️⃣ Stablecoin Accounts

Teams can launch money apps in days, not months.

This is our answer to the growing demand from fintech and global payments teams who want to launch with stablecoins, but are blocked by fragmented infra and crypto complexity.

Stablecoin Accounts simplify everything: wallet infra, on/off-ramps, payment flows, and more.

2️⃣ Stablecoin Hub

A free and evolving resource to help teams navigate the stablecoin ecosystem. Think: the go-to learning destination for anyone curious about building with stablecoins.

Lastly, we'll be livestreaming our Stablecoin Stories event. You can tune into @dynamic_xyz X at 2:30pm ET!

43,31K

Matt Walsh kirjasi uudelleen

Recent reporting projects that stablecoins could grow into a $3.7 trillion market by the end of the decade. That scenario becomes more likely with passage of the GENIUS Act.

A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower government borrowing costs and help rein in the national debt. It could also onramp millions of new users—across the globe—to the dollar-based digital asset economy.

It’s a win-win-win for everyone involved:

✅The private sector

✅ The Treasury

✅ Consumers

These are the fruits of smart, pro-innovation legislation.

1,79M

Matt Walsh kirjasi uudelleen

.@intangiblecoins has already discussed this NYT op-ed well, but my 2c. the author makes elementary mistakes about the dollar system and stablecoins.

> [crypto] carries enormous risk for financial stability across the world. For starters, we can look at the words of crypto enthusiasts who used to dream that a private digital system could displace the dollar.

stablecoins represent a more moderate faction than the bitcoiners who think bitcoin will take over. most on-chain settlement on blockchains happens on stablecoins, not BTC/ETH others. objectively, stablecoins are dollarizing blockchains, by taking over UoA and MoE.

> American financial hegemony would give way to a private-sector free-for-all.

money is already a private sector enterprise. monetary base (i.e. "government" money) is $5.6T, bank-created money (M1) is $19T. private sector money is 75%, public is 25%. if you include offshore money, M0 is only 10-15%.

> Democratic staff members on the Senate Banking Committee say that the Genius legislation would allow U.S. exchanges to trade stablecoins from offshore companies outside the full scope of U.S. regulation.

This is literally already the case under the pre-GENIUS status quo. GENIUS restricts how domestic firms are able to operate wrt offshore stablecoins, and disempower offshore stables to the benefit of onshore ones.

> Yet if confidence in their stablecoins fell and they were suddenly required to redeem 20 percent of their holdings, these smaller [european] banks would face the equivalent of a deposit run.

The European fragility with regards to stablecoins is self-imposed. MiCA requires stablecoins hold large portions of their reserves in uninsured cash deposits in banks, which is obviously a bad idea. Would not be a feature of the US system

> Specifically, if a stablecoin got into trouble or turned out to be a fraud, would it be bailed out? Doing so could create massive liabilities for U.S. taxpayers.

The GENIUS act tightens up regulation of stablecoin issuers, to ensure 1:1 backing with high quality liquid assets, depositor priority in liquidation, and improved transparency. The odds of a bank run (and resultant bailout) are similar to a run on a money market fund – virtual nil. If a stablecoin is a fraud, it will be very easy to spot, under the new rules. Something like Terra's UST would be impossible to run in this system.

> Furthermore, the emerging dollar-crypto nexus might enable criminal finance at an unprecedented scale.

Stablecoin issuers have become very adept at freezing and seizing illicit flows or seizing hacked funds and so on. They are vastly better for dealing with criminal finance than cash transactions or even transfers through networks of banks.

> Philip Lane, the chief economist at the European Central Bank, argues that reliance on stablecoins would shift financial activity from euros to private-sector cryptocurrencies based on the dollar.

Europe's problem. Maybe they should have written regulation allowing Euro stablecoin issuers to compete rather than crushing the sector.

> [A digital Euro] would provide built-in privacy and security and, unlike stablecoins, would be controlled by the public sector.

So stablecoins are "too private" in the previous paragraph and "not private enough" in this one. And there's no reason a public sector payments system is inherently better than a private sector one. Payment systems globally are a blend of public and private.

> Stablecoins are not cementing dollar dominance by allowing the United States to catch up with the rest of the world.

Stablecoins are empirically extending the reach of the dollar, 99% of stables are dollar-based, and they are giving individuals worldwide access to the dollar (and highly efficient payment rails) where they never had it before. This is not debatable, it's just the reality today.

73,2K

Matt Walsh kirjasi uudelleen

For stablecoins and other digital assets to thrive globally, the world needs American leadership.

The Senate missed an opportunity to provide that leadership today by failing to advance the GENIUS Act.

This bill represents a once-in-a-generation opportunity to expand dollar dominance and U.S. influence in financial innovation. Without it, stablecoins will be subject to a patchwork of state regulations instead of a streamlined federal framework that is more conducive to growth and competitiveness.

The world is watching while American lawmakers twiddle their thumbs. Senators who voted to stonewall U.S. ingenuity today face a simple choice: Either step up and lead or watch digital asset innovation move offshore.

1,68M

Enjoyed discussing @CantonNetwork and more with @YuvalRooz and @wesarn_real of @digitalassetcom on the show this morning

On The Brink15.4.2025

Today on the podcast @MattWalshInBos sat down with @wesarn_real and @YuvalRooz of @digitalassetcom to discuss @CantonNetwork, the role of privacy on public blockchains, and how institutions are approaching building on shared financial infrastructure:

1,24K

Enjoyed chatting with @HoolieG of @coinbase on today's show

On The Brink8.4.2025

In our latest episode @MattWalshInBos sat down with @HoolieG of @coinbase Ventures to discuss the state of the crypto venture market, the history of Coinbase Ventures and more:

8,83K

Enjoyed catching up with @brian__foster of @coinbase on this morning's show

On The Brink24.3.2025

On our latest episode @MattWalshInBos sat down with @brian__foster of @coinbase to discuss the wholesale business at Coinbase and how banks, broker-dealers and governments are pursuing digital assets in 2025

1,59K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin