Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

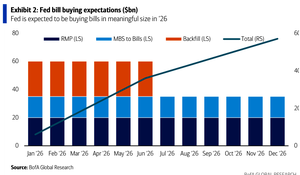

Here's a simple way to view 2026:

1. Fed increases Reserve Management Purchases (RMP) --> Bank reserves increase

2. Effective Fed Funds Rate (EFFR) ticks down (rate cuts) --> Bank lending ticks up

3. Deregulation of post-2008 GFC policies --> Looser capital requirements on banks --> Even more bank lending to grow the economy

Don't overthink it.

Dec 8, 07:17

QE = Fed prints money; buys long-term bonds

RMP = Fed prints money; buys short-term bills

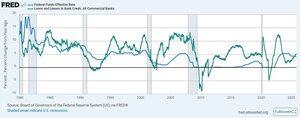

Now, look at the recent EFFR and Loans/Leases in Bank Credit data, and what do you see?

The Federal Reserve intentionally constraining the private sector (TDS affects many academics).

With Powell out and Hassett in (June 2026), I'd argue we see bank credit meaningfully expand.

42.7K

Top

Ranking

Favorites