Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

What is the "purpose" of $IREN moving up their earning's date? 👀🤔

This is a recurring theme that I have written about regarding IREN: purpose. Their slogan is "proceed with purpose", so whenever IREN announces something, the first thing that runs through my mind is what is the purpose behind this move? Throughout their history they have telegraphed many moves that had many breadcrumbs in hindsight.

The pulling forward of the earnings call by more than a week ahead of the usual time slot is no accident, it too must serve a purpose IMO. There was nothing that crossed my mind, until @IndustryRPh talked about Nasdaq 100/QQQ inclusion in a chat with a couple of us IREN bulls.

Matt was looking at the next QQQ reconstitution, which happens once a year with the cutoff on November 28th this year to determine eligibility. He was also looking at possible IREN share prices that would give them a market cap that would bump off some of the weakest incumbents at this time.

This is where the breadcrumbs lead me towards a possible "purpose" of IREN moving up their earnings call. If IREN management knows that have a catalyst or tailwinds that can propel the SP to get into QQQ inclusion, they would be better off pulling forward those announcements/guidance and giving the SP a chance for an extended run into the November 28th cutoff date. If IREN kept their customary time slot towards the middle of November, that would give it about 2 weeks to make up ground. However moving it up, they would have 3 weeks to make up that ground, after the catalysts/tailwinds are announced.

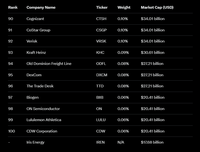

Here are the market cap estimations of some of the companies that $IREN can catch and displace for QQQ inclusion (Grok at the top, GPT at the bottom). Realistically, the companies that IREN has a chance to displace are $CDW $LULU $ON $BIIB $GFS. GFS currently is at an approx. $19.6bil MC.

The distance of those MCs vs IREN's range from $20bil to $22bil vs $17bil. Which would translate to about a 17.6% to 29.4% lead over IREN at this time. However, knowing how hard the AI infrastructure sector can rally (and drop), a 17% to 29% lead is hardly that much.

We have speculated about $IREN pursing, and just missing out Russell 3000 inclusion earlier this year. Part of the reasoning behind IREN's change to domestic issuer status has to be targeting of index inclusions. After the torrid run by the AI infrastructure plays in the past 6 months, Russell 3000 is now just a small pond compared to what IREN will be going after. Once again, all eyes will be on $IREN for November 6th.👀

Top

Ranking

Favorites