Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ethean

Cooking @ourtintinland| $BTC $ETH $OKB | Bullish on Stablecoin & RWA |Addicted to AI Agent | prev @solvprotocol

Hong Kong on Friday gives a sense of an economic upturn.

Bars are packed, and after work, finance professionals are discussing Web3 while slightly tipsy.

Recently, the government’s cooling measures on stablecoins have led some to say that Hong Kong got up early but arrived late.

Indeed, compared to the United States, Hong Kong appears cautious and restrained, and there is a gap in talent density and overall Web3 awareness compared to Singapore.

Notably, the Cyberport, fully supported by the Hong Kong government, has established a Web3 working group and partnered with Asia's largest developer community @OurTinTinLand to launch a talent program.

The Hong Kong government’s determination to develop Web3 is still present.

(Shall I treat you to the first cup of milk red bean ice of autumn?)

CyberportAug 22, 11:29

【BuildSpace Talent Program】Cyberport and @OurTinTinLand Join Hands to Promote Web3 Talent Development in Hong Kong. Join now and build the future of Web3 together! Registration link:

32.83K

Likes fade, Trends stay

@trendsdotfun

Trends | Information Capital MarketAug 12, 15:01

likes fade, trends stay

2.85K

Annual revenue of $500 million, the sudden commercialization explosion of AI Agents

In the stereotype, AI Agents have always been seen as a small business, or rather as "future technology." Recently, I noticed that the growth rate and profitability of AI-native companies are far higher than those of internet companies, and even higher than all crypto companies outside of Tether.

- Meitu: Transformed by AI, from an annual loss of $190 million to an annual profit of $590 million,

- Cursor (AI programming assistant): Achieved $500 million ARR (Annual Recurring Revenue) in just 2 years

- Perplexity (AI search engine): $120 million ARR

- GenSpark (AI search engine): Achieved $36 million ARR in just 45 days

The high valuation of AI hardware in the capital market is also shifting to the AI application layer:

- Meitu (Market cap $6.4 billion, PE 56x)

- Cursor (Valuation $18 billion, Premium rate 36x)

- Perplexity (Valuation $14 billion, Premium rate 117x)

ToB-led commercialization path

In a report published by @CBinsights, among the top 20 AI Agent companies ranked by revenue, all have chosen ToB as their main commercialization direction.

The common growth path chosen by leading companies:

- Scenario focus: Establishing a professional moat in vertical fields such as programming and law

- Integration with existing workflows: Achieving deep seamless integration with existing industry workflows to enhance user willingness to pay and reduce friction

- Value proof: Providing quantifiable ROI improvement solutions

Comparing actual revenue and PE ratios, it seems reasonable that the recent crash of altcoins occurred, but even now, crypto themes are still enjoying valuation dividends in the capital market (CRCL PE 2021x), while AI is still in a value gap compared to crypto.

1.81K

Compared to other high-performance new chains, Ethereum's real advantage is the 10 years it has been through.

Friends in traditional finance tell me: "We would rather use an old version of Windows than easily switch to an unverified new system."

For financial institutions, performance is not the top priority; stability and security are the most important.

When financial services truly go on-chain, they will ultimately choose Ethereum.

蓝狐Jul 30, 2025

以太坊的过去十年是概念验证的十年;以太坊的未来十年是世界结算层的十年。再过五年,以太坊的伟大无须多言,正如今日比特币。

8.69K

In April, I bought a gold pit of BTC for $75,000 in Hong Kong

In June, I bought a golden pit of $XRP 2.0 in Hong Kong

Feng Shui has a little something

AB Kuai.DongJul 18, 2025

XRP's coin price has reached a new high, but there seems to be little discussion on the Chinese push, and it has been the top trading volume in various Korean exchanges for a week, more than four times that of ETH. Now open 5 Korean communities, 4 of which are discussing Ripple.

As with the Chinese community, no one talks about other altcoins anymore.

The Korean brother asked me, what is the Chinese area frying?

A: ETH has not yet broken through new highs.

21.74K

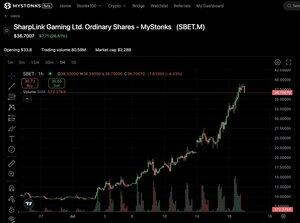

There are so many exchanges that are doing the tokenization of U.S. stocks, and now there are only @MyStonks_Org that can buy $SBET

(It's not that the mouth is not wide, it's purely that I bought $SBET and I'm very happy, but @BTCBruce1 is also welcome to give me money)

Yesterday, I talked to a friend, and there are two routes for the projects that can be run out now:

1. Go to the extreme and win over top resources to form a bureau; #美国 #川普 #交易所

2. Penetrate down to the end, relying on strong community + user growth to penetrate through.

In the area of U.S. stock tokenization, @xStocksFi is obviously the first category. The partners include not only Backed Finance and Solana, but also centralized exchanges such as Kraken and Bybit; On-chain DeFi collaborations also include Raydium, Jupiter, Kamino, and Bybit's incubated DEX - Byreal.

But the pace of the product on the user side has slowed down, $SBET is almost $40, and xStocks is not yet live.

On the other hand, @MyStonks_Org got on SBET on May 27, when it was only $32, and later dropped to $10.

Anyone who played meme last year should remember @BTCBruce1 bringing up the CTO of mystonks. (See here for a short history story.)

Now MyStonks has gone from a meme to an exchange, from a narrative to a product. Fidelity was selected as the custodian of the first batch of U.S. stock assets, and all tokens are 100% backed by real stocks. In fact, asset transparency was average in the early days, but it has accelerated significantly recently:

- Obtained the MSB license of FinCEN in the United States

- In July, it plans to complete the SEC STO filing and launch the Merkle Tree on-chain proof-of-asset mechanism

- Plan Q3-Q4 to apply for an EU MiCAR license

The small problem is that it took 30 minutes for the Solana recharge to arrive yesterday, but the customer service response is very fast, and the experience is still reassuring.

Buy U.S. stocks on-chain:

Operations & Customer Service: @MyStonksCF @MyStonks_Sam

Boss himself: @BTCBruce1

19.46K

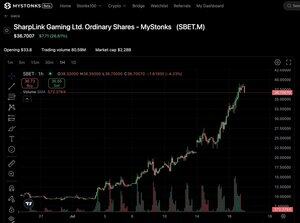

There are so many exchanges that are doing the tokenization of U.S. stocks, and now there are only @MyStonks_Org that can buy $SBET

(It's not that the mouth is not wide, it's purely that I bought $SBET and I'm very happy, but @BTCBruce1 is also welcome to give me money)

Yesterday, I talked to a friend, and there are two routes for the projects that can be run out now:

1. Go to the extreme and win over top resources to form a bureau; #美国 #川普 #交易所

2. Penetrate down to the end, relying on strong community + user growth to penetrate through.

In the area of U.S. stock tokenization, @xStocksFi is obviously the first category. The partners include not only Backed Finance and Solana, but also centralized exchanges such as Kraken and Bybit; On-chain DeFi collaborations also include Raydium, Jupiter, Kamino, and Bybit's incubated DEX - Byreal.

But the pace of the product on the user side has slowed down, $SBET is almost $40, and xStocks is not yet live.

On the other hand, @MyStonks_Org got on SBET on May 27, when it was only $32, and later dropped to $10.

Anyone who played meme last year should remember @BTCBruce1 bringing up the CTO of mystonks. (See here for a short history story.)

Now MyStonks has gone from a meme to an exchange, from a narrative to a product. Fidelity was selected as the custodian of the first batch of U.S. stock assets, and all tokens are 100% backed by real stocks. In fact, asset transparency was average in the early days, but it has accelerated significantly recently:

- Obtained the MSB license of FinCEN in the United States

- In July, it plans to complete the SEC STO filing and launch the Merkle Tree on-chain proof-of-asset mechanism

- Plan Q3-Q4 to apply for an EU MiCAR license

The small problem is that it took 30 minutes for the Solana recharge to arrive yesterday, but the customer service response is very fast, and the experience is still reassuring.

Buy U.S. stocks on-chain:

Customer service: @MyStonksCF @MyStonks_Sam

Boss himself: @BTCBruce1

8.36K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable