Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

gala⚡

8-year-old leek|alpha info|DM for Collab 📩👻

Inner Circle CT @KaitoAI|Creator @OpenLedgerHQ|Ambassador @OKX @wardenprotocol

It's all Guangzi, if you don't like to watch it, just block it, don't force Lai Lai 👿

The latest #Starboard is online, this time with @irys_xyz. After teaming up with Cod3x, we're starting to do some truly "smart" things in DeFi, not relying on manual parameter adjustments or bots relying on luck, but allowing AI to remember things, learn things, and potentially make money by "selling brains".

Previously, trading configurations like positions, stop losses, entry conditions, etc., were mostly kept off-chain. If they were tampered with or lost, it could lead to serious losses. Now, these can be directly put on-chain with Irys, where no one can change them, and AI can call them safely and adjust them dynamically. This is the real "safety strategy".

What's even more interesting is the AI's "memory system". Irys is not an ordinary data chain; it has a three-layer structure: short-term memory for the current market, long-term memory for historical trades, and another layer for long-term strategy logic. Cod3x's AI bot can repeatedly learn from its past decision outcomes and continuously optimize. This kind of reinforcement learning is indeed much stronger than the old method of relying on hard-coded rules.

Moreover, strategies are no longer just for "internal use". Irys supports directly packaging strategies and signals on-chain for sale, allowing others to copy, rent, or package them into assets for trading. If you do well, not only can you run steadily, but you can also make money by "selling models". This is the commercialization path that DeFi should take next.

Overall, what Cod3x aims to do is not just to transform the trading experience but to completely move "financial intelligence" onto the chain. Irys provides all the infrastructure that this AI needs—storage, execution, data, memory, and monetization. If this combination works, it will be the core facility of the next wave of DeFi.

5,63K

🤪 @TheoriqAI recently integrated The Graph Protocol into their AI agent system. The whole idea is quite clear: it's to enable the intelligent agents to access on-chain data in real-time and automatically respond, especially when executing DeFi liquidity strategies.

Currently, they are using something called Substreams, which is a streaming data tool launched by The Graph. You can think of it as having a pool on-chain, like Uniswap; when the state of these pools changes, the agent can immediately receive signals, process the data, and then pass it to the strategy module for the next steps. This way, the entire process runs almost automatically, with speed and accuracy significantly improved compared to before.

This design actually addresses a long-standing issue in Web3: the difficulty of obtaining and processing on-chain data. Previously, many projects had to run their own nodes to pull data, which was slow and unstable. Now, with Substreams, agents can access data as easily as turning on a faucet, making it convenient and fast.

Theoriq isn't just casually integrating this; they have publicly detailed this integration case and collaborated with The Graph's official team to showcase a technical case, effectively pushing both parties towards standardizing this solution. In the future, it may not only be used by them but also facilitate more teams working on AI + DeFi to integrate.

Ultimately, there are not many projects that can truly run AI agents effectively, and even fewer that can tackle problems from the infrastructure level. Although Theoriq is still in its early stages, its direction is worth paying attention to. The key is that it has a leaderboard activity on @KaitoAI.

27,63K

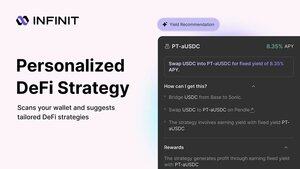

😜 @Infinit_Labs The launch of INFINIT Intelligence seems just like the beginning, with more significant updates to come. Next, they are going to introduce a module called "DeFi Agent Network," which essentially means completely opening up the "agents" of DeFi, allowing developers to connect and create their own Agents.

This is quite significant, as it transforms the intelligence from "a platform's intelligence" to "a network's collaboration." Various complex operations—such as automated arbitrage, hedging strategies, and circular collateral—could potentially be completed through the cooperation of multiple Agents, executed with a single click. This direction is closer to a true integration of AI and DeFi, rather than just simply recommending a few pools.

Moreover, it supports multi-protocol and cross-chain operations, meaning that when users click once, the backend automatically completes a whole set of on-chain operations like cross-chain transactions, token swaps, liquidity provision, and staking, truly achieving "just click, and leave the rest to the system."

Ultimately, INFINIT aims to make the originally high-threshold DeFi operation process as lightweight as possible. Whether you are a beginner just starting out or an experienced player earning across chains, its goal is to automate the entire link from research to execution. The key is that it has a leaderboard activity on @KaitoAI!

27,65K

😜 @TheoriqAI's OLP Swarm has recently entered its second phase, which can be understood as "intelligent agents starting to go into action." Previously, they were working on the "reserve team": cleaning and making the data more useful for the subsequent strategy modules to call upon. Now, this data is finally going to be used for actual on-chain liquidity management.

Their current strategy structure is quite similar to an assembly line: the front-end Observer and Signal Agent are responsible for extracting real-time status from pools like Uniswap and cleaning it into usable signals. Then, these signals are handed over to the Policy and LP Agent, which will dynamically execute some swap operations based on the current market conditions, such as adjusting positions or migrating liquidity. All these decisions and execution actions are run automatically, requiring almost no human intervention.

In the previous first phase, the focus was on turning the raw on-chain data into signals with practical use. This process involves many data sources, such as the on-chain structured data provided by The Graph, as well as other auxiliary data from Cookiedotfun. They also introduced statistical agents, predictive agents, and are even experimenting with using LLMs to drive part of the strategy logic for experimental comparisons.

In simple terms, the entire OLP architecture has now upgraded from "being able to acquire data" to "being able to react based on data," and these reactions are automated and executable. In the future, they may continue to optimize these strategy logics, such as tuning parameters and introducing more complex models. Although this is still in the early stages, you can feel that they are indeed gradually making "AI-driven DeFi" more substantial.

31,38K

😜 @dYdX has acquired Pocket Protector and simultaneously launched their open-source software version 4.0. The new version brings several feature upgrades, particularly in risk management and governance mechanisms, making them more mature, and overall performance is more stable.

A quite practical update is the introduction of "Reduce-only" orders. Simply put, these orders can only reduce positions and cannot increase them, making them suitable for short-term trading and conditional orders, helping everyone better control risks and avoid increasing positions in the opposite direction due to operational errors.

In terms of withdrawals, several security measures have been added, such as setting limits on IBC cross-chain withdrawals, with caps on both hourly and daily transactions, which can prevent large amounts of funds from being quickly withdrawn in emergencies. Additionally, if a sub-account experiences negative collateral or issues on-chain, withdrawals will be temporarily frozen to protect the overall system's stability.

In governance, a new x/govplus module has been added, allowing token holders to directly penalize violating validators, which is particularly important for preventing unfair operations like MEV. The newly introduced authorization module allows accounts to authorize other accounts to operate on their behalf, facilitating voting delegation and automatic reinvestment, enhancing user experience and system flexibility.

Overall, it feels like dYdX's upgrade not only enhances security and efficiency on a technical level but also puts effort into governance and user convenience, aiming to create a healthier and more sustainable ecosystem, which is quite worth paying attention to.

49,32K

🤠 @TheoriqAI released a live demo showcasing their entire OLP Swarm process. The core idea is how a group of Agents can fully automate "market watching + placing orders + adjusting positions" on-chain. After watching it, I can only say that this project is genuinely serious about its work.

So how does this Swarm work? It starts by reading pool data from Uniswap v3, such as price change pulses. Then, it hands over the data to the Statistical Agent for analysis, calculating key indicators like recent averages and volatility. The Policy Agent then decides whether to adjust strategies based on the volatility, such as changing position widths or switching trading ranges.

The most critical part is the actions of the LP Agent. After receiving the strategy signal, it directly opens positions on-chain, performs swaps, and mints liquidity positions, with transaction hashes returned throughout the process to confirm completion. This is no longer a project that "only does research"; it is a truly operational automated strategy bot on-chain.

Moreover, this Swarm perceives market changes in real-time. When we give it a natural language command, such as "Help me check how the market is doing; do I need to adjust parameters?" it can automatically analyze the current market situation and then adjust the existing position strategies in real-time, such as tightening or loosening position ranges. This is true Agent collaborative execution.

In simple terms, Theoriq is not just talking about some AI + DeFi concept; it has already enabled a group of agents with the basic capabilities of "market watching + making judgments + on-chain execution." The next step should be to see them open this system to more developers, at which point the entire agent network's activity will truly come alive.

28,94K

Currently, many BTC Layer 2 solutions on the market claim to be "trustless" systems, but if you take a close look at their mechanism design, you'll find that many have a fatal flaw: the withdrawal path is not secure enough. Especially in the previous version of BitVM2, there was a typical issue—if an Operator maliciously forks the state chain, they could forge a "seemingly fine" zk proof to withdraw real BTC from Layer 2.

@GOATRollup BitVM2 was specifically redesigned to address this flaw. Its core logic is: no matter how you mess around on Layer 2, all withdrawals must be validated by the BTC main chain to count. This is not about "coordinating after a problem arises," but rather directly eliminating the path of "forging state + generating false proof" from the mechanism.

GOAT uses a decentralized sorting network, where each block is signed, and both the block header and signature are published to the Bitcoin main chain. This effectively gives each operation a "main chain seal." All zk proofs must match this on-chain state; otherwise, they are directly invalidated, leaving no room for loopholes.

The withdrawal path has also been redesigned into a three-step process: "burn + prove + withdraw." If you want to withdraw, you first need to burn your PegBTC on Layer 2, then the Operator must provide an SPV proof recognized by the main chain for BTC to be truly released. This mechanism is very rigid, relying entirely on code execution, and no one can "intervene."

The most ruthless part is that it has added a challenge mechanism—if one party commits fraud, anyone can initiate a challenge, and the entire process is executed in Bitcoin's native script, requiring no DAO, no arbitration, and relying solely on the protocol to resolve it. This "anti-fraud" design is really practical.

For BTC Layer 2, speed is not the primary concern; being able to exit safely and protect assets is the bottom line. GOAT BitVM2 is not about optimization but rather restoring trust back to Bitcoin itself, fundamentally rebuilding security. This structure is what truly represents "trustlessness."

32,52K

🤠 @0xSoulProtocol The current DeFi landscape, to be honest, is quite loud, but the fundamentals haven't kept up. There seem to be more and more products, yet the ones that are truly usable are becoming increasingly fragmented. Soul is not here to chase the hype; what it aims to do is to truly connect the foundational infrastructure that should have been unified in this field long ago.

Why did we initially believe in decentralized finance? Isn't it because it has no barriers, allows free flow of capital, and enables various protocols to interoperate? But how many of these promises are genuinely fulfilled today? Soul wants to pick up these "things that should have been realized" again, and not by putting new wine in old bottles, but by directly connecting at the foundational level.

It no longer allows different protocols to fight their own battles, nor does it let liquidity be locked on a single chain. It aims to make lending a "truly open" market, rather than a bunch of interfaces and bridges, each playing by their own rules.

Soul's vision is not to create another "louder" lending protocol, but to return to the original intention of this industry, making "open finance" a reality again, rather than just a slogan. If you also feel that the current DeFi is becoming increasingly cumbersome, why not take a look at how Soul operates?

Official website:

34,11K

😜 @Mira_Network is gradually upgrading its verification capabilities, starting with simple validity checks, then moving on to comprehensively reconstructing invalid content, and finally even being able to directly generate verified results. This means it resolves the traditional conflict between speed and accuracy, pursuing real-time performance while ensuring strict verification standards.

More importantly, Mira records these economically guaranteed facts on the blockchain, forming a powerful knowledge base. This not only supports a reliable fact-checking system but can also serve as a secure oracle service. In this way, the network transforms scattered data into valuable "facts" through an economic incentive mechanism, laying the foundation for trustworthy AI systems.

This is not just a minor improvement in AI development, but it opens up a whole new paradigm. In the future, AI can achieve zero-error autonomous operation without human intervention, significantly enhancing reliability and truly entering a brand new intelligent era. It is clear that Mira is not only thinking about technology but also aims to elevate the future safety and trust of AI to a new height.

9,1K

🤪 @TheoriqAI has taken a big step forward; Swarm can now automatically adjust its strategies based on market changes. For example, in the last 24 hours, with price fluctuations and trading volume suddenly increasing, the Policy Agent determined that the current market is unstable, so it proactively narrowed the tolerance for fluctuations, changing the tracking time from 24 hours to 4 hours to respond more sensitively to market changes. The core of this step is that Swarm's reaction speed and strategy adjustment capabilities are beginning to approach that of a "human".

This change is significant because it means that Theoriq's Agent network now has a complete closed loop of "self-decision-making, self-ordering, and self-adjusting". The LP Agent can open positions and swap coins on-chain, the Policy Agent actively optimizes strategies, and in the future, it can even integrate data sources like this to assist in decision-making, making the entire system resemble a financial entity that can think and execute on its own.

Don't forget, the underlying foundation of all this is driven by Theoriq Protocol, which is essentially the infrastructure designed for Agent collaboration. It includes identity authentication for Agents, encrypted communication, group discovery and coordination mechanisms, as well as value exchange logic on-chain. In simple terms, Swarm operates not on hard-coded instructions but on a flexible architecture empowered by the protocol.

The next steps they are taking are also very promising. On one hand, they are refining the OLP Swarm system thoroughly, and on the other hand, they are preparing to unveil a batch of new partners and delve into what more complex Agent applications Theoriq Protocol can support. This is just the beginning; the true Agentic Economy is still on the way, but judging by the current pace, Theoriq is among the frontrunners.

34,32K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin