Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Blair Marshall

MEV @0xFastLane

Blair Marshall kirjasi uudelleen

Rough timeline of events here:

1. Justin Sun pulls ETH supply from Aave.

2. Utilization spikes ETH borrow rates on Aave.

3. stETH loopers are now unprofitable, so start de-leveraging.

4. A bunch of this de-levered stETH hits the staking withdrawal queue.

5. stETH depegs 30 basis points as some sell to avoid the queue.

6. Loopers are now forced to either take this 30 bips hit (3% loss on 10x leverage), or lose money on the position until peg re-gains.

All of these stETH oracles use redemption not market rate, so lenders are stuck in the position for potentially ~18 days as thats the ETH unstake queue right now. We may end up seeing some stETH liquidations from interest accrual which will only make the situation worse by de-pegging stETH further.

238,2K

Blair Marshall kirjasi uudelleen

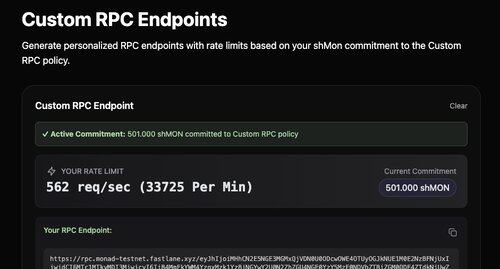

Fast blockchains introduce new challenges for bandwidth management and RPC fairness. Today we’re introducing a mechanism for shaping RPC access using liquid staking commitments. The system is live via FastLane’s ShMonad RPC. This thread explores the architecture and rationale.

🧵

6,6K

1. Tariffs are resolved -> pump

2. Fed finally signals rate cuts -> pump

3. Market realizes fed only cuts rates when economy is tanking -> dump / mini GFC / buffet finally deploys some cash

4. Governments take swift action and implement the beginnings of UBI -> pump

5. Unemployment remains sticky bc of AI, so governments step up the UBI -> moon

326

Blair Marshall kirjasi uudelleen

Why is Bitcoin's price stuck? There are billions in inflows from ETFs and treasury companies and the supply of newly mined Bitcoin is miniscule compared to these flows. What gives?

One answer is that there's lot of paper Bitcoin flowing around suppressing the price. I do not agree with this theory.

The simple truth is 100k was a magic number for a lot of long-time holders, who happen to hold a huge fraction of the total liquid supply of Bitcoin.

The selling from these whales is easily enough to match the demand from ETFs and Saylor, and could for some time.

This is not something to be concerned about, but something to celebrate. The process of monetization involves the distribution of a new monetary good among the population. This cannot happen without whales letting go of their long-held coins.

Eventually whales will sate their demand to diversify and the price will begin moving again, and hit the magic number of some other group of long-time holders.

Along the way there will be air pockets both up and down as it becomes clear, for example, that there are very few whales interested in selling between, e.g., 120k and 150k.

Do not fret about the sideways grind. Just know that under the hood the process of monetization of Bitcoin continues unabated.

267,26K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin