Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

熊猫CryptoPanda.𝟎𝐱𝐔

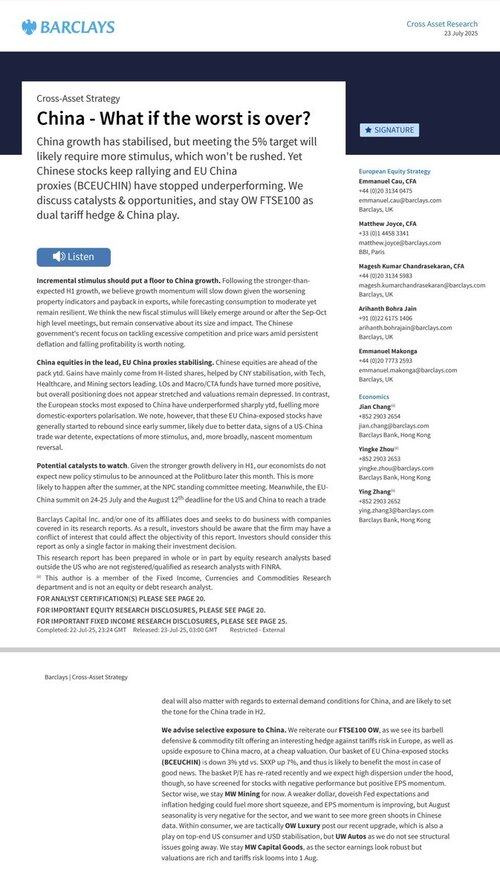

Barclays analysts:

China is expected to launch a new stimulus package of 0.5 trillion to 1 trillion yuan in the second half of the year to ease the expected economic slowdown.

熊猫CryptoPanda.𝟎𝐱𝐔22.7. klo 05.40

1 Intro

The significance of the Brahmaputra River

It takes time for the market to find a new reservoir, and that's what I think the Brahmaputra is all about. In other words, after the reform of the tax-sharing system, the first equilibrium formed in the game between the central government and the local government is self-land finance.

But now that the equilibrium is changing, the real meaning of "stabilizing housing prices" is to dilute the role of real estate in local finances, and the Brahmaputra River provides a strategic buffer for the formation of a new equilibrium.

🔻 Long threads 🔻

950

熊猫CryptoPanda.𝟎𝐱𝐔 kirjasi uudelleen

The crazier the bull market, the calmer we must be.

Yesterday, I didn't tweet but took the time to summarize and organize my thoughts from the past few days:

The first question is, what is the main narrative of this entire cryptocurrency circle?

#BTC 15000➡️120000

This atypical bull market has lasted for two and a half years. Why do we say this is an atypical bull market? Because it is a bull market that has erupted during a tightening cycle.

Excluding the overall rebound from the severe drop in the early bull market (after the big bear in 2022) and the various narratives that were later debunked (L2, modularization, etc.), and excluding the super MEME season that emerged due to overall liquidity shortages during the bull market; from a holistic perspective, there is still nothing exciting in the internal narratives of the crypto space. This bull market can basically be defined as a "capital bull" led by the United States after the East-West handover in the 20-21 season.

The characteristic of this bull market is that altcoins will rebound sharply in every small trend, while Bitcoin continues to soar.

The second question is about Ethereum.

#ETH (1300➡️3800)

Following the thought process of the first question, let's look at Ethereum; before we look at Ethereum, let's first deconstruct the various stages of Bitcoin's bull market from 15476➡️30000, which experienced a rebound after a deep bear market. But what about after 30000? To now 120000? Interest rate cut expectations? ETF expectations and the capital inflow after the ETF approval?

If we connect the entire trend of Bitcoin after it broke through 30,000 in October 2023, we will have the answer.

Is this entire range (202310➡️now) peaceful? Were there any negative factors in between? The Japanese interest rate issue, war issues, the favorable conditions after Trump's inauguration, the tariff war... but did these hinder Bitcoin's rise? Not only did they not hinder it, but it also reached new highs. I want to say this is the top-level conspiracy of the "Musk and others."

Why do we need to deconstruct Bitcoin first? Because Bitcoin is the template that Ethereum has already run through, and now we can see that capital is beginning to replicate Bitcoin's path on Ethereum;

Why did Ethereum rise so quickly from 1300 to 3800, not giving people a moment to react? Aside from a brief consolidation at the beginning, it has basically been following small technical indicators since then?

Because this path is familiar, too familiar; Bitcoin has just completed it.

The third question: the next thought process.

Following the clarified thought process, we can draw the following conclusions:

1. Altcoins are just companions; at least until there is enough exciting endogenous narrative in the crypto space, altcoins can only rebound sharply; do you think it's easier to pick 3-5 coins with a 10000% increase among tens of thousands of coins, or to earn 100% on Bitcoin or Ethereum?

If you want to gamble on the former's returns, then why not check if your position has outperformed Bitcoin and Ethereum's gains?

2. We need to give Ethereum enough room for imagination. This question may seem simple, but it's not easy to execute. After all, chasing highs is a tough game; our trading system and technical system naturally reject this emotion and capital-driven rise;

3. In a bull market, technical indicators, especially small-level technical indicators, become ineffective; this is also why many technical traders missed out in this round or exited midway;

Overbought? Divergence? Waiting for a pullback? The result of waiting for a pullback is that once you exit, it's hard to get back in; because a bull market is always about emotion, not about any technicality, as bull markets are irrational.

In conclusion,

A bull market is a great retreat.

We cannot predict the overall market top, and predicting the top of individual coins is also difficult. What we can do is to reasonably plan our positions and strategies to cope with the market trends we cannot accurately predict;

Taking profits is not wrong, chasing highs is not wrong; what is wrong is taking profits and then chasing highs, chasing highs and not setting stop losses, and being repeatedly harvested after not setting stop losses due to being eroded by crazy emotions.

I remember seeing a stock market guru's saying a few days ago: after an attack, the first thing to think about is always defense; and defense without an attack is not called defense, it's called losing money; achieving a balance between offense and defense is a top-level skill;

I want to say, don't overthink it, and don't want too much. In a simple market, just earn the money that is within your ability!

140,92K

熊猫CryptoPanda.𝟎𝐱𝐔 kirjasi uudelleen

An understanding of a non-conspiracy plate market cap high

100K,

Wealth transfer within the group.

500K,

Movement between several communities.

2m,

The push began to ferment, and the group sentiment rose.

15m,

A small number of secondary funds entered the market, and real money began to be tested.

above 100m,

It is a small economy.

At this time, there is no one who is cutting whom,

It's all a game.

Find cult,

Find a narrative that can break the circle,

Support with action.

More PVE less PVP.

locked in.

46,51K

Some traders' opinions: It is recommended to consider shorting again in September.

熊猫CryptoPanda.𝟎𝐱𝐔18.7. klo 10.53

Compliance cattle should be coming soon

Get ready, a whole bunch of money is coming

One guess: the more compliant and DeFi are, the more likely some projects that seem to be less willing to buy with less money may rise

Let's study it these days

4,01K

Here's a quick recap of this 2025 bull run:

The market started in early April, after a round of declines, and the real plunge began on April 2 when Trump announced "Liberation Day" tariffs, triggering global supply chain concerns and risk aversion.

The S&P 500 fell about 11-17.8%, close to the bear market threshold (20%), and indices such as Nasdaq fell in tandem.

1,63K

Suddenly there was a brain hole...

Based on Bridgewater's All Weather Strategy, build a passive portfolio and package it into a passive asset package.

Divide all assets into two categories: passive and active. Then we only need to do two things to make an investment:

1. Adjust the position between the two packages

2. How to invest in the active asset package.

2,04K

Report to the Xiong Family:

About 500 concerns have been cleared and exhausted.

Tomorrow to continue hehe

熊猫CryptoPanda.𝟎𝐱𝐔16.7. klo 18.25

My account is too miscellaneous, and I'm going to clean up my watchlist in the past two days, take down at least 1,000 people, and sort out my own information flow.

The current idea is to clear out all the 40-day inactive users, I wonder if you have any good suggestions?

2,49K

I haven't kept up with the market much recently, and I brushed up on Mr. Fanfan's review post, which is very well written, so share it.

凡15.7. klo 21.09

Recent Review: Total profit of about 10,000 in the past half month.

Far below expectations, adjustments are needed:

1. Avoid PVP, focus on high-certainty narratives.

The better the liquidity, the more you should play PVE. The risk of bundled PVP after midnight is extremely high, easily leading to profit loss and affecting mindset.

2. Continuous chain scanning to maintain market sensitivity.

Scanning the bottom like #旺柴 at 7k and #Priceless at 5k often leads to hundredfold coins. If you're not in the right state, take a break; only when you're in good condition can you strike accurately.

3. Pay attention to the movements of market makers and deeply analyze the chain.

Market makers who like to manipulate during a bull market are more active. Spending time analyzing addresses is a core step in uncovering big opportunities.

4. Improve aesthetic judgment and assess market cap potential.

Selling off 旺柴 and several other coins was primarily due to an inability to judge the market cap ceiling, resulting in missed huge profits, selling off at 300,000.

5. Get rid of "price obsession" and go with the flow.

You shouldn't refuse to chase high prices just because you held early. In a big market, there is still a tenfold space from 800,000 to 16 million. You should broaden your perspective and seize every opportunity to withdraw liquidity.

Summary:

High certainty + continuous chain scanning + deep analysis of market makers + assessing potential + going with the flow.

This is the core formula for retail investors to reap big rewards in a bull market.

1,08K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin