Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Tim哥

Focus on Web3 retail investor information sharing, market analysis, and hair opportunities.

@arbitrum Chinese Ambassador|@Doge_Camp Founder|Binance Place Creator: Brother Tim

Collaboration DM📩|TG:@tim131411

Kaito's fourth project @rise_chain has too low of a buzz, should we invest or not?

I think the lack of interest mainly stems from a few points:

1. Serious lack of information disclosure

RISE has only announced a 200 million FDV + 4% public offering share, but key information such as total token supply, team/investor allocation, and unlocking mechanisms are missing, making it difficult for investors to assess the risk of selling pressure and long-term value, leading to a wait-and-see attitude.

2. Mismatch between valuation and market sentiment

RISE is positioned in the L2 track, and a 200 million FDV is not low among new L2 projects. Moreover, RISE is still in the testnet phase, with no historical revenue or expense data to support it, making investors more cautious about a "high FDV + opaque" new L2.

3. Subscription rhythm and psychological gap

The first day of Kaito's public offering did not see a "sell-out in seconds," indicating that both large and retail investors are maintaining a wait-and-see approach. Additionally, the official extension of the fundraising period further reflects insufficient demand, which weakens market confidence.

Of course, there are also highlights:

🔸 Technical route: Parallel EVM + decentralized sequencer, which offers differentiation in the track.

🔸 Investment background: Supported by Vitalik, Sandeep, Galaxy, etc., proving that the project itself is not "without a background."

🔸 Low initial circulation: After 2% TGE, it may indeed bring short-term speculative opportunities.

However, due to the token economic model not being implemented, these highlights are still insufficient to convert into strong subscription motivation.

Conclusion:

Personally, I believe that in this current state, I will not invest. If @rise_chain discloses complete Tokenomics, technical progress, or reveals any first batch of ecological applications in the coming time, I will consider it!

514

How I used @Surf_Copilot to accurately bottom-fish $Sapien without playing the secondary market

Timing

At 1 AM last night, I had just finished my late-night snack and was planning to write a few articles when I noticed that $Sapien was going live on Binance Alpha. I was ready to bottom-fish with 1000U, but I didn't have a precise entry point in mind.

So I asked @Surf_Copilot:

"What do you think about the future value of the SAPIEN token? I have 1000U; when is the right time to bottom-fish?"

Since we talk about the @JoinSapien project every day, we are very familiar with the backers behind it. Projects with ample funding and a Web2 gene have a high chance of rebounding after going live, which is why I pay close attention to them.

I remember the price was around 0.2 at that time, and Surf responded:

Decision

Considering the airdrop unlock from @cookiedotfun, I didn't buy in immediately but checked their information and found that the website wasn't even ready, with a lot of complaints. So I hesitated for a while.

At this point, I noticed the price had dropped to around 0.14, so I asked @Surf_Copilot a second question:

"Is the price of 0.14 the bottom?"

Surf provided investment advice:

After observing for a while, I saw that the price stabilized around 0.14, and there was no new information from cook, so I thought that compared to the TGE price of 0.20, it had dropped 26.5%. I decided to place a market order to buy in.

Conclusion

By noon, I had made about 40% profit. I personally believe that as long as it can hold at 0.2, it will push up again later. The initial chips are relatively few, and with sufficient funds, it can easily rise.

This precise bottom-fishing, although with a small amount of capital, was very fulfilling. Of course, not all projects can be played this way. First, you must understand the project itself and the Binance Alpha mechanism, along with the multi-dimensional analysis from Surf to give you the confidence for a higher win rate. Enjoy a wave of profits from talking about it, and then bottom-fish when it goes live—steady happiness.

Brothers, be good at thinking and utilizing opportunities; they are still out there.

6,52K

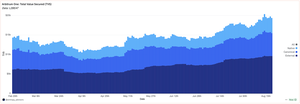

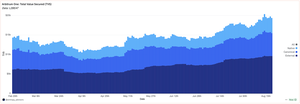

Arbitrum has officially broken through the $20 billion Total Value Secured (TVS) threshold for the third time, solidifying its position as the leader in the Layer 2 ecosystem.

What is Total Value Secured (TVS)?

In the blockchain ecosystem, TVS (Total Value Secured) refers to the total value of assets used to secure the network, support application operations, and collateral mechanisms on a particular chain or protocol.

It differs from the DeFi TVL (Total Value Locked), which primarily measures the amount of funds locked in DeFi protocols. TVS is more comprehensive, reflecting the asset value supported through collateral, staking, cross-chain, and other methods across the entire ecosystem, thus better representing the security and ecological capacity of a public chain.

Arbitrum's Breakthrough and Position

Arbitrum has officially broken through the $20 billion TVS threshold for the third time, currently maintaining around $18.8 billion, firmly holding the top position in the Layer 2 ecosystem.

This not only indicates the network's capacity to handle funds and its security but also shows that more and more users and institutions are willing to entrust their assets to the Arbitrum ecosystem.

Although Base has seen faster growth in DeFi TVL and has led in some metrics at times, Arbitrum still occupies the highest level in overall TVS value. Through innovative mechanisms such as Timeboost auction sorting and high-yield DeFi sectors, it has brought stable and strong revenue growth momentum, creating a differentiated advantage.

Summary

Arbitrum's repeated breakthroughs in TVS are not just numerical milestones but also a comprehensive reflection of its ecosystem's security, user trust, and innovation capabilities.

As competition in the Layer 2 space intensifies, TVS will become an important indicator of a public chain's long-term competitiveness, and @arbitrum will continue to shine brightly!

@arbitrum_cn #ARB

Entropy Advisors20.8. klo 03.00

Last week, Arbitrum's Total Value Secured crossed $20B!

Powered by:

🔹 ~$9.7B External

🔹 ~$6.5B Canonical

🔹 ~$4.3B Native

Almost half of all L2 value is secured on @arbitrum.

8,61K

Arbitrum has officially surpassed the total value secured (TVS) threshold of $20 billion for the third time, solidifying its dominant position in the Layer 2 ecosystem.

What is Total Value Secured (TVS)?

In the blockchain ecosystem, TVS (Total Value Secured) refers to the total value of assets used to secure the network, support application operations, and collateral mechanisms on a particular chain or protocol.

It differs from the DeFi TVL (Total Value Locked), which primarily measures the scale of funds locked in DeFi protocols. TVS is more comprehensive, reflecting the asset value supported through collateral, staking, cross-chain, and other methods across the entire ecosystem, thus better representing the security and ecological carrying capacity of a public chain.

Arbitrum's Breakthrough and Position

Arbitrum has officially surpassed the $20 billion TVS threshold for the third time, currently maintaining around $18.8 billion, firmly holding the leading position in the Layer 2 ecosystem.

This not only indicates the network's capacity to carry funds and its security but also shows that more and more users and institutions are willing to entrust their assets to the Arbitrum ecosystem.

Although Base has shown faster growth in DeFi TVL and once led in certain metrics, Arbitrum still occupies the highest level in overall TVS value. Through innovative mechanisms such as Timeboost auction sorting and high-yield DeFi sectors, it has brought stable and strong revenue growth momentum, creating a differentiated advantage.

Summary

Arbitrum's repeated breakthroughs in TVS are not just numerical milestones but also a comprehensive reflection of its ecosystem's security, user trust, and innovation capabilities.

As competition in the Layer 2 space intensifies, TVS will become an important indicator of a public chain's long-term competitiveness, and @arbitrum continues to shine brightly!

@arbitrum_cn #ARB

Entropy Advisors20.8. klo 03.00

Last week, Arbitrum's Total Value Secured crossed $20B!

Powered by:

🔹 ~$9.7B External

🔹 ~$6.5B Canonical

🔹 ~$4.3B Native

Almost half of all L2 value is secured on @arbitrum.

1,2K

INFINIT V2 is finally live!

Just announced the launch of @Infinit_Labs V2, which aligns well with the previously disclosed timeline.

Major updates include:

🔹AI Agent Swarm architecture: 20+ professional agents collaborating, including yield discovery, cross-chain bridging, risk assessment, simulation previews, and more.

🔹Account abstraction (ERC-4337/EIP-7702): A bundled transaction smart wallet experience that remains non-custodial, with assets always in the user's wallet.

🔹Cross-chain automated execution: Covering multiple chains including Ethereum, Arbitrum, Optimism, Base, Solana, and more.

🔹Creator economy: Strategy creators can publish executable DeFi strategies and profit through transaction fees.

Data and market performance:

Public test user count: 184,000, on-chain interactions: 456,000, accumulating rich strategy data.

Network distribution: Ethereum 38%, Arbitrum+Base 27%, BNB 18%, Solana, etc. 17%.

INFINIT V2 represents a significant innovation in DeFi user experience, transforming complex multi-protocol strategies into easy one-click executions.

This update also opens up 5 selected strategies, showcasing @Infinit_Labs' AI Agent Swarm coordination capabilities.

With data growth and active community feedback, V2 is expected to become the industry benchmark for AI-driven DeFi automation.

Try it out now!

18,02K

How to Reshape Solana Investment Logic - @OfficialSolanaR

TL;DR

Strategic Solana Reserve ( $SSR ) is the first decentralized token portfolio fund (DTF) on the Solana chain launched by EnigmaFund. It combines the community power of meme culture with the rigorous deployment of professional capital, creating a unique market position within the Solana ecosystem.

The project is gradually growing into a representative project on Solana that embodies both financial innovation and cultural narrative, with core advantages of transparent fund operations, a structured buyback mechanism, and highly active community participation.

Project Positioning and Core Identity

The @OfficialSolanaR token $SSR is supported by the well-known venture capital firm @EnigmaFund. The project initially started as a meme coin but quickly completed an upgrade to become the first on-chain decentralized token portfolio fund (DTF) on Solana.

This identity transformation not only laid the foundation for financial productization but also strengthened its uniqueness within the Solana ecosystem.

Market Positioning Advantages

🔹Innovative: As the first DTF on Solana, it provides retail users with a "one-click" opportunity to access a basket of quality Solana ecosystem assets.

🔹Verification and Recognition: The project has received a verification badge from Jupiter Exchange and has achieved on-chain transparent tracking on SolanaTracker and Indexy.

🔹Unique Narrative: It merges meme culture ("Make Animals Great Again") with venture capital deployment, combining community enthusiasm with institutional endorsement.

Core Competitiveness

🔸Capital Commitment and Transparency

EnigmaFund has injected six-figure USDC funds and has committed that the team has never sold any tokens.

The project ensures transparent operations by publicly disclosing all transactions and investment records through real-time wallet addresses and weekly "Strategic Solana Sunday Shares."

🔸Innovative Profit Mechanism

Structured Buyback: 50% of the fund's profits are used for $SSR buybacks and locked for 36 months, creating sustained buying pressure while effectively reducing selling pressure.

Community Incentives: Ongoing operational reward mechanisms, such as the monthly "Raider" reward of 888 SOL, enhance community stickiness.

🔸Token Economics Design

Founders hold 20%, with 15% liquidity locked on Jupiter for 6 months.

11.7 million tokens are locked in LP, enhancing market stability.

50% of the fund's profits are used for buybacks and locked long-term, driving value accumulation.

Market Performance and On-Chain Data (as of August 19, 2025)

Fully Diluted Market Cap: Approximately $3.9 million

24-Hour Trading Volume: Approximately $120,000 (99% from Raydium)

On-Chain Liquidity: Approximately $413,000

7-Day Price Change: +7%

Liquidity/FDV Ratio: Approximately 10%

It is evident that @OfficialSolanaR $SSR is still in its early stages, with a relatively small market cap, but it demonstrates differentiated advantages on multiple levels, making it worthy of continued attention.

8,78K

From the deep collaboration with WLFI, we see the strategic value of Falcon Finance.

TL;DR

The $10 million strategic partnership between Falcon Finance and WLFI is not just a simple exchange of funds and resources, but a groundbreaking experiment: the deep integration of political capital and DeFi technology.

Through the interoperability of USDf and USD1, they are building a regulatory-friendly stablecoin ecosystem, providing a new leapfrog development path for medium-sized DeFi projects.

1. Complementary resource integration: Political capital meets technological innovation

@FalconStable's advantage lies in its mature over-collateralization model, cross-chain architecture, and an existing circulation of over $1 billion in USDf; while @worldlibertyfi brings strong political and compliance resources, backed by the Trump family and a network of former high-ranking officials in regulatory bodies, with USD1 positioned as "the fastest-growing fiat-backed stablecoin."

This complementarity is not just a connection of technology and capital, but a combination of "decentralized markets" and "real political influence." For Falcon, this means upgrading from a purely technical player to a participant that can hold a place in compliance and political maneuvering.

2. Innovative dual-token liquidity model: Trust premium brought by hard anchoring

Falcon and WLFI have achieved a hard 1:1 interoperability between USDf and USD1 through the Mint-Burn Parity mechanism:

🔸 Users deposit USD1 and can receive an equivalent amount of USDf after verification via Chainlink.

🔸 Burning USDf releases USD1, with the entire process featuring transparent and mandatory anchoring.

This model, combined with the dual-track architecture of LayerZero and Chainlink CCIP, significantly reduces cross-chain latency and gas costs, while ensuring instant liquidity through a universal collateral router.

For users, this is not only an improvement in efficiency but also a "new paradigm of cross-chain stablecoin liquidity," further enhancing the market trust in stablecoins on a technical level.

3. Compliance synergy: Dual transparency and political endorsement

Falcon itself possesses Chainlink PoR real-time reserve proof, Gibraltar VASP registration, and a comprehensive risk control integration; WLFI relies on a New York trust license, monthly audits, and deep political connections. The combination of the two forms a dual transparency + dual compliance framework.

More importantly, the political resources behind WLFI bring a "safeguard effect" to the entire system. In the current core pain point of the stablecoin sector, the compliance and regulatory game, Falcon, through this cooperation, has effectively secured a "political insurance" for future development.

Conclusion

@FalconStable's deep collaboration with WLFI represents an important direction for the evolution of DeFi: shifting from purely technology-driven to a comprehensive strategy of technology + politics + compliance.

Although facing risks of political centralization and technological coupling, its innovative dual-token interoperability design and regulatory-friendly ecosystem construction bring new competitive variables to the stablecoin market.

This model of "regulatory political capital as a service" combined with multi-chain DeFi backends provides a new path for medium-sized DeFi projects to achieve leapfrog development through strategic alliances. Successful cases may give rise to a new class of DeFi projects that combine political influence with technological innovation.

6,59K

Lombard Finance: Making Bitcoin Work for You

Bitcoin is the most consensus-driven asset, but it has a "flaw": when it's just sitting in a wallet, it's a "dead asset" that doesn't generate income on its own.

What @Lombard_Finance does is simple but significant: it "activates" Bitcoin, allowing you to hold BTC while also earning staking rewards.

The operational logic is not complicated:

Deposit BTC into Lombard → The protocol gives you a 1:1 LBTC token → Lombard stakes these BTC into the Babylon protocol → Staking rewards are automatically reflected in the price of LBTC.

Why do I have high hopes for Lombard? There are three main reasons:

1. The growth rate is astonishing

Lombard went live in April 2024 and reached over $1 billion in TVL in just 92 days. This is an incredible record in the DeFi industry. It now manages assets totaling $1.57 billion and has firmly established itself at the top of the "liquid Bitcoin staking" sector.

2. The broadest cross-chain layout

LBTC is natively deployed on 12 chains, including major networks like Ethereum, BNB Chain, and Base. Users holding LBTC can not only enjoy staking rewards but also participate in lending, trading, and liquidity mining across various DeFi protocols, truly achieving "earning while being liquid."

3. Institutional backing + deep ecosystem

Lombard has received $16 million in funding led by Polychain Capital and collaborates with top institutions like Coinbase and Tezos. More importantly, it has integrated with mainstream DeFi protocols such as Aave, Curve, and Uniswap, making LBTC genuinely usable within the entire ecosystem, rather than just a shell token.

@Lombard_Finance is upgrading "holding Bitcoin" to "making Bitcoin work for you." In my view, this is not just a sector opportunity but could be a key entry point for BTC in the DeFi world, deserving of long-term attention!

24,86K

You guys should still remember the @grass project that allowed countless people to reap big rewards not long ago.

It gained popularity with its low entry barrier and rapid airdrops, reaching a market cap of over $700 million at one point, becoming a star project in the DePIN space.

But today, I want to talk about another project in the same space, @theblessnetwork, which is about to launch.

In my opinion, Bless's design is more promising in terms of long-term sustainability and network effects compared to Grass.

Token model comparison: Bless is more innovative.

Grass: single-token model, fixed supply of 1 billion, users can trade the $GRASS they receive immediately, a typical "short-term gains + instant cash out" scenario.

Bless: dual-token model (TIME + BLESS), with a total supply of $BLESS capped at 10 billion, while $TIME is generated in real-time as points, which can eventually be exchanged for BLESS. This essentially incorporates delayed cashing out and continuous incentive mechanisms into the design.

In other words, $Grass is like a one-time candy giveaway, while $Bless is more like a continuous drip, encouraging users to keep investing.

Airdrop and participation threshold: Bless focuses more on quality.

Grass: 27% airdrop, almost everyone gets a share, but the result is "meager per capita" rewards, with severe dilution in distribution.

Bless: 10% airdrop, with 8.5% of the genesis pool directly aimed at early participants, and a mechanism to prevent "whale" manipulation, ensuring real user benefits.

It can be seen that Grass is competing on speed and breadth, while Bless values quality and long-term community.

User retention and incentives: Bless shows healthier data.

Grass: 280,000 daily active users, which seems impressive, but the retention rate after 30 days is only 62%.

Bless: 160,000 TIME point earners, though smaller in scale, has a retention rate of 78%, indicating that users are more willing to run nodes long-term.

This is also the advantage of the dual-token mechanism: users are not just in it for a one-time airdrop, but for long-term gains and governance rights.

Community sentiment: Grass is cautious, Bless is optimistic.

Grass: the community is concerned about "too scattered distribution and too thin rewards"; although the hype is high, the sentiment is cautious.

Bless: the genesis pool design is considered "generous", with transparent mechanisms, and everyone is more concerned about when the TGE will start. With Kaito incentives, the overall atmosphere is "patiently waiting, full of confidence".

Final evaluation (personal opinion only):

Grass represents the classic Web3 airdrop model of "rapid growth + instant incentives".

Bless, on the other hand, through the TIME-BLESS dual-token design, creates a new way of "delayed cashing out + continuous incentives", which is more conducive to forming long-term network effects.

For the DePIN space, which requires long-term computing power and node support, I believe Bless's model is clearly healthier and more worthy of long-term optimism.

8,4K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin