Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

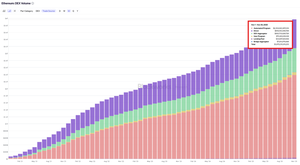

Ethereum is accelerating, even in a cold market.

DEX volume keeps climbing month after month, hitting $3.9T in November 2025, the highest level ever recorded!

Thread:👇

1/ Ethereum DEX volume has been in a multi-year uptrend.

And as we see, it’s structural growth driven by better liquidity and better UX.

Because when fundamentals and real usage align, the curve starts looking exponential.

2/ Automated programs lead the way.

Automated trading programs dominate the chart with $2.3T in volume.

Obviously, this shows that algorithmic liquidity is now forming the backbone of Ethereum’s DEX ecosystem.

3/ Direct trading still moves almost $819B monthly.

Even with aggregators and automation, users continue to rely on Ethereum’s native DEX flows.

High trust ≠ low activity.

High trust = consistent activity.

4/ Aggregators pushed $683B that month.

People don’t want to search for the best price, they want the best execution instantly.

Smart routing = better deals for everyone.

5/ Lending Pools and Bridges.

Lending pools added $33.8B, while bridges contributed $7.2B.

Capital efficiency and cross-chain mobility are now essential pieces of Ethereum’s liquidity loop.

Source: @blockworksres

2.95K

Top

Ranking

Favorites