Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Over $34 billion in microinsurance demand went unmet across 37 countries last year.

The bottlenecks are trust, liquidity, efficiency, and compliance. Blockchain and DeAI are solving these.

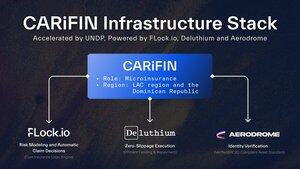

We're working with @UNDP Latin America & the Caribbean (LAC region) and the Dominican Republic, @Deluthium, and @AerodromeFi to build onchain rails for microinsurance that ensure privacy, regulatory compliance, fair and efficient insurance claims.

Our first goal: Unlock microinsurance access at scale for the unbanked, especially for women across the LAC region and the Dominican Republic.

2/ Accelerated by @UNDP LAC and the Dominican Republic, CARiFIN (Caribbean Resilience Finance Platform) is an onchain microfinancing platform specialized for the region, targeting solutions for microinsurance, microcredit, and microsavings.

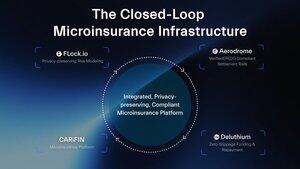

3/ CARiFIN is powered by a high-trust backend:

→ FLock is responsible for risk modeling and automatic claim decisions, serving as the core insurance logic engine.

→ @deluthium handles currency transaction execution and stablecoin conversion during claims, ensuring smooth settlement.

→ @AerodromeFi unlocks identity verification and compliance for payment recipients via the open-source and modular VerifiedERC20 standard.

4/ CARiFIN’s first use case begins with microinsurance, but the horizon is far wider. The team is expanding the scope to microcredit and microsavings.

We’re building tech that creates real impact. The ultimate goal is to support Resilience Finance in the LAC region and the Dominican Republic - empowering the unbanked with blockchain and DeAI technology. 🌎

This is just the beginning. Pilot launch coming soon.

3.29K

Top

Ranking

Favorites