Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

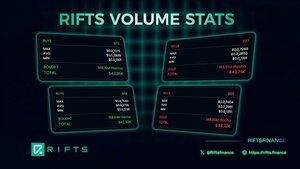

Over the past 4 days, we deployed a temporary dedicated RIFT for $RACHA <—> $rRACHA to demonstrate how our infrastructure can stimulate on-chain activity while generating sustainable returns.

Here’s what happened:

~$90,000 in trading volume generated for RACHA, resulting in more than $900 in fees for the $RACHA team

~$3,000 in direct arbitrage returns flowing to the protocol

+$350 from wrap/unwrap & SPL-2022 fees

These micro-flows accumulate into predictable, repeatable revenue lines.

Additional Benefit:

Because the arb engine continuously buys discounted $RACHA on pullbacks and sells the tokens back into the rRACHA pool (which is owned and operated by RIFTS), the system naturally absorbs sell pressure during sharp dips.

This has two effects:

· Softens hard dumps on the underlying token

· Generates additional arbitrage profit when price snaps back

It’s an on-chain stabilizer—fully mechanical, emissionless, and always running.

Takeaway

The RACHA / rRACHA deployment shows how a single RIFT can:

· Stimulate meaningful volume for any asset

Produce organic fee revenue for the underlying token ecosystem

· Deliver profitable, recurring arbitrage yield for the RIFTS protocol

· Create additional fee layers through wrap mechanisms and SPL-2022 logic

This is the model we are scaling across Solana. If you want this for your token, we’re already onboarding the next set of assets.

Top

Ranking

Favorites