Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

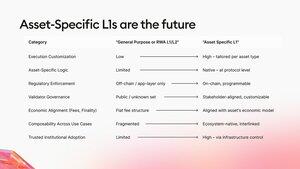

Most blockchains are designed for broad use cases, which work well for trading and fast retail activities but not for regulated assets like real estate. Property transactions require strict identity checks, verified documents, predictable settlements, and coordinated venues. General-purpose chains simply don’t optimize for these needs.

@integra_layer follows a different approach by developing a purpose-built Layer 1 blockchain specifically for real estate markets. They are already laying the groundwork:

Native compliance: By aligning with the ERC-3643 Association, Integra supports permissioned assets and ONCHAINID at the base layer, providing issuers with a ready-made framework for regulated transfers.

Active ecosystem onboarding: The City of Integra missions and dashboard demonstrate early user and builder engagement even before the complete infrastructure is in place.

What will validate the vertical-L1 model?

1. Regulated issuers launching identity-gated instruments on-chain.

2. Rental income or dividends settling directly on the network, showcasing visible performance gains.

3. Cross-venue liquidity routing designed for compliance, not haphazardly patched together.

The thesis is simple: A generic chain can’t meet the performance and regulatory requirements of real estate markets. A specialized chain can. If @integra_layer starts delivering real flows, the “Internet of Real Estate” becomes a practical market structure, not just a concept.

Top

Ranking

Favorites