Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

In the past couple of days, I've been reviewing my trades using Gemini, and I mentioned a problem: cost control. A piece of advice here inspired me greatly, which is to redefine "cost control". Simply put, if you want to achieve extraordinary things, you must abandon mediocrity.

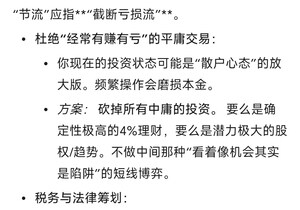

For those currently in this asset phase, saving on coffee is meaningless. Your "cost control" should refer to "cutting off loss flows".

👉 Eliminate mediocre trades that have "frequent gains and losses":

- Your current investment state may be an amplified version of the "retail investor mentality". Frequent trading can erode your principal.

- Solution: Cut all mediocre investments.

It should either be a highly certain 4% financial product or a highly potential equity/trend. Avoid the middle ground of short-term speculation that "looks like an opportunity but is actually a trap".

For example, after almost losing money on a short-term bottom fishing of $SAHARA yesterday, I realized that after the short position was hit by ADL, there would be a large number of liquidation orders putting pressure on the market. To bet that the project party would care about their reputation and make an announcement, I still made a move. This trade would at most rebound to 0.5, but the downside potential is huge. In a bear market, encountering such an opportunity, buying $50,000 to earn 10% could potentially lead to a 50% loss, making the significance of the trade very small. Before making each trade, you must consider the risk-reward ratio, which requires a high level of rationality.

After talking with Gemini, my biggest insight is not to overtrade. My understanding of this statement is profound, but in practice, I often can't control my hands. What AI does is actually help to think about the causes and consequences of this matter in a more systematic way.

👉 Tax and Legal Planning:

- When assets reach a certain level, the biggest costs are tax and legal risks.

- Solutions: Establish a family trust (to isolate risks) or optimize taxes through offshore structures. Prevent asset depreciation due to marital changes or unexpected liabilities.

Here's a section in case some friends are interested; I'll add it as well.

27.45K

Top

Ranking

Favorites