Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

In fact, @centrifuge's deRWA (tokenized RWAs in DeFi) thesis is compelling:

– Institutional-grade assets (stable cash flows) in DeFi

– Composability (use as collateral, LP, trade 24/7)

– Transparency (on-chain verification, real-time NAV)

– Accessibility (permissionless, fractional ownership)

For example, if you want S&P 500 exposure, you can buy SPXAA from Centrifuge.

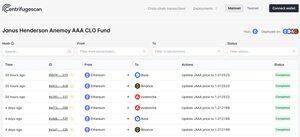

Or, there's also deJAAA – a wrapped version of JAAA CLOs, a freely transferable and DeFi ready version of the Janus Henderson Anemoy AAA CLO Fund.

↓

– Institutional backing from Janus Henderson

– Transparent NAV reporting

– Integration with Centrifuge's $1.37B RWA ecosystem

– Low fees: 0.50 bps

– Regulatory compliance, structured for accredited investors

deRWA is the thesis.

Top

Ranking

Favorites