Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Lombard makes the ending of BTC.b different!

Avalanche handed BTC.b over to Lombard, which is not just a technical migration, but more like a transfer of power.

The issue with Bitcoin on-chain has never been a lack of liquidity, but rather a lack of trust-level infrastructure. In the past, BTC.b was part of Avalanche, with a circulation scale of over 500 million dollars, integrated into mainstream protocols like Aave and GMX, but its cross-chain and custody mechanisms were still a centralized semi-closed model.

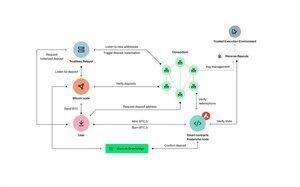

After Lombard took over, this structure was completely rewritten. A security alliance of 15 institutions replaced the original Warden nodes, with Cubist responsible for the key signing layer and Chainlink CCIP providing real-time reserve verification.

More importantly, BTC.b is no longer a single-chain asset, but has become a multi-chain standard. It will simultaneously launch on ecosystems like Ethereum, Solana, and MegaETH. For developers, this is the first time they can seamlessly access real Bitcoin liquidity; for institutions, this is a structure that can be audited and recognized by compliance systems.

In the long cycle of Bitcoin financialization, this acquisition is a signal:

The logic of infrastructure is reversing.

In the past, on-chain assets had to connect to Bitcoin;

Now Bitcoin has to connect to on-chain.

The story of BTC.b is just beginning.

#KaitoYap @KaitoAI #Yap $BARD @Lombard_Finance

Top

Ranking

Favorites