Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Prediction markets Overview

1. TLDR

• Allows users to trade “shares” on future events (sports, politics, culture, crypto) that pay $1 if the event happens and $0 if it doesn’t

• In theory, markets aggregate dispersed information into better forecasts; in practice the UX and distribution are shifting fast toward social, feed-native experiences

• Daily volumes are around ~$30M each on Polymarket ($1b valuation) and Kalshi (~$2B valuation) and a friendlier U.S. regulatory stance on this market

• Adheres to the "hypergamble/hyperfinancialisation" thesis and a growing social element --> every post has an attached market and “bets become statements” (identity + reputation), lowering intent/friction and broadening participation

- - - - -

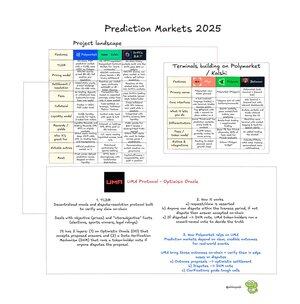

2. Project landscape

a) Markets

• @Polymarket: largest crypto-native venue on @Polygon whose markets resolve through UMA’s optimistic oracle

• @Kalshi: A CFTC-regulated, U.S.-accessible exchange --> contracts listed on a Designated Contract Market with event specifications

• @DriftProtocol B.E.T: DeFi native market on @solana

b) Terminals & bots building on top

• @fliprbot: social trading bot + terminal that started on X, goal to become a cross-venue aggregator

• @polycule_bot: @telegram-native bot for Polymarket with copy-trading

• @betmoardotfun: a Polymarket web terminal with breaking-news feeds, on-page trading, wallet/profiles analytics

- - - - -

3. The risks (and why disputes happen)

• Unclear market rules: Recent example was the $14M “Zelenskyy suit” where the market showed how even widely reported “facts” (most outlets said he wore a suit) can still be argued both ways --> what is perceived fairness?

• Oracle design & governance trade-offs: On Polymarket, many markets ultimately rely on UMA token-holder votes. In the Venezuela election market, critics argue UMA voters overrode the event’s posted resolution rules (primary source of truth was the official results) and paid out based on a media-consensus standard instead --> i.e. conflicts if voters can also be traders

• Manipulation risk: can shift from “truth-seeking” to “tautology-seeking” --> incentives to push narratives rather than measure them

They were initially quite niche, but quickly moving into mainstream + socially distributed products.

...

Top

Ranking

Favorites