Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

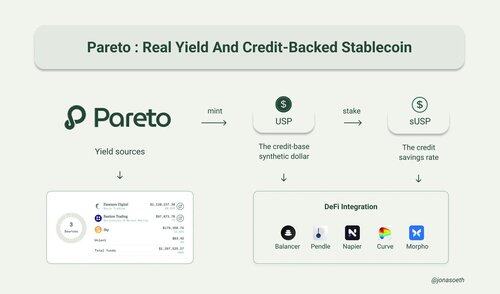

"Today, I want to talk about a new emerging YBS player: Pareto"

@paretocredit is pioneering institutional-grade yield from RWA-backed lending activities

Backed by real-world assets, optimized for on-chain performance

→ If you're not in this, you're missing one of the clearest opportunities in DeFi

There are 2 easy ways to acquire USP ↓

1/ Permissioned Minting (KYC Required)

Mint directly via Pareto’s app at

KYC → Deposit USDC/USDS via Pareto → Mint USP (no slippage)

2/ Permissionless On‑Chain Acquisition

Trade on Balancer V3 pool → Swap USDC ↔ USP directly

Provide liquidity to the USP/USDC pool on the same Balancer V3 pair

• Earn trading fees

• Receives 3x Pareto Efficiency points

_____________________________________________

USP = Transparent, Yield-Backed Stability

Here’s what powers USP ↓

• $1.00 peg | 100%+ collateralized

• $1.39M TVL backed by institutional credit

• sUSP earns 9.25% APY

Yield sources? 100% transparent on-chain:

• @FasanaraDigital Credit Vault: $1.12M (80.16%) → Basis trading strategies with managed risk

• @BastionTrading Credit Vault: $97.8K (7%) → Derivatives & market-making exposure

• USDS: $159K (11.4%)

• Unlent: $20K (1.43%)

Over the past two weeks, USP’s capital allocation and vault performance have been stable and gradually increasing a sign of growing confidence and institutional participation

3.72K

Top

Ranking

Favorites