Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ParaFi Capital

ParaFi is an alternative asset management and technology firm that operates liquid and venture strategies focused on the digital asset ecosystem.

ParaFi Capital reposted

The Crypto Treasury Playbook

🎙️ @joshsolesbury @JasonYanowitz Ben Forman

02:54 Crypto Treasuries Overview

23:51 Scale of Crypto Treasury Vehicle Growth

27:11 Green Flags When Launching A Treasury

53:56 Joining Top 50 Equities

01:03:15 This Cycle's Top Signals

Full episode available via links below ↓

5.34K

ParaFi Capital reposted

DigitalX Limited (ASX:DCC) has secured a $20.7 million strategic investment from global digital asset leaders Animoca Brands, UTXO Management, and ParaFi Capital.

The funds will expand DigitalX’s Bitcoin treasury, reinforcing our Bitcoin-first strategy. Upon completion, DigitalX’s total assets will exceed A$95 million.

As part of the raise, industry veterans Yat Siu (Animoca Brands) and Hervé Larren ( will join our Advisory Board, providing strategic insight and global reach as we enter our next phase of growth.

Read the full announcement here:

8.35K

ParaFi Capital reposted

Michael Shaulov, CEO of Fireblocks, spoke to @joshsolesbury of @paraficapital at today's @SCB10X_OFFICIAL & @business #REDeFiNETOMORROW2025 event.

They discussed customer stickiness through the peaks and troughs of the market & the mission criticality of what Fireblocks does.

2.08K

ParaFi has been entrusted with managing @SharpLinkGaming’s Ethereum treasury. Through our asset management agreement alongside @galaxyhq, we are supporting SharpLink’s strategic path to becoming the largest ETH public company holder.

Consensys.ethJun 2, 2025

We are proud to announce that, with the closing of the $425 million private placement led by @Consensys, SharpLink will become the largest publicly traded ETH holder globally.

Sharplink shares our vision of @Ethereum as a new kind of economic infrastructure and will use the proceeds to adopt ETH as their primary treasury reserve asset. 🧵

4.13K

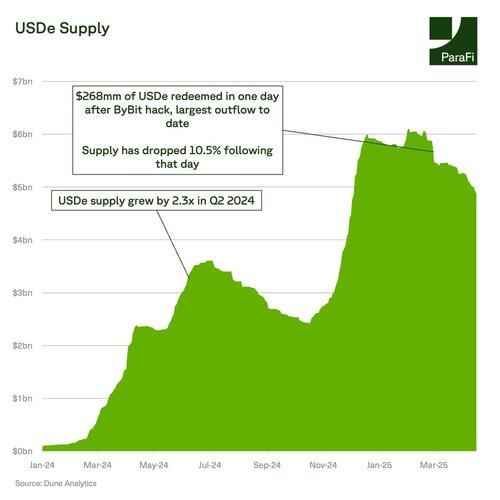

🧵 1/ In less than 18 months, Ethena has become a bedrock across both DeFi and CeFi infrastructure.

Ethena’s USDe has become the fastest USD asset to reach 5bn in supply. With Ethena’s rapid growth, the ParaFi team wanted to do a deep dive into the protocol’s mechanics. We focused on three main areas:

1. Peg Resilience: To what degree has Ethena maintained its peg through massive market drawdowns?

2. Yield Profile and System Backing: How have the protocol’s asset composition and yield drivers changed YTD?

3. Capacity Constraints: Is Ethena nearing DeFi TVL or open interest limits?

33.63K

ParaFi Capital reposted

M^0’s stablecoin platform is live on @solana.

@KAST_official will be building the first stablecoin powered by M^0 on Solana, unlocking new digital dollar use cases for payments and savings.

They’re joined by integrators @spreefinance, @SquadsProtocol, @jito_sol and @Perena__.

Each partner brings unique value to the M^0 ecosystem. Let’s break it down ⬇️

385.53K

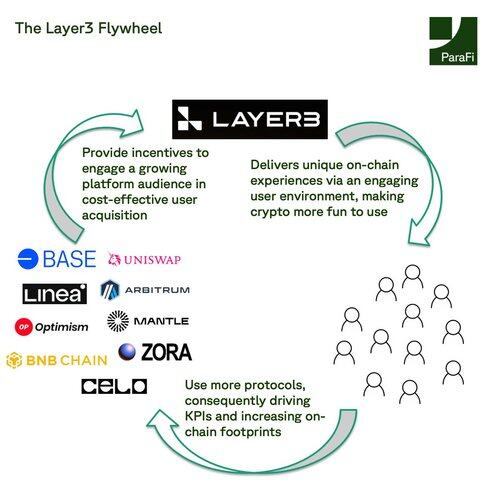

🧵1/ Layer3 is now one of the largest routers of on-chain economic activity, formulating its position as a next-generation aggregator. It’s not just a ‘quest platform’ as some misconstrue it, but much more.

Layer3 has:

-Powered on-chain experiences for 5mm+ users

-Facilitated 157mm transactions

-Worked with over 500 crypto applications

Additionally, it has some of the stickiest users in the crypto space, with top users spending 100+ consecutive days on the platform.

👉Let’s take a closer look at Layer3 and its mission to become the homepage for the on-chain world.

37.12K

Top

Ranking

Favorites

Trending onchain

Trending on X

Recent top fundings

Most notable