Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

0xAnna

stay hungry stay foolish

$ena

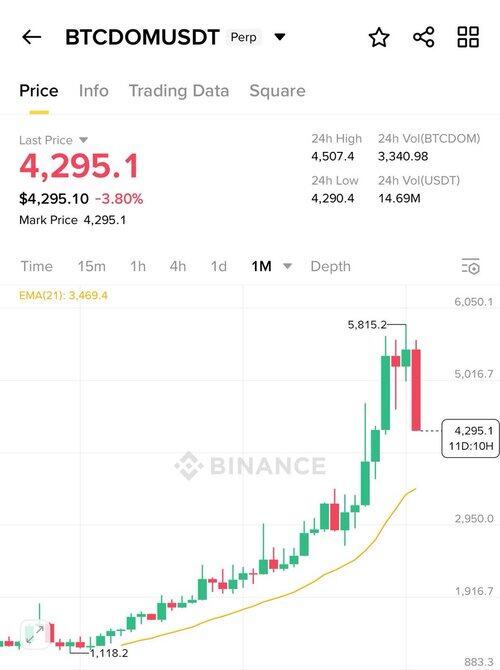

I have always believed that it could become a hot target for speculation in the crypto space, but it has failed to take off several times. I wonder if it can succeed this time?

In the US stock market, the concept of stablecoins is scarce, which is why crcl has such an outrageous PE ratio. The stablecoinx company has painted a nice picture; they plan to launch the ena treasury and list on the US stock market with the usde code. Just think about it, a US stock directly named after the stablecoin usde is really making people feel FOMO.

I’ve opened a small position. Can Bitcoin give me a break and pull back a bit so I can add to my position? 😂

12,82K

Many people are starting to call $sol. $sol is increasingly resembling the last ETH, playing the role of the doomsday chariot.

Is this week's script about $sol making up for losses or everyone pulling back together?

Looking at the sol/eth trading pair since May, it can be said to be a sight to behold 😢

4,6K

Speculating on bubbles also requires looking at the other side of the bubble. Even if you make money, you should still put that money into value investments.

链研社19.7. klo 10.20

Explain why it is said that the net is being closed. SBET holds over 310,000 coins, worth more than 1 billion USD, but most of these holdings are just shifting from one hand to the other, with a small portion purchased from the market. Holding 1 billion USD worth of ETH cannot dominate the crypto market.

So SBET takes a different approach, using 1 billion USD to leverage a market cap of 400 billion for ETH. Recently, many people have started to claim that ETH has risen because of value discovery, but the relationship is not significant; it’s not due to fundamental improvements, but rather because a consortium has discovered a way to print money. Let me explain this to you in detail.

1. Buy a shell company in the US stock market, inject 1 billion USD into the publicly listed company, and dilute existing shareholders through a new issuance. They control 90% of the circulating shares, then say, look, my company’s net assets are equal to the ETH I hold, why don’t you buy in?

2. In the crypto market, they say that US-listed companies are starting to hoard ETH, and the company still has cash and will continue to purchase tens of billions of USD from the market, so ETH is bound to skyrocket.

3. When ETH rises, it becomes easier to raise funds through issuing junk bonds in the US stock market, raising a few hundred million USD, all used to buy ETH.

In the end, not only do they gain a company worth tens of billions of USD, but they also hold tens of billions of USD in ETH. With only around 3 billion USD, they still want to issue more stocks to raise 5 billion USD. After calculating and deducting liabilities, they could net tens of billions of USD in just a few months? Faster than Trump’s money printer!

It’s absurd that junk bond fundraising exceeds that of US stock market fundraising, similar to the previous SPAC shell company hype, which will eventually be called to a halt by regulators. If that happens, the stock could face a drop of 50%-70%, and ETH might also fall back to its original point, dropping 30%.

I don’t know how long this market irrationality will last, but these are things you need to understand clearly before participating. This is neither a new model nor a perpetual motion machine.

1,12K

0xAnna kirjasi uudelleen

🧵

1/

On DAT* and BTC/ETH Treasuries

*post has consent from @saylor

CASE STUDY: $MSTR created the template for crypto treasury.

- since 2020 start of $BTC strategy, @MicroStrategy

- stock gain from $13 to $455

QUESTION?

How much is due to BTC rise vs treasury strategy

$BMNR @BitMNR

315,24K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin