Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

🚨Attention all $GLXY holders🚨

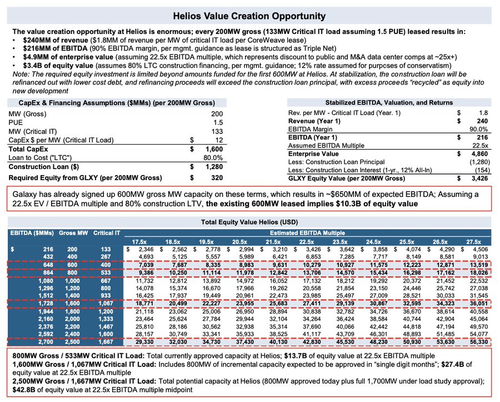

$GLXY's AI data center business alone could add anywhere from $10-40B in market cap over the next few years (vs current market cap of $10B today).

This report from @RHouseResearch is a must read. They do a comprehensive deep dive on Galaxy's AI data center business vs bitcoin mining peers like $CORZ $WULF $IREN & traditional data centers.

At a 22.5x Equity Value / EBITDA ratio (traditional data centers like $DLR & $EQIX trade at ~24x multiples) that would contributes this much market cap to galaxy:

At 600MW (current lease with $CRWV) = $10.3B

At 1600MW (current 800MW approved + another 800MW from ERCOT expected by EOY) = $27.4B

Helios's max potential 2.5GW = $42.8B

Vs a current market cap today of ~$10B... PLUS management has told us they are evaluating ~40 different Bitcoin mining sites that they may buy and convert into AI data centers, potentially expanding their power pipeline beyond the current 2.5GW at Helios!

16.5.2025

Rittenhouse Research is long Galaxy Digital $GLXY $BRPHF

We believe Galaxy's flagship data center Helios will generate $1.7B of EBITDA and $32B of equity value in the near-term, w/ significant further upside.

Our full thesis can be found via PDF here:

11,9K

Johtavat

Rankkaus

Suosikit