Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

- XRP at ATH

- New player Sentora just raised raised $25M from Ripple, Flare, Tribe, etc to go into XRP DeFi.

- Came out of a merger between two DeFi infra teams with $3B+ in flow

- PayPal as a partner

- Founder of Sentora deployed a new project on base to give retail to access what institutions are about to tap into

- Reminds me of Tibbir quite a bit in the early days, when people could not connect the dots.

Thanks for the info @dogoshii

Finally a way to get onchain exposure to XRP without bridging over there.

Reminder…

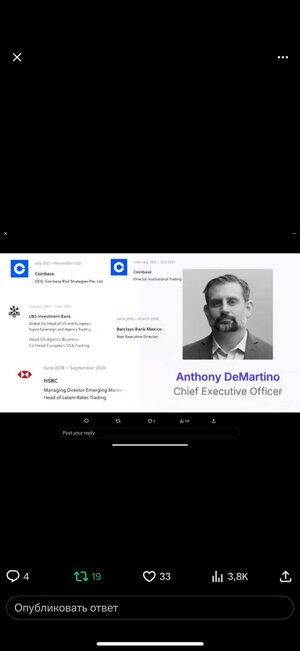

Another point I just discovered, founder has very close ties to Coinbase (is an ex Coinbase exec).

more info here

19.7. klo 00.41

🧠 Founder Breakdown: @admff492

1. Institutional Finance Expertise

•@Barclays Capital: Specialized in capital structure and risk frameworks at the institutional level.

•@HSBC & @UBS : Deep experience in derivatives, structured credit, and advanced portfolio risk strategies.

•His expertise lies in building and managing complex financial infrastructure for multi-billion-dollar systems.

2. Coinbase Executive Legacy

•Served as Head of Risk at @coinbase Institutional.

•Helped build regulatory-compliant frameworks, custody architecture, and risk control systems.

•Directly worked on integrating TradFi-grade compliance into onchain products — a rare bridge between $TradFi and $DeFi.

3. Founder of @SentoraHQ @OfVoice25355 token)

•$Sentora isn’t just another $DeFi protocol. It’s an institutional risk layer, focusing on:

•Onchain risk management infrastructure

•Compliant smart contract vaults and custody mechanisms

•Decentralized counterparty risk scoring models

•$ADM serves as the access token to this regulated DeFi stack.

4. Elite Backing and Strategic Capital

•Raised $25M from top-tier investors:

•@Ripple (Xpring) – institutional-grade endorsement

• @TribeCapital_ , and PetRock Capital

•This isn’t retail hype — this is deep, vetted, institutional belief in his long-term vision.

🔍 Final Take:

@admff492 isn’t building a meme token — he’s building the rails for institutional DeFi.

He understands both sides of the equation: Wall Street compliance and onchain agility.

ADM isn’t just a token. It’s a bet on the coming wave of regulated onchain finance, where DeMartino is laying the groundwork — years ahead of most founders.

🔍 Anthony DeMartino – Visionary Breakdown

1. Onchain Risk Pioneer

•Sees onchain risk as infrastructure, not a feature.

•Building a financial backend for institutions — like a “DeFi @BlackRock .”

2. Regulation-First Mindset

•Welcomes compliance, not avoids it.

•Bridges DeFi with traditional finance through audit-ready systems.

3. Sentora = Trust Layer

•Turning risk into a standardized, tokenized metric.

•Lays foundation for ETF-grade DeFi exposure.

4. Institutional Language Fluency

•Talks to funds, auditors, regulators — not just crypto-native circles.

•Building for capital allocators, not degen traders.

5. Long-Term Infrastructure Thinker

•Doesn’t chase hype; builds systems that survive cycles.

•Thinks 5–10 years ahead: insurance, ratings, derivatives, custody.

⸻

Anthony isn’t just building a project.

He’s architecting the trust layer for onchain capital markets.

Congrats on ATH

Up only

6m -> 24m.

Base is a great chain for fundamental plays.

72,62K

Johtavat

Rankkaus

Suosikit