Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

1/ L2s aren’t just scaling Ethereum.

They’re scaling demand for ETH.

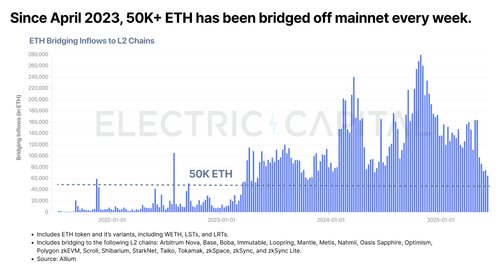

• 50K+ ETH bridged to L2s weekly

• ETH = 35% of L2 lending collateral

• Every new wallet = more ETH to hold, trade, and stake

L2s turn ETH into the monetary base of the on-chain economy.

2/ Mainnet usage flat? Doesn’t matter.

ETH bridges to L2s at 50K+ ETH/week.

Each bridge = demand signal.

L2s activity is scaling ETH demand.

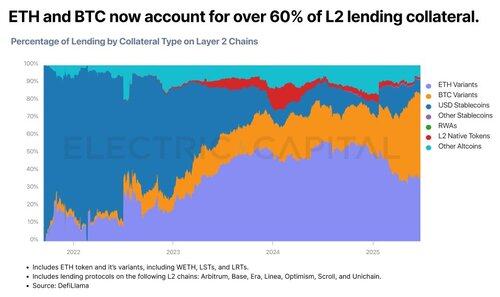

3/ ETH is becoming DeFi’s collateral of choice.

On L2s, ETH + BTC = 60%+ of all lending collateral.

ETH leads because it earns, secures, and settles.

Bitcoin leans on Ethereum’s rails for programmable finance.

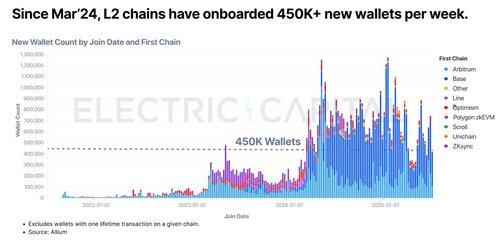

4/ L2s = distribution channels for ETH.

Since March 2024, 450K+ new wallets per week onboard to @arbitrum, @base, and more.

They skip the main chain.

But they buy and use ETH.

6/ Thanks to our data partners at @AlliumLabs and @DefiLlama.

Follow for more deep dives on crypto data, Ethereum scaling, and the evolving on-chain economy.

59,32K

Johtavat

Rankkaus

Suosikit