Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

大晖哥Whdysseus

@1783DAO Initiator @BroadChain_info Founder~ Crypto OG since 2014 , Global Macro & Strategy Analyst (Wild), 10-year veteran TCM, focusing on crypto, U.S. stocks and Hong Kong stocks and other markets, former securities and fund practitioners, EX Tencent, DYOR!

SharpLink Gaming @SharpLinkGaming $SBET announced that former BlackRock $BLK Head of Digital Asset Strategy Joseph Chalom has been appointed Co-CEO to help strengthen its Ethereum $ETH treasury development.

Joseph Chalom worked at BlackRock for 20 years and was involved in launching several significant products, including $IBIT (with assets under management exceeding $87 billion), $ETHA (with assets under management exceeding $10 billion), and $BUIDL (the first tokenized treasury fund on Ethereum).

1,53K

Hong Kong's listed companies related to Crypto and stablecoins have begun to collectively issue new shares to raise funds.

On the morning of July 25, OSL (HK:00863), a licensed Crypto trading platform in Hong Kong, announced that it had signed a "private placement" agreement.

The share transfer price is HKD 14.9, totaling approximately HKD 2.355 billion. After deducting costs, the raised funds amount to about HKD 2.336 billion, roughly USD 300 million. The funds will be used to advance global compliant payment channels, stablecoins, and RWA tokenization business.

An estimated 158 million shares will be issued, increasing the previous share capital of 627 million to a new total of 785 million.

Based on the closing price of HKD 17 on July 25, OSL's actual market value reaches HKD 13.345 billion, approximately USD 1.72 billion.

On July 4, the largest digital bank in Hong Kong related to Crypto and stablecoins, ZA Bank, through its parent company ZhongAn Online (HK:06060), completed a placement of 215 million shares at a transfer price of HKD 18.25. The total amount raised from the placement is approximately HKD 3.924 billion, with a net amount of about HKD 3.896 billion, roughly USD 500 million.

Based on the closing price of HKD 21.15 on July 25, ZhongAn Online's market value reaches HKD 35.634 billion, approximately USD 4.568 billion.

The next estimated fundraising through share issuance is by Victory Securities (HK:08540), a licensed Crypto securities company in Hong Kong.

Since 2025, Victory Securities' stock price has surged nearly 180%, and its market value has reached HKD 1.795 billion, approximately USD 230 million.

457

BitMine @BitMNR $BMNR Chairman and Fundstrat founder Tom Lee @fundstrat stated in an interview with CoinDesk that if we refer to Circle's $CRCL current valuation level (130 times EBITDA), then it is completely reasonable for Ethereum to rise to $15,000.

Data shows that Bitmine holds 566,800 $ETH, worth approximately $2.1 billion.

1,55K

What happened?

Hong Kong's largest digital bank, ZA Bank, has been removed from the App Store in China?

However, Wise, Airstar Bank, Livi Bank, and Mox Bank are still available for download.

I have a feeling that as Hong Kong's crypto regulatory policies become more refined,

loopholes will become fewer and exploiting them will become increasingly difficult.

491

On July 24, Bitmine $BMNR submitted a supplemental prospectus to the U.S. SEC, authorizing the continuous sale of common stock in the public market through two brokerages, Cantor Fitzgerald and Think Equity.

The size of the at-the-market (ATM) funding plan has been increased from $2 billion to $4.5 billion.

This additional issuance provides funding support for Bitmine to further increase its holdings of $ETH and expand its asset reserves.

1,49K

The resilience of the US stock market

The Dow Jones Industrial Average (DJI) and the S&P 500 have reached new historical highs.

The Nasdaq Composite Index (NASDAQ) is approximately at a historical high.

During the US earnings season, there are both ups and downs.

Tesla $TSLA fell short of expectations, with its stock price dropping 4.41% in after-hours trading.

This is the first earnings report since Musk and Trump had a falling out, with both revenue and profit declining, and cash flow plummeting.

In Q2 2025, revenue was $22.5 billion, down 12% year-over-year, slightly below the expected $22.64 billion; net profit was $1.172 billion, down 20.7% year-over-year, but slightly above the expected $1.136 billion.

Gross margin was 17.2%, compared to 18% in the same period of 2024, and the expectation was 16.5%.

Free cash flow was only $146 million, down from $664 million in the previous quarter, while the market expected $760 million.

Google's parent company Alphabet $GOOG, amidst its core business being eroded by #OpenAI, saw its cloud business greatly exceed expectations, and YouTube performed well, with its stock price rising 1.74% in after-hours trading.

In Q2 2025, revenue was $96.43 billion, up 14% year-over-year, exceeding the expected $94 billion.

Net profit was $28.2 billion, up 19% year-over-year.

Service revenue was $82.5 billion, up 12% year-over-year.

#YouTube advertising revenue was $9.79 billion.

Google Cloud revenue was $13.6 billion, up 32% year-over-year, exceeding the expected $13.1 billion.

354

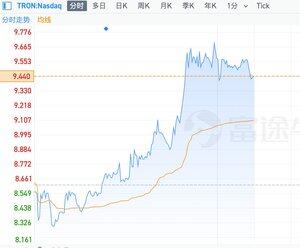

On July 24th (Thursday) Eastern Time, the strongest post-90s figure in the universe, Justin Sun @sunyuchentron, will hold a bell-ringing ceremony at the Nasdaq MarketSite in Times Square, New York, for the Nasdaq-listed company $TRON that he actually controls.

Although it's a bit convoluted, the situation is that the US-listed company with the stock code $TRON holds 365.09 million $TRX, worth approximately $113 million, with a market capitalization of about $165 million.

In the context of a general decline in Crypto concept stocks, TRON's stock price is rising against the trend.

Brother Sun remains a global advisor for the Nasdaq-listed company TRON, similar to his role at #HTX, likely to avoid subsequent compliance risks.

Background: The Nasdaq-listed company TRON was previously named SRM Entertainment, and after being effectively controlled by Brother Sun, it was renamed TRON, with the stock code changed to TRON as quickly as possible.

6K

In the past 24 hours, the liquidation volume reached 376 million USD.

Among them, long positions accounted for 238 million USD, and short positions accounted for 138 million USD.

$ETH is leading again, reaching 127 million USD.

$BTC is in second place, reaching 49.56 billion USD.

The third to seventh highest liquidation volumes are:

$SOL approximately 25.17 million USD.

$DOGE approximately 16.54 million USD.

$SPK approximately 14.03 million USD.

$XRP approximately 12.69 million USD.

$XRP approximately 11.52 million USD.

54,32K

Waking up one night

The centralized exchange platform and blockchain giant—Binance's platform token $BNB has reached a historic high

The new meme leader—Pudgy Penguins $PENGU has reached a historic high

Since 2025, the only coins that have truly reached historic highs are $BTC and $XRP.

Next, we look forward to $ETH, $SOL, and others achieving historic highs, liberating everyone.

17,81K

In the past 24 hours, liquidation volume

Data from Coinglass

$ETH remains in first place, reaching $182 million

$BTC ranks second, reaching $111 million

The third to fifth liquidation volumes are

$SOL approximately $38.29 million

$DOGE approximately $29.96 million

$XRP approximately $22.65 million

36,1K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin