Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Chok楚克

PKUer, Singer. LPing everywhere. Flywheel Analyst, T Capital Founder @T_Capital2140 Insights are My Own. #中英粤

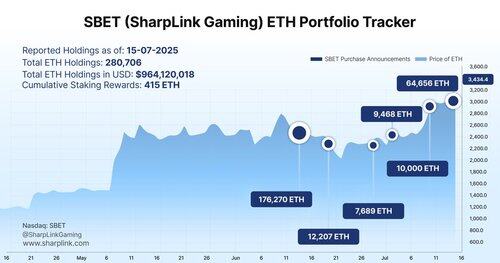

The SBET plan is refinancing $5 billion, with the first goal: to hold 1 million ETH.

Behind this is Joseph Lubin, the founder of Consensys and co-founder of ETH, who understands Ethereum commercialization and the flywheel effect the best.

On the other side is BMNR, which has already accumulated 300,000 ETH.

The "micro-strategy dual-head" pattern of ETH has already formed, with one side being technical fundamentalism + business closed loop, and the other side being capital will + long-term belief. The competition for ETH treasury has just begun.

937

Currently, the market capitalization of $SBET is $3.2 billion, with a stock price of $36. The market capitalization of holding ETH is $1 billion. If SBET achieves a holding of 1 million ETH (worth $3.6 billion) in the future, and if other parameters remain unchanged (mNAV, ETH price), the market capitalization of SBET could proportionally increase to $11.52 billion. If during this process, the average performance of mNAV exceeds the current 3.2 and the ETH price is better than $3600, it will also have a certain degree of positive impact on the market capitalization of SBET.

Joy Lou18.7. klo 12.53

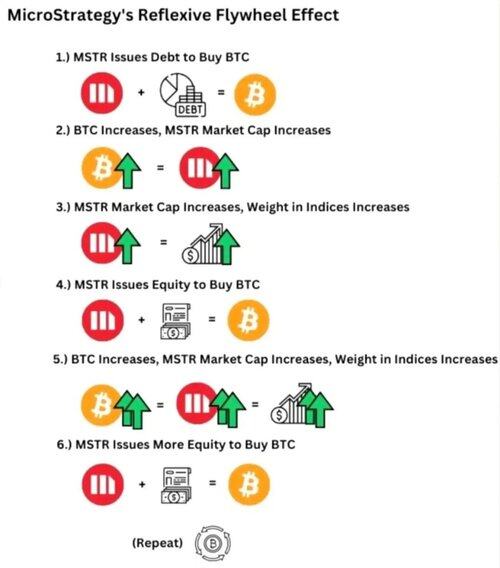

Many people use mNAV to calculate the limit of SBET and compare it with the peak period of MST R, which is actually incorrect because it is reflexive. You need to divide the maximum value of the money it can raise by the current market value and then divide by the proportion of the new issuance to get the proportion by which the current price can rise.

8,35K

ETH currently has two $1 billion war machines #BMNR #SBET

SOL has two $100 million war machines #DFDV #UPXI

Allen Ding 鼎17.7. klo 23.42

There have been too many people chatting privately lately, so let's summarize my opinions:

1. The essence of the treasury strategy is infinite bullets + the attention of the stock market.

2. Emotions have continuity and inertia, and ETH's emotions have just begun to detonate for 10 days. Unless there is a huge bearishness, the trend will not reverse.

3. There are still a large number of people who don't get on the ETH, or get off halfway. Because ETH has spent a whole year cultivating everyone's empty thinking.

4. The treasury strategies of other currencies have not formed a large-scale consensus at present, so the effect is not as good as ETH.

5. Look at the pattern of ETH/BTC.

6,09K

$SBET closed today at a market cap of $3.335B, with mNAV maintaining a high of 3.6 and strong trading volume. The #ETH micro-strategy's first vehicle has truly started moving, and at the same time, the price of $ETH has outperformed SOL/BNB/TRX for the third consecutive month. Generally speaking, such a trend doesn't stop for several months.

The holding ratio of SBET remains very low at only 0.2325%, which is less than 1/10 of MSTR, indicating significant potential. Moving forward, keep an eye on the actual financing capabilities of the vehicle each month.

20,66K

The market is calling for a Japanese version of #ETH micro-strategy, as Japanese stocks have surged the most in the past.

Currently, there are two SOL vehicles: $DFDV and $UPXI, with holdings in SOL exceeding 100 million USD, just starting to ignite.

AB Kuai.Dong16.7. klo 23.01

Past Year:

Japan's BTC Microstrategy Metaplanet Rises 1216%

US BTC MicroStrategy Rises 170%

Solicitation on the whole network! Whoever wants to make a Japanese version of ETH micro-strategy, welcome to provide clues or chat.

Now these ETH micro-strategies in the United States have fluctuated by 5-10 times, and if you want a Japanese version of the ETH micro-strategy, the account has been opened, just wait for the operation.

2,95K

The market is calling for a Japanese version of #ETH MicroStrategy, with Japanese stocks surging the most. The #SOL MicroStrategy currently has two vehicles,

$DFDV, $UPXI, with holdings in SOL exceeding 100 million USD, just starting to ignite.

AB Kuai.Dong16.7. klo 23.01

Past Year:

Japan's BTC Microstrategy Metaplanet Rises 1216%

US BTC MicroStrategy Rises 170%

Solicitation on the whole network! Whoever wants to make a Japanese version of ETH micro-strategy, welcome to provide clues or chat.

Now these ETH micro-strategies in the United States have fluctuated by 5-10 times, and if you want a Japanese version of the ETH micro-strategy, the account has been opened, just wait for the operation.

2,76K

Moreover, the appreciation logic of ETH includes Staking rewards + ecological expectations + DeFi flywheel, and the holding income of SBET should be greater than the price increase of ETH itself. This is also a component of the premium.

The higher the mNAV premium of SBET, the greater the expectations placed behind the assets, and the more motivated (and capable) SBET is to further increase its holdings of the underlying assets.

$ETH to 5000, full of momentum.

Joy Lou15.7. klo 23.47

This classic diagram of the "reflexive feedback loop" is presented. NAV only needs to be greater than 1 for SBET to start its "premium issuance" operation, using the largest trading volume to continuously issue stocks, obtaining the most funds to purchase ETH, driving its price up. The rise of ETH further enhances the company's market value and financing capability, allowing this cycle to continue. The infinite money printer + the concept of selling cheaper and cheaper has ushered in a new multi-fold stock — SBET.

4,9K

Keeping other parameters unchanged, if ETH rises to $5000, the mNAV of SBET will only drop to around 1.8, maintaining a premium level similar to MSTR.

This means that with $ETH moving from 3100 to 5000, the momentum is strong, at least stronger than MSTR.

Chok楚克16.7. klo 14.16

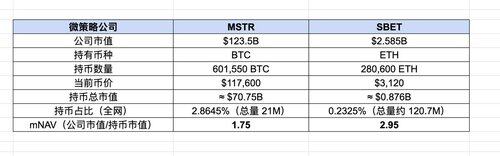

MSTR vs SBET Data Comparison (BTC MicroStrategy vs ETH MicroStrategy)

Currently, #MSTR's holding ratio is 2.8645%, while #SBET's holding ratio is only 0.2325%, a difference of 12 times, and the company's market capitalization differs by 47 times.

SBET's current mNAV is in the range of 2.5-3.5, higher than MSTR's 1.75, indicating that the market gives SBET a higher valuation premium. This premium also provides SBET with greater motivation to continue accumulating ETH, and the buying pressure for ETH will continue.

6,37K

MSTR vs SBET Data Comparison (BTC MicroStrategy vs ETH MicroStrategy)

Currently, #MSTR's holding ratio is 2.8645%, while #SBET's holding ratio is only 0.2325%, a difference of 12 times, and the company's market capitalization differs by 47 times.

SBET's current mNAV is in the range of 2.5-3.5, higher than MSTR's 1.75, indicating that the market gives SBET a higher valuation premium. This premium also provides SBET with greater motivation to continue accumulating ETH, and the buying pressure for ETH will continue.

4,26K

Although @HashKeyGroup has not gone public, all Hong Kong stock companies that claim to be related to the "coin-stock concept" cannot avoid Hashkey and have some level of cooperation.

Brokerage stocks: Guotai Junan (cooperating with HashKey Exchange)

Hong Kong micro-strategy: Boya Interactive (buying cryptocurrency through HashKey)

RWA concept: Taiping, GF Securities Hong Kong (cooperating with HashKey Chain)

Equity investment: Puxing Energy (subscribing to HashKey preferred shares)

加密无畏14.7. klo 23.39

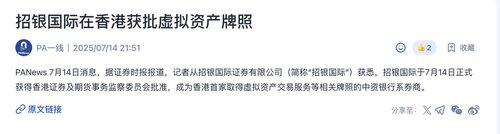

HashKey 的战略投资者和股东,招银国际,也在香港获批虚拟资产牌照。目前中资的券商/银行,在香港拿虚拟资产牌照,已经成了政治任务。

HashKey 的通道的重要性,还在显现。此前,HashKey Exchange 宣布已为超过 30 家在港持牌机构提供虚拟资产交易、托管及交割等一揽子服务,合作覆盖香港 90% 持牌券商。

国泰君安、老虎、富途等均在使用 HashKey 的这一服务。招银国际自然也会使用这一服务。 $HSK #hashkey

621

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin