Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

wsjack.eth🇭🇰 |𝟎𝐱𝐔

ex-president @0xUClub , Ponzi lover, meme, e-beggar, degen, proficient in various money-losing techniques Building @aveai_info @AveaiGlobal "Jack's Dining Table" is always open 👀 Tg:wsjack_eth

It's a very interesting event. We're bringing together several mainstream live streaming platforms, not just for the p little general's competition, but also for the live streaming platform competition! 🤣

Ave.ai(信号广场疯狂安利版🔥)5 tuntia sitten

#Aveai Crazy Thursday 💥

Is it "Crazy Thursday"?

Am I seeing things? No!

Crazy Thursday is starting early 🔥🔥

This week's topic: Give a shoutout to your favorite "Golden Dog King 👑" 🚩 Win 100U (10u*10)

☑️ Follow @aveai_info, retweet this post, and tag 3 friends

☑️ Join the official TG community @ave_community_cn

☑️ Shoutout for the host in the comments

Event time: 8.13~8.19

😎😎😎😎 Super strong host lineup:

@spacedogeNet Old Immortal

@FYweb3 Noodle Brother

@FUGUIHK Hong Kong King Fu Gui

@xiaojinyu168 Little Fortune Star

@0xCryptoHoward Howard

🎙️🎙️Hosts:

@0xJosh_liu Josh

@Amberoo7 Amber

Live PK match time: 2025.8.14 8:00~10:00 (utc+8)

Live first battlefield: 👉

Live second battlefield: (The second battlefield for each host will be released 1 hour before the Thursday live stream)

@FoChatOfficial @Sidekick_Labs @LOOPSPACE_xyz

928

wsjack.eth🇭🇰 |𝟎𝐱𝐔 kirjasi uudelleen

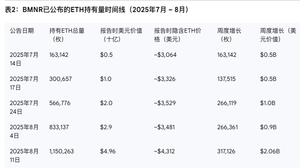

"Why BMNR May Have Laid a Subprime + Luna Bomb for the Crypto and US Stock Markets"

In just over a month, Bitmine (BMNR) has transformed from an obscure company with a market cap of tens of millions into a giant holding over $4.9 billion in Ethereum.

This remarkable achievement is beyond description, even a snake swallowing an elephant doesn't do it justice.

It must be said that the operator Tom Lee has made a name for himself in the crypto space.

We retail investors must also recognize that this is both an opportunity for Ethereum and provides us with more methods for trading volatility.

BMNR's operational methods have brought innovation as well as dangerous precedents—leverage—to companies like DAT (Digital Asset Treasure) that are listed as digital asset vaults.

Looking back at BMNR's financing process, it is not hard to see that they used very aggressive leverage early on:

The launch of BMNR's strategy did not rely on its own funds but was completed through a $250 million private placement. This was led by MOZAYYX and included top investors such as Founders Fund (associated with Peter Thiel), Pantera Capital, Kraken, and Galaxy Digital.

Legendary investors Bill Miller III and Cathie Wood from ARK Invest later joined to provide collective endorsement for BMNR's new strategy.

The $250 million private placement, combined with an earlier public offering of about $20.7 million, totals approximately $270 million in funds, which is clearly insufficient to support its nearly $5 billion acquisition. The key to unraveling this mystery lies in a large and extremely flexible financing tool established by BMNR: the "At-the-Market" (ATM) equity financing mechanism.

The initial authorized amount for this mechanism was $2 billion, which was quickly expanded to $4.5 billion. The ATM mechanism allows the company to continuously and opportunistically sell stock directly in the public market to raise cash when the stock price is high and market trading is active, like turning on a faucet.

Stimulated by news of transformation and institutional endorsements, BMNR's stock price soared over 300%, with daily trading volume skyrocketing from millions of dollars to over $2 billion, making it one of the most liquid stocks in the US market. This created perfect conditions for the execution of the ATM mechanism. BMNR effectively converted the market's optimistic sentiment (reflected in its soaring stock price) directly into real cash for purchasing ETH.

If this were the whole story, then BMNR's model would be no different from MSTR, but the devil is in the details.

If we closely examine BMNR's asset purchase schedule, we will find that the early purchase amounts far exceed the funds they obtained.

There can only be one explanation for this—leverage!

Further checking BMNR's announcements reveals clues:

In the press release on July 17 announcing that their holdings surpassed $1 billion, a key footnote revealed this: "Among them, 60,000 ETH (nominal value of about $200 million) is held through in-the-money options."

Yes, not only leverage but also options.

Of course, BMNR has played this hand very well, first using options, then raising a large amount of cash through ATM to pump the stock, quickly reducing the risk of options while locking in substantial profits.

This operation itself does not carry much risk, although it cannot be said to be completely risk-free.

However, this sets a dangerous precedent for the market, especially when competition among DAT companies is so fierce. New entrants seeking to achieve a lower NAV multiple (the ratio of holdings to market cap, equivalent to PB) to attract investors may adopt similar methods, which will undoubtedly lay explosive landmines for the future market.

This is simply the beginning of Luna 2.0.

As retail investors, we must embrace the Ponzi scheme, enjoy the massive pump, but also keep a close eye on the leverage of these DAT companies to avoid a massive collapse.

165,55K

It feels like some projects have really raised too much funding, with products that are garbage, yet they can support an entire team lying flat for years. 😅

I think the funding in the crypto industry should be reduced to 1/10; those that originally raised 10 million should now raise 1 million; those that originally raised 100 million should now raise 10 million, in order to accelerate the elimination and upgrade of the industry.

11,31K

I believe my judgment is correct: a certain coin that is about to have its TGE will fail, and it will drag the entire sector down with it because the fundamentals are not solid, the ceiling is too low, and the technology is still too poor.

I've only discussed this privately with a few friends; I'm afraid of being criticized by FOMO fans if I talk about it in public 😅.

17,26K

wsjack.eth🇭🇰 |𝟎𝐱𝐔 kirjasi uudelleen

When I was a child, I watched a lot of clips of Jobs' words, such as:

- You must only recruit Tier 1 talent, as Tier 1 people only play with Tier 1 people.

- Do something. It is meaningless to only do strategic consulting, just see a two-dimensional paper with pears on it, and really know the taste of pears must be bitten.

- All the things that were tossed and turned at the time may become a chapter that connects the dots in the future.

- It is necessary to have one CNC machine in the office, if it is not enough, put three.

Everyone who felt something at the time but didn't know what to say was understood more thoroughly after doing things.

Do it ______.

15,81K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin