Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Hanzo ㊗️

I share ways of turning $0 into $1,000, $1,000 into $10K, and $10K into $1M using memes, airdrops, alts, and…

Avail just launched Nexus — a big step forward for multichain apps.

It lets users access assets across 11+ chains right inside apps like Aave.

No need to switch networks, use bridges, or deal with wrappers.

@AvailProject is making multichain feel like a single chain.

Avail8.7. klo 22.27

Imagine using Aave to bring in assets from 11 chains... without EVER leaving the app.

That's the Avail Nexus upgrade. No bridges. No wallets. No manual swaps.

Just seamless cross-chain liquidity.

Watch it live 👀

6,89K

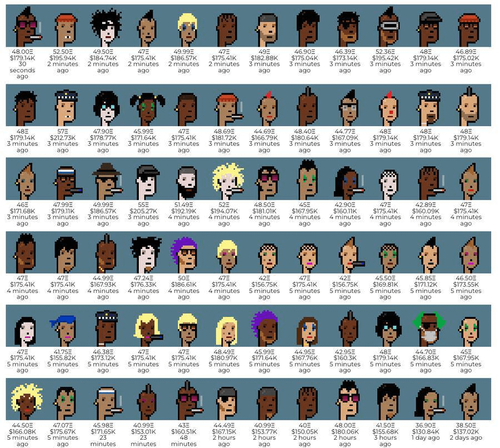

During the last NFT cycle, I made over $300K just by being early.

No team, no VC backing. Just timing, creativity, and a few right calls.

Now, I’m starting to see similar patterns form again.

This week, someone swept over 60 CryptoPunks. Floor jumped to $175K.

That’s not a coincidence, it’s ETH flowing into premium NFTs.

When holders don’t want to sell ETH, they rotate it into assets that hold status and scarcity.

I’ve seen this play out before.

What most people miss is how fast the opportunity window closes.

You’re either early or you are an exit liquidity.

If NFTs run again, it won’t be about hype or Twitter threads.

It’ll come down to who gets into the right projects before they blow up.

And that means one thing: whitelists.

Whitelists aren't about grinding anymore.

They’re about being useful. Founders reward early contributors, the people who create value, not just noise.

That could be:

– Sharing real feedback

– Helping in chat

– Making a meme

– Dropping a small tool

– Building trust early

You either deserve your WL, or you get filtered out.

If you want to be in a position, now’s the time to set up your info field.

Start tracking the right NFT infls, builders, and projects' Discords.

I've been creating a list of sources I trust for early NFT signals. Make sure to enable the notifs — will share it here soon. And tell me in the comments, if you need this

But don’t wait for anyone to spoon-feed you. If you want to catch the next cycle, get moving now.

9,29K

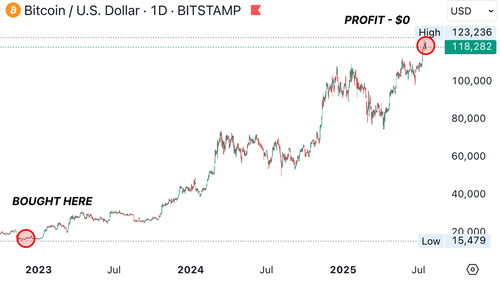

Bitcoin is ATH, but YOU have NO profit?

5 days ago, Bitcoin smashed past $123k

That’s not a small rally — that’s nearly 8x from the 2022 bottom at $15,5k

And yet… you’re still not in profit.

You bought too late. You didn’t take profit when you could. You’re waiting for a “perfect exit” that doesn’t exist.

I’ve seen it before, in every cycle. And it never ends well for the ones who just sit and watch.

Think of this like poker.

When you sit at the table, you don’t win by folding every hand. You win by playing smart, knowing when to hold, when to raise, and when to cash out.

But eventually, the game ends. The bullrun is the same. It always ends. And when it does, the chips on the table disappear fast.

Most people don't take profits because they think "it'll go higher." That’s how they stay broke while watching Bitcoin print new highs.

If you’re still sitting there with an empty wallet and a "long-term vision," you’re not an investor - you’re a spectator.

Now let’s talk strategy.

You don't need to go all-in on random altcoins to win big. You also don’t need to play it safe with just Bitcoin and hope it saves you. What you need is a balanced stack, just like in poker.

Here’s what works:

• Keep half your portfolio in low-risk assets like BTC, ETH, maybe a couple solid L1s.

• Use the other half for higher-risk plays: small caps, early narratives, or short-term trades with high upside.

This way, you’re not risking your whole portfolio, but you’re still in the game, as a player, not a spectator.

This cycle is your game to play. But don’t forget, the bullrun won’t last forever. It never does.

The pot won’t always grow. At some point, you have to push your chips in and make the call. Waiting forever is just another way to lose.

So ask yourself: are you still hoping for the perfect hand, or are you ready to play it?

Because in the end, profit doesn’t come from being right, it comes from being bold at the right moment.

12,28K

Why $ETH is Pumping?

Ethereum is showing strong momentum, and many people believe that this momentum will stay.

So let's go through every factor that pushes ETH right now, and decide on real targets:

— Spot ETF Inflows

Major institutional demand through new ETH ETFs is pushing sustained buy pressure. Over $700M has flowed in recently, with daily inflows from top issuers like BlackRock.

— Corporate Accumulation

Public companies are adding ETH to their treasuries. This reduces the liquid supply and reflects growing confidence in ETH as a strategic asset.

— CEX Balances at All-Time Lows

The exchange-held ETH supply is now at its historic low. More ETH is moving to self-custody or staking, tightening available supply for trading.

— On-Chain Activity Rising

Transactions, gas usage, and Layer 2 adoption are all increasing. Network demand is healthy and trending up.

— Technical Breakout

ETH has broken above key resistance ($3,100), with bullish continuation patterns forming.

— BTC.D

Bitcoin dominance is slipping, and capital is rotating into ETH and other alts.

How Long Can It Last?

As long as ETF inflows remain steady and supply stays off exchanges, ETH’s rally could extend through Q3.

Watch for cooling if ETF flows slow or BTC regains dominance.

For now, my price targets range between $3,300–$3,600 if momentum holds.

11,74K

HAHAHAH YOU DON'T KNOW WHAT ARE FVGs???

Keep trading blind or let me break them down in simple terms

1. What is FVG

2. Types of FVG

3. How to spot an FVG

Read below 👇

— Fair Value Gap (FVG)

A Fair Value Gap (FVG) is an imbalance in price action — a spot where the market moved so aggressively that it left unfilled orders behind.

This happens during strong buying or selling when the price skips levels with no trades in between.

These gaps are often “revisited” by price later, as the market naturally seeks to fill those inefficiencies.

Think of them as footprints of imbalance; the market wants to come back and clean up.

— BISI & SIBI

FVGs come in two key forms:

BISI (Bullish Imbalance Sell-side Inefficiency): Buyers are in control. The gap forms between the high of the first candle and the low of the third, with the middle candle pushing strongly up on high volume.

SIBI (Sell-side Imbalance Buy-side Inefficiency): Sellers dominate. The gap appears between the low of the first candle and the high of the third, again with the middle candle showing a strong push, but this time downward.

Spotting these 3-candle formations helps you understand who’s in control and where the price may return.

— Inverted FVG

When a FVG doesn’t hold, meaning price breaks through it, it can flip its role.

A failed SIBI often turns into support, and a failed BISI may act as resistance. These are called inverted FVGs.

The idea is simple: what was once an imbalance becomes a key reaction zone.

Watch these areas closely, price tends to respect them on the retest.

— BPR

Balanced Price Range (BPR) forms when a bullish and bearish FVG overlap.

It’s a zone where buy-side and sell-side imbalances meet, creating a more neutral area.

This overlap often acts as a magnet for price and becomes a key decision point.

To find a BPR, mark out an FVG above and below the current price, where they intersect is the balance.

— How to Identify FVGs

Look for a 3-candle setup: the middle candle shows a big move, and there's a gap between the wicks of the first and third candles. That’s your FVG.

These gaps are often highlighted with a shaded box on charts.

Price usually comes back to these zones, either to fill them or react to them.

Watch how price behaves when it returns; it tells you whether the gap still holds power or flips.

— FVGs on Different Timeframes

FVGs exist across all timeframes, from 1-minute charts to weekly candles.

Higher timeframe FVGs (like 4H, daily, or weekly) carry more weight and often act as stronger magnets for price.

Lower timeframe FVGs form more often, but are less reliable on their own; they work best when aligned with a higher timeframe structure.

Always zoom out and check if a lower timeframe FVG sits inside a higher timeframe one; that’s where confluence and strong setups appear.

I hope you found this guide useful.

Don't forget to Like & Repost if you want to see more educational content.

9,21K

Understand Liquidity or SUCK

You have to know this basics, or MM will f u hard every time u trade:

1. Liquidity Sweep

2. PO3

3. Volume

Read Below 👇

— Liquidity Sweep

A liquidity sweep happens when the price spikes above a recent high or below a recent low to trigger stop-losses.

These zones are where most traders place their Stop Losses, making them targets for larger players who need liquidity.

After the sweep, the price usually reverses fast, trapping those who entered on the fake breakout.

It’s not a real move, it’s a shakeout. If you see a breakout with no follow-through, it’s likely just a liquidity grab.

— PO3

PO3 (Power of Three) is a market pattern with three phases:

1. Accumulation – price ranges, big players quietly build positions.

2. Manipulation – price fakes a move, sweeping liquidity.

3. Expansion – the real directional move begins with volume.

Most retail traders get caught in phase 2.

But once you learn to wait for the manipulation to play out and enter during the expansion, you stop trading noise and start trading intent.

— Volume

Volume is confirmation. A breakout without volume is weak; it’s probably just stop-losses getting hit.

Real moves come with real participation, and you’ll see that in volume spikes.

If price breaks out and volume surges, that’s conviction.

No volume? No trust. Always check volume to separate fake outs from true breakouts.

If you enjoy this kind of content, don't forget to Like & Repost, and let me know in the comments.

I’ll keep breaking down market structure in simple language.

9,33K

🚨BREAKING: THESE WALLETS HELD 80,000 $BTC FOR 14 YEARS (the list at the end)

All the funds of this entity are distributed among 8 wallets.

Two of them received 20,000 BTC each back on April 2, 2011, when #Bitcoin was trading at just $0.78.

The other six wallets received 60,009 BTC on May 4, 2011, when BTC was priced at $3.37.

Today, 4 of these wallets sent out 40,000 BTC, while the remaining four are still untouched.

Who is this mysterious whale who bought Bitcoin at $0.78 and is now selling near $109K?

Holding a $10B bag this long seems almost impossible, unless you had no choice, like being in prison.

In that case, you accidentally become a genius investor.

Fun fact: Silk Road was launched just months before this whale stacked their BTC.

As they say, sometimes the best investor is the one who buys, forgets, and let's time do the work.

Maybe the ultimate strategy is to buy, disappear, and come back in 20 years.

Wallet addresses below 👇

6,46K

Kaito Top 1 Mindshare | Anoma

Imagine you wanna trade stuff.

You’ve got apples, but the person you’re buying from wants bananas.

Normally, you’d have to find someone who wants apples and has bananas to swap.

But Anoma does that whole process for you automatically, you just say what you want and what you have, and solvers find the best path for you.

Kinda like a Web3 barter assistant that works behind the scenes.

No middlemen, no complicated steps. It can even use different blockchains.

And the best part? It keeps your transactions private and super cheap.

Anoma is built around something called intent-based architecture. You don’t send direct orders like "swap here, now." You just post your intent, like "I want 10 $ETH for the best $USDC rate"

The protocol finds the best deal through solvers and just makes it happen.

• Who's behind this?

@anoma raised over $57 million from top names:

• Polychain Capital

• CMCC Global

• Electric Capital

• CoinFund

Serious backers who usually don’t jump into small bets.

Right now, they’re running a 1% $ANOMA token giveaway on Yapper Leaderboard.

• Here’s how it works:

• 0.7% goes to the most active, consistent, creative people (posting about Anoma)

• 0.3% goes to the broader Kaito community

• Part of it is locked for China and Korea

You don’t need to have a huge account to win, if you’re real, active, and bring value, you’ve got a chance.

So yeah, now’s the time to yap smart.

TL;DR

Anoma is building something that makes crypto more human-friendly.

You just say what you want, and the network finds the way, like magic but private.

Funded by big players, backed by tech that could unlock real-life use for Web3

If you wanna get in early, now’s the time to start yapping.

P.S.

I will be reviewing top Kaito mindshare projects, so if you like this topic — like, repost, leave a comment

#kaitotopmindshare

2,16K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin