Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

infiniFi

infiniFi kirjasi uudelleen

Too Much TVL Kills Yield?

Biggest question from @infinifilabs users: "Will more TVL mean less yield?" The short answer: no.

infiniFi is built on a model that scales yield with volume, not against it. InfinfFi leverages the depth and maturity of DeFi fixed-yield markets to maintain high, consistent APRs even as TVL grows. Unlike protocols that offer inflationary incentives or short-term bribes, every yield on infiniFi is net real yield. Unboosted, organic, and transparent.

Capital Allocation

infiniFi intelligently routes user capital based on deposit type:

- Liquid Depositors (iUSD and siUSD):60% goes to fixed-term yield strategies like Pendle PTs and Ethena.

40% stays in top-tier liquid lending markets.

- Locked Depositors (liUSD-1week to liUSD-13week):100% is deployed into higher-yield fixed-duration assets.

This dynamic allocation ensures that every user, taps into multiple yield streams.

Strategy Composition

- Liquid Strategies: Includes top-tier lending markets like Morpho Blue, Spark, and Aave.

Designed for low-risk, steady yield.

- Fixed-Term, Illiquid Strategies: Pendle PTs (auto-rolled for compounding)

Ethena (PTs and naked sUSDe)

Full transparency:

Why is dilution not a concern here?

Scalable Underlying Markets

- infiniFi is built on top of scalable, high-capacity markets.

- For instance, Pendle PTs currently hold over $2B in total value and can comfortably absorb large inflows.

- Internal backtests show that a $25M deposit into Pendle PT sUSDe would only shift the market by ~20% (15% to 12%), proving deep and scalable capacity.

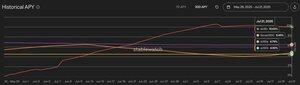

Yield Performance Comparison (siUSD, SyrupUSDC, sUSDe, sUSDS)

Avg APY for the last 30 days

Why Not Deposit Directly Into Lending Markets?

InfiniFi simplifies what institutions already do: strategic yield diversification. Instead of manually parking assets on a single platform like Aave, infiniFi routes your funds:

- Across multiple lending markets to optimize for APR

- Into illiquid PTs or markets when higher returns are available

- With automated rebalancing to ensure consistent exposure

You earn higher yield without lifting a finger.

Lending directly on Aave gives ~3% APY. Depositing via infiniFi earns 7–8% by being exposed to additional strategies.

The point is that infiniFi isn’t competing with these protocols (maple, ethena Aave etc), it amplifies their TVL by using them as yield sources, by diversifying users portfolio exposure while still delivering superior returns to users.

TLDR

As TVL grows, infiniFi's yield potential scales with it. This is not a protocol built on incentives that fade or bribes that dry up. With every additional dollar, infiniFi accesses deeper, better markets, without compromising risk or returns.

2,01K

infiniFi kirjasi uudelleen

The shift from 'trust me' to 'verify me' in institutions.

How? Through onchain proof.

Join our X Space tomorrow to discuss this transformation with our CTO @EduardoFuture and experts from @t3rn_io, @FolksFinance, @infinifilabs, & @immutableailabs.

Moderated by @JackGK_BTC

🗓️ July 22 at 1 PM EST.

39,44K

infiniFi x Steakhouse Financial

Borrow against your infiniFi positions, Loop yields & Amplify returns.

With No auto-expiry, No PT rollover risk & Keep your loops open indefinitely.

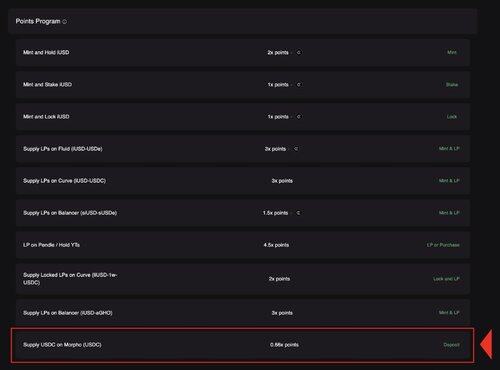

Start earning your boosted points:

infiniFi17.7. klo 02.31

infiniFi x Steakhouse Financial

We’re excited to launch the infiniFi USDC Vault on @MorphoLabs curated by our partners at @SteakhouseFi.

Borrow against your infiniFi positions, Loop yield & Amplify returns.

Get higher returns on PT loops than with PTs alone.

break down 👇

2,17K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin