Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

sri | srimisra.eth

building defi’s asset mgmt stack @aarnasays - ai x tokenized vaults | ex milk mantra | aspen & yale fellow | alpha un# 🎙️

aarnâ rewards early deployers.

With TGE approaching, early TVL deployers receive protocol yield and incentives, along with ASRT and a material allocation of $AARNA.

ASRT, as a reward mechanism, will be exchanged for 2.5 $AARNA at TGE, based on the seed round valuation of $40 million-ensuring a fair.

Integrations with Sonic, Balancer, and Pendle are expanding composability and reach as aarnâ develops into a full-stack onchain asset manager.

The right time to join is now.

495

Superior primitives + real-time composability pull capital without headline subsidies.

What this means is simple - if your chain lets apps read market truth and move liquidity within the same block, builders ship faster and users deposit deeper.

Design tokenomics that funnel protocol revenue into long-term value capture, not one-off rewards.

Prioritize depth over vanity metrics: a concentrated base of conviction drives sustainable utility.

Build permissionless rails that let teams iterate, integrate, and compound network effects quickly.

If you want growth that lasts, architect for composability, capture value at the protocol layer, and make conviction easy to find.

The DeFi Investor 🔎20.8. klo 17.43

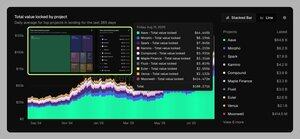

HyperEVM's recent growth is WILD.

In April, it had less than $400M TVL.

Now it just surpassed $2.2 billion in TVL and it just keeps growing.

1,05K

Almost 200 million different addresses hold stablecoins with a market cap of $288.7 billion.

All of those could be used in yield markets to generate even more value for these tokens.

Yield aggregation is severely facilitated on DeFi, with automatic looping across protocols, letting the algorithm find the best opportunities.

It democratizes finance as anyone can stake ETH or restake via EigenLayer for even more returns.

aarnâ does that with the 100 series vaults and âtvUSDC, a yield-bearing ERC4626 that represents staked positions on âtv 111 vault.

It takes the deposited USDC and aggregates it using multiple platforms, ensuring higher yields.

An estimated $17.5 million is given out daily as yield farming rewards on ETH alone.

Much more is there to be earned.

5,86K

Great post by @Satyams2468 on DeFi lending

$100b in lending protocols is a milestone - but the bigger shift is that DeFi makes credit markets transparent and uniform.

No hidden spreads, no geography-based penalties. the same collateral rules, the same rates - whether you’re in New York or Nairobi.

> that’s the real disruption

Satyam Singh17.8. klo 19.13

Total deposits into Lending Protocols have surpassed $100 billion.

Its has reached ~$100.2 billion, up from $32 billion, 3.13× increase in the last year.

Aave holds $64.6 billion, representing 64% of the lending market.

Over the past year, @Aave has seen 3–4x growth across all key metrics such as TVL, fees, revenue, and active loans.

I believe the lending protocol has more potential than we think. Its adoption has only just started.

We haven’t even reached 1% of the deposits we may see in the next 10 years. Deposits will compound in the coming years.

Why Lending Protocols Will Become the World's Largest Banks

1/ Borderless Access to Capital:

If you have an internet connection, you can borrow or lend — no matter where you are.

2/ Better Yields for Lenders:

Banks typically pay just 1–3% interest on savings, while DeFi lending protocols offer significantly higher rates.

3/ 24/7 Instant Liquidity:

Need a loan or want to repay? It happens in minutes, any time of day, anywhere in the world. No paperwork. No waiting.

4/ More Types of Collateral:

Crypto, NFTs, tokenized stocks, gold, silver, and more can be used as collateral.

5/ Global Rate Opportunities:

Borrow where rates are lowest, lend where returns are highest.

Example: Use Apple stock to borrow on Aave at 5%, or lend USDT on another protocol offering higher yields.

6/ Everyone Will Join In:

Hedge funds, corporations, banks, pension funds, sovereign wealth funds, universities, endowments, insurance companies, non-profit organizations, and even governments.

Everyone can join

Aave is a leader in lending protocols. Now, let's understand Aave's potential with an example.

What if you want to buy Apple stock and don’t live in the U.S.?

1st Step

First of all, choose a broker that allows you to trade U.S. stocks and complete KYC with Proof of address.

You may also need to submit tax forms (e.g., W-8BEN) for U.S. tax compliance and reduced dividend withholding.

2nd Step

Fund your account with your local currency (e.g., INR, EUR) or GBP if you have a foreign account.

The broker will convert your funds to USD when you buy Apple shares.

Pay Fees:

- Currency conversion: 0.5–2%

- Brokerage fees: 0.1–0.5%

Restrictions:

Some countries under U.S. sanctions can't buy the US stocks.

Because of tokenization, anyone can buy U.S. stocks from anywhere, without KYC or proof of address, and at low fees, which could drive greater demand for U.S. equities.

If anyone wants to borrow money for a short or long period, Aave will offer loans at around 4–6%. Similarly, in TradFi, we can pledge our stocks as collateral to borrow.

The best thing is that the interest rates would be the same for everyone, whether you’re from America or Burundi.

Many countries charge higher interest rates to their citizens, and their stock markets are often stagnant.

Thanks to tokenization, they would be able to invest in the best-performing stock markets and use their stocks as collateral for borrowing.

Today, the combined market cap of the top 10 U.S. stocks is $23 trillion. If just 10% of that market cap comes on-chain in the next five years, it would amount to $2.3 trillion.

If only 10% of that goes into Aave for lending, it would be $230 billion.

I am not assuming any growth in these stocks, even though they are likely to grow at least 2x over the next five years.

I’m pretty sure Aave will reach at least $500–700 billion in TVL by 2030.

10,31K

"Blockchain or not?"

This will be the first question every entrepreneur asks when starting a business - just like we choose between AWS and Google Cloud today.

The future: tens of thousands of purpose-built chains for specific use cases.

Fascinating take from @0xMarcB, CEO of @0xPolygon on the latest alpha un# episode.

1,31K

aarnâ is a full-stack DeFi asset management platform, combining AI, tokenized vaults, and a mobile-first UX in the $150+ billion DeFi industry.

From yield aggregation with âtv 111 to targeting contrarian alpha capture with âtv 808, it’s got the strategies to refine your DeFi approach.

âtv 808 hunts undervalued tokens, using AI to spot short-term dips with strong rebound potential. It dynamically reallocates and holds to capture recovery and maximize returns.

Currently at 77% with a 90% of all time return, it has outperformed assets like BTC and the CCI30.

The future is clear: integrateing AI and decentralization to navigate market volatility and capture alpha.

For those who share this vision, aarna’s vaults offer a chance to be part of this evolution.

5,25K

Today is India’s Independence Day 🇮🇳 and also, Janmashtami 🙏🏼

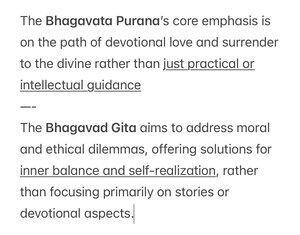

The two scriptures - Bhagavata and the Bhagavad Gita - both pertaining to Krishna Avatar’s life are distinct and offer profoundly different insights. Learnt this over a cup of tea in the morning with my mom :)

Was reflecting, with shifting geopolitics and deceit, the Bhagavad Gita reminds nations to act with clarity of purpose & pragmatism.

> India knows that well

And for people everywhere, across all cultures and eras, the Bhagavata Purana points to living with love, surrender, and alignment.

> Gratitude - that’s what we understand it now as

Happy Independence Day and 🧡 to everyone!

272

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin