Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Mona El Isa

🍉 Founder @avantgardefi @enzymefinance

Mona El Isa kirjasi uudelleen

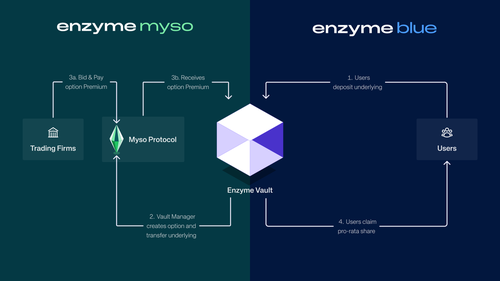

How DAOs are running recurring options strategies from their treasury vaults?

With Enzyme.Myso now integrated in Enzyme.Blue, DAOs can create a dedicated Options Vault to run recurring covered call or put strategies directly from their treasury.

How it works:

• The DAO creates an Enzyme Vault on Enzyme.Blue, sets up permissions, and funds it with idle assets.

• The vault is connected to Enzyme.Myso, which enables the DAO (or an assigned manager) to execute options trades on a recurring basis.

• All trades, yields, and flows are fully auditable and visible to the DAO community.

• Roles can be delegated or managed by the DAO’s own process.

Case in point: Compound DAO’s options vault uses this structure to regularly sell covered calls, helping the DAO target yield, maintain transparency, and customize risk exposure.

Ready to see how Enzyme.Blue + Enzyme.Myso vaults could fit your treasury?

Learn more:

3,58K

Mona El Isa kirjasi uudelleen

One of #DeFi’s favorite strategies in the recent low-yield environment has been the $LSTETH/ $WETH leverage loop.

But $WETH's latest rally has pushed borrow rates up turning looped performance negative.

Now you have:

– $LSTETH selling pressure

– Withdrawal queue >17 days

– Liquidity drying up

– Liquidation risk rising

It’s very easy to lever up in highly liquid, low rate environments.

Levering down in a tight market is another story.

Stay safe 🧑🚒

376

Should we be worried? 🤔

Watcher.Guru15.7. klo 04.35

JUST IN: Jim Cramer says JPMorgan CEO Jamie Dimon will "go all in on crypto" after calling it a fraud and a ponzi scheme last year.

692

Mona El Isa kirjasi uudelleen

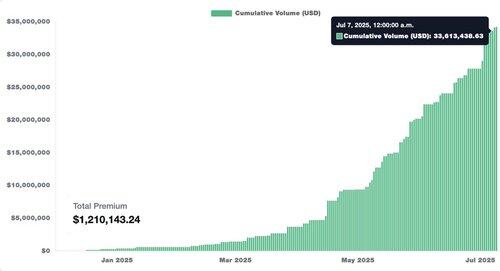

Another milestone for Enzyme.Myso - After crossing $20M in notional just weeks ago, we’ve now reached $1.20M+ in premiums 📈

Here’s where we stand today:

• $1.20M+ in total premiums

• $33M+ in notional volume

• 7× growth over the past 90 days

As demand for structured strategies accelerates, Enzyme.Myso is becoming the go-to execution layer for tokenized options and yield. Explore:

7,18K

Mona El Isa kirjasi uudelleen

Bonjour Cannes 🇫🇷

Kicking off @EthCC week with French baguettes, Enzyme crew, sea views, & some sharp conversations around the future of on-chain asset management.

We’ve got two more side events lined up. Come join us for DeFi, good food, and even better company.

À très vite!

20,75K

Very excited to be sharing some perspectives on on-chain asset management with @JuanDMendieta at EthCC this year 🔥

EthCC - Ethereum Community Conference27.6.2025

Say hello to more EthCC[8] speakers!

Maya Dotan from StarkWare

Track: 🧬 Zero Knowledge & Cryptography

Mona El Isa from Avantgarde Finance (@Mona_El_Isa)

Track: 🏦 DeFi

Daniel Worsley from OneBalance (@DanielWorsley_)

Track: 💡 For Developers and Users

Marijke van Engelenburg from StarkWare (@shadowfax_gg)

Track: 📢 Product & Marketers

See you in Cannes! 💙💛🧡

1,63K

As the industry gathers this week in Cannes for @EthCC, I’ve been reflecting on a piece I wrote back in 2020: A Day in the Life of an Asset Manager in 2030

→

Some things have changed since then. Melon is now @enzymefinance, we’ve grown into a global infrastructure layer, and a few of the actors mentioned are no longer around.

But the trajectory I imagined still feels right.

Onchain asset management, real-world strategies, structured products, and permissionless innovation… it’s all playing out.

Always fun to revisit a vision. Even more satisfying to build toward it.

Would love to hear your thoughts if you give it a read 🙌

4,66K

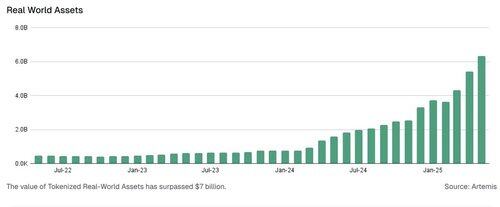

The next evolution in tokenized finance is already unfolding, and it goes deeper than most realize.

Crypto has gained recognition as an asset class, but holding tokens was never the full story. Stablecoins accelerated adoption by creating a liquid, interoperable base layer for value transfer.

Then came tokenized ETFs and funds, bringing familiar wrappers onchain. But most of these products still rely on offchain processes: traditional issuance mechanics, centralized NAV, and legacy custody setups.

They introduced structure, but not autonomy.

What comes next is full-stack financial instruments: term deposits, tokenized ETNs, convertible notes, bonds, stocks… all built with logic encoded from day one.

This isn’t theoretical anymore. Over $7B in tokenized treasuries are already live. Structured yield products are moving from pilot to production. Reinsurance deals are being executed onchain.

And the best part is, this is only the beginning. @enzymefinance already powers this evolution.

1,41K

A huge milestone for the future of decentralized finance: The GENIUS Act 👏

The GENIUS Act passing in the U.S. Senate this week sends a clear message: stablecoins are foundational to the next era of financial infrastructure.

For those of us who’ve spent years building onchain systems for compliant, transparent, and capital-efficient financial products, this moment is both validating and energizing.

Stablecoins, when issued under clear guardrails, unlock the ability to rethink everything from cash management to fund distribution, cross-border capital movement to embedded yield.

The rails are catching up with the vision and it’s an exciting time to be working on infrastructure that’s ready for what comes next.

6,19K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin