How do I withdraw SGD with FAST, MEPS and International wire transfer?

You can withdraw SGD from your OKX account to your bank account. FAST, MEPS, and international wire transfers are now available to Singapore users for cash withdrawals.

How do I make a cash withdrawal?

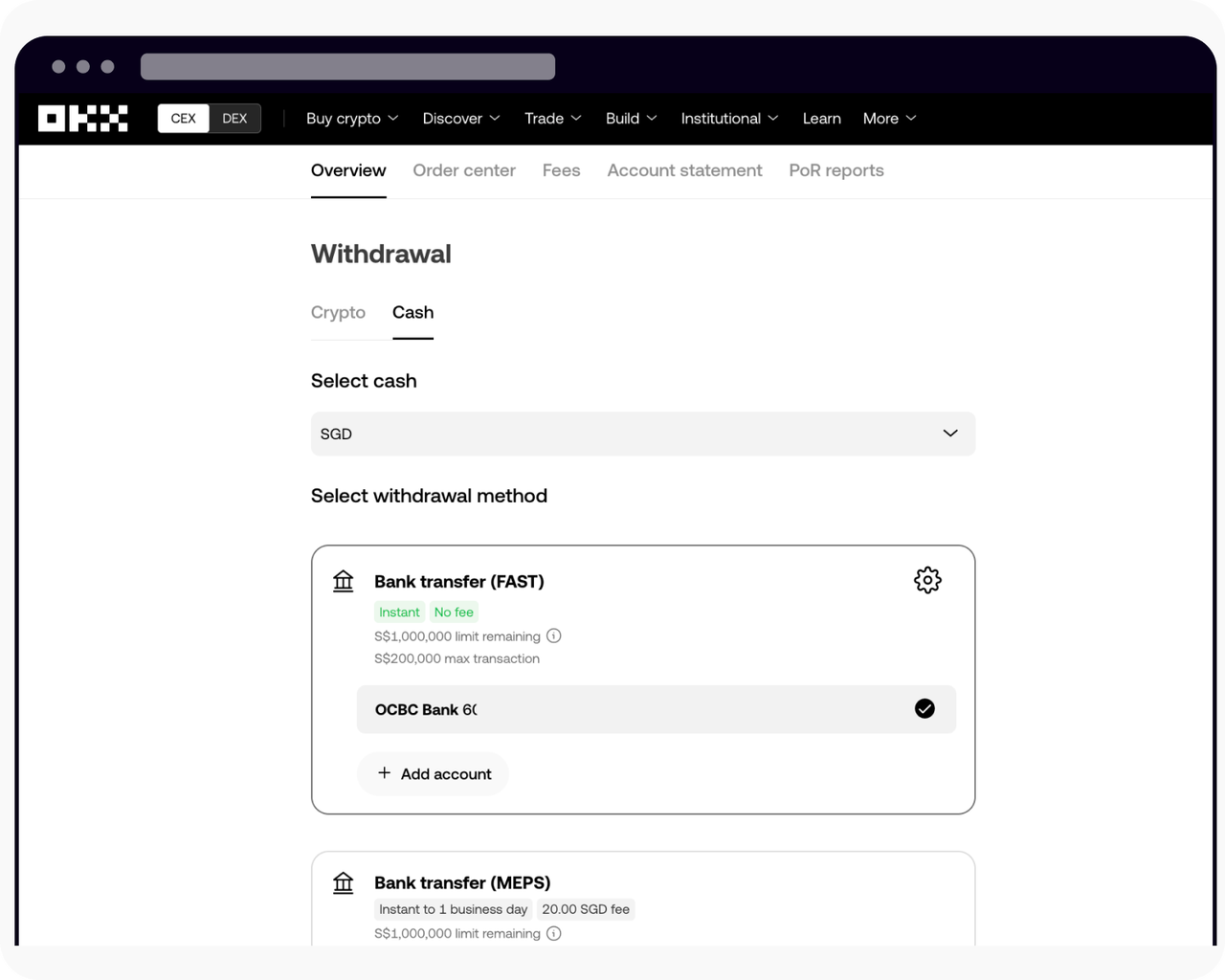

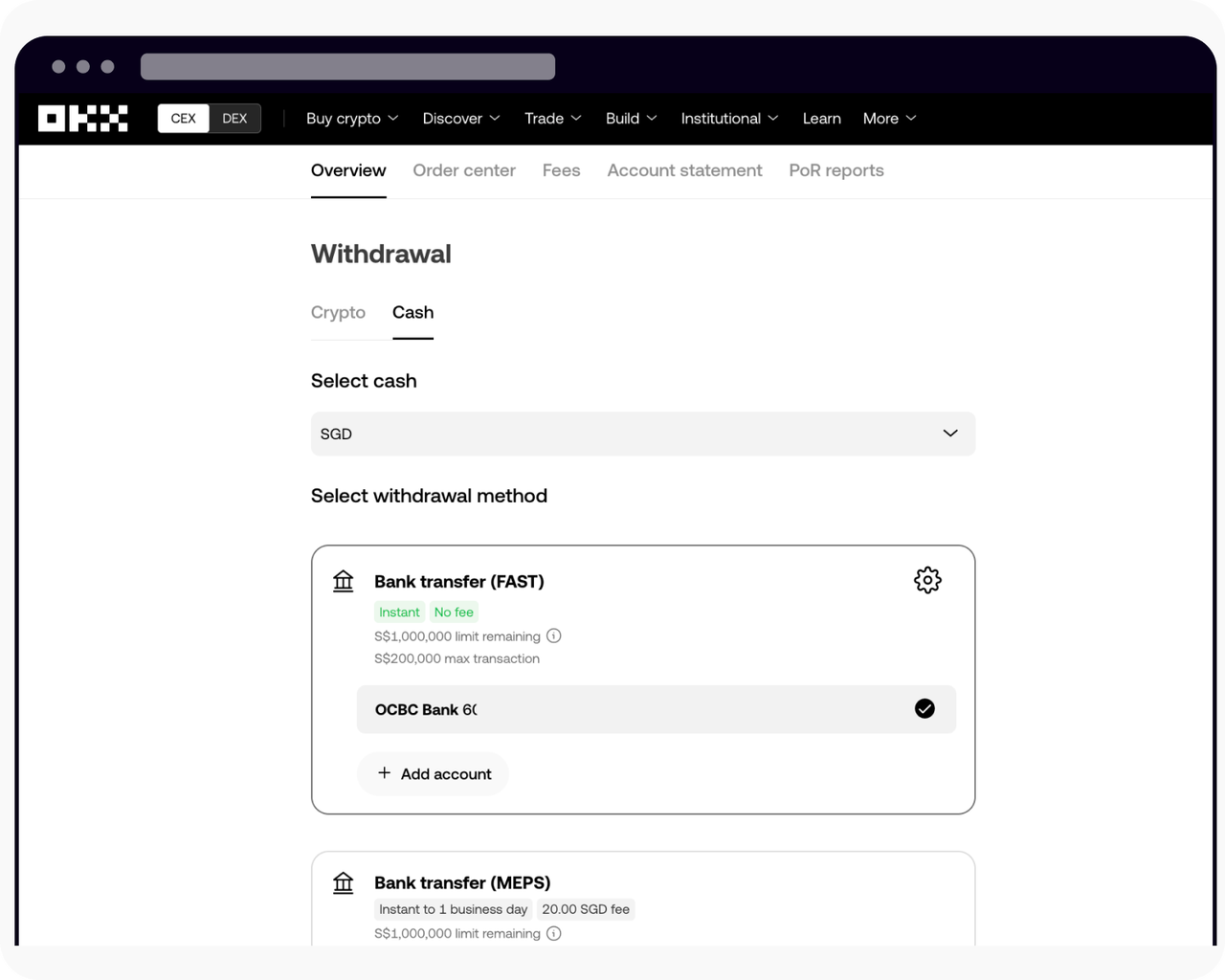

On the web

Log in to your account at my.okx.com. Go to Assets and select Withdraw

Select Cash and SGD to start a withdrawal

Select Cash and SGD to start a withdrawal

Select the bank account you'd like to withdraw from in the international wire transfer method and Preview withdrawal

Enter your authorization code or SMS code and select Withdraw to submit your SGD withdrawal

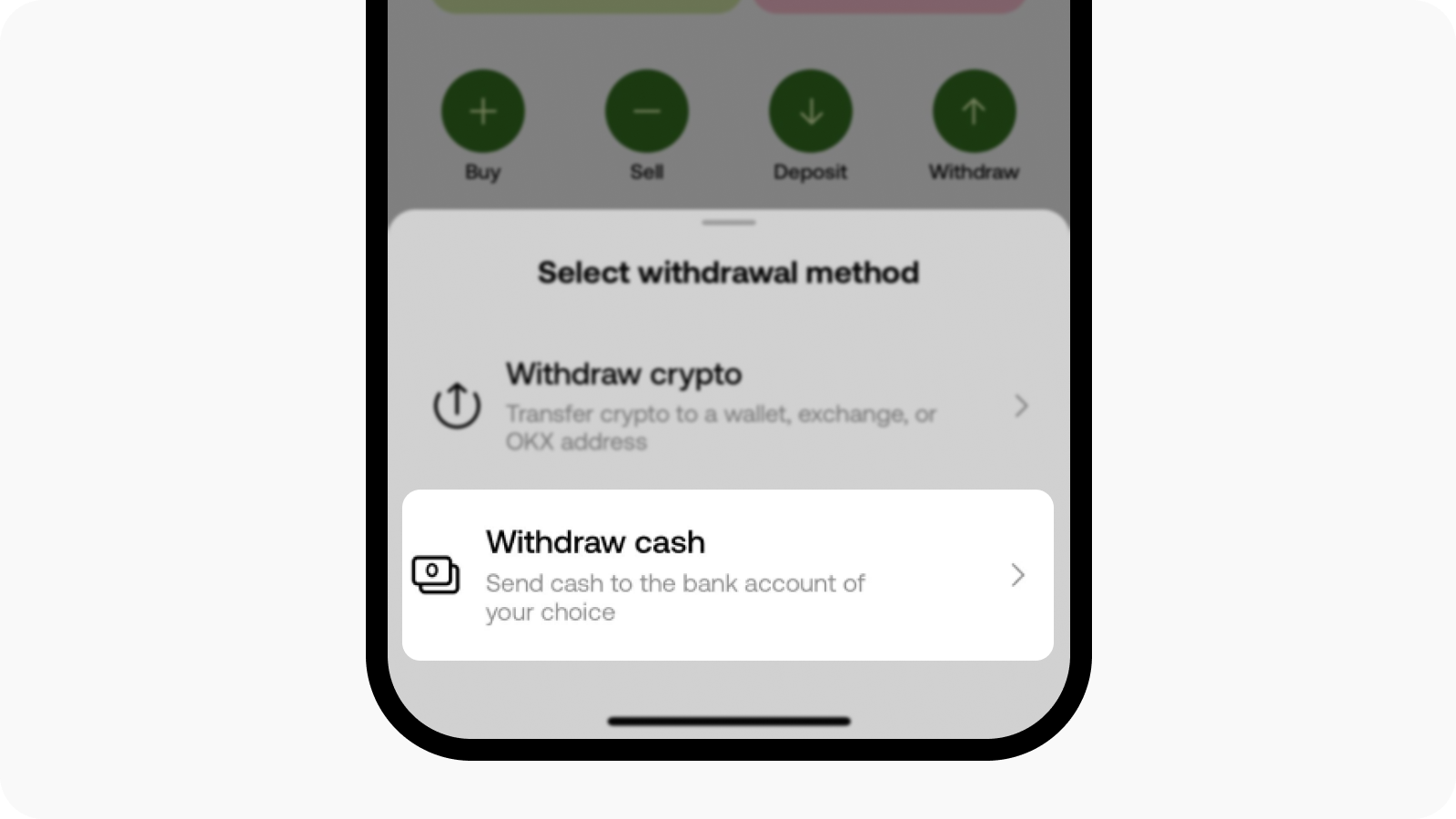

On the app

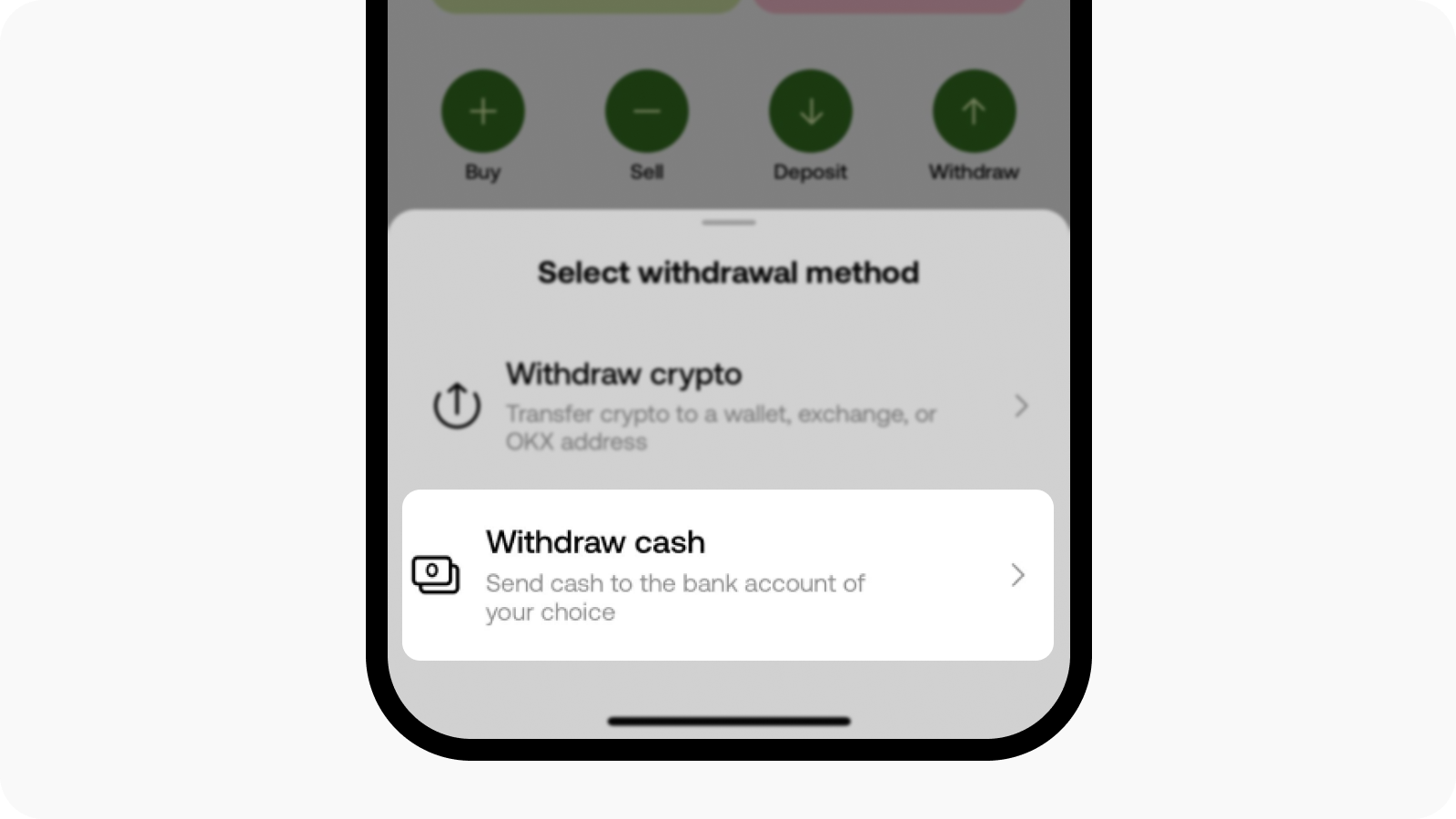

Open your OKX app, go to Portfolio on the home screen, select Withdraw and Withdraw cash

Select Withdraw cash to start

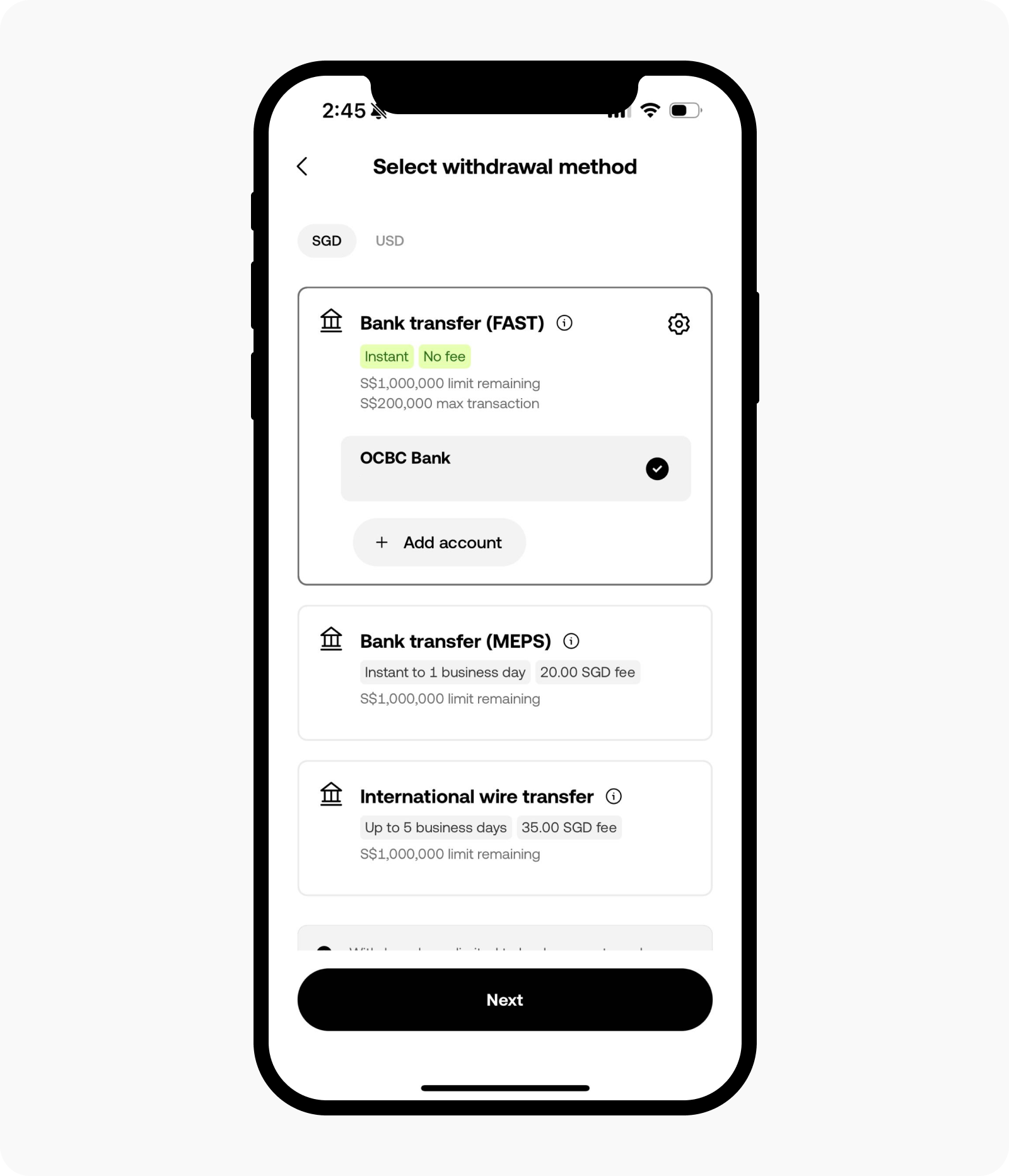

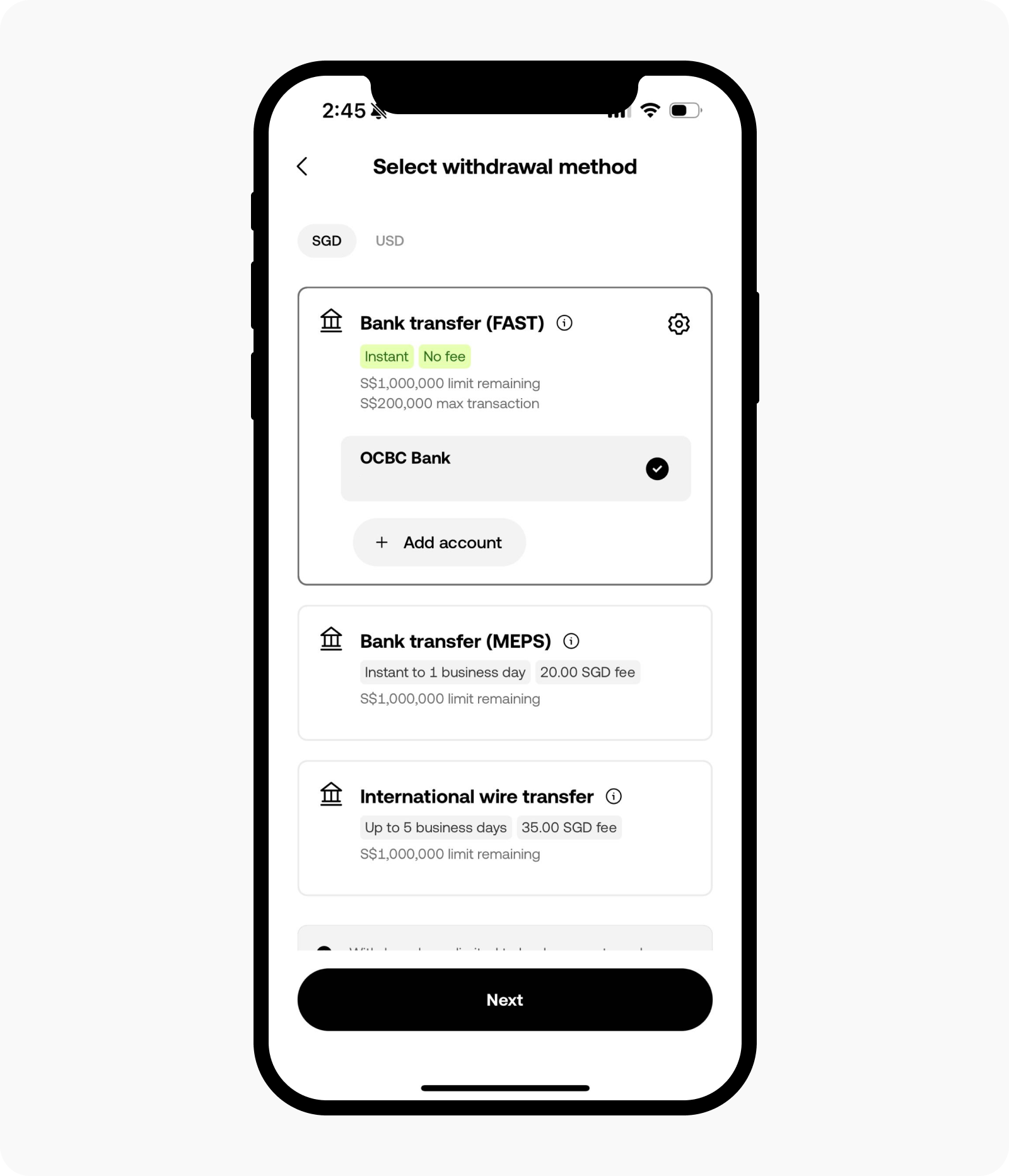

Select Bank transfer under SGD and Next

Select bank transfer under SGD to continue

Select the bank account you'd like to withdraw from in the international wire transfer method and Preview withdrawal

Enter your authorization code or SMS code and select Withdraw to submit your SGD withdrawal

Notes

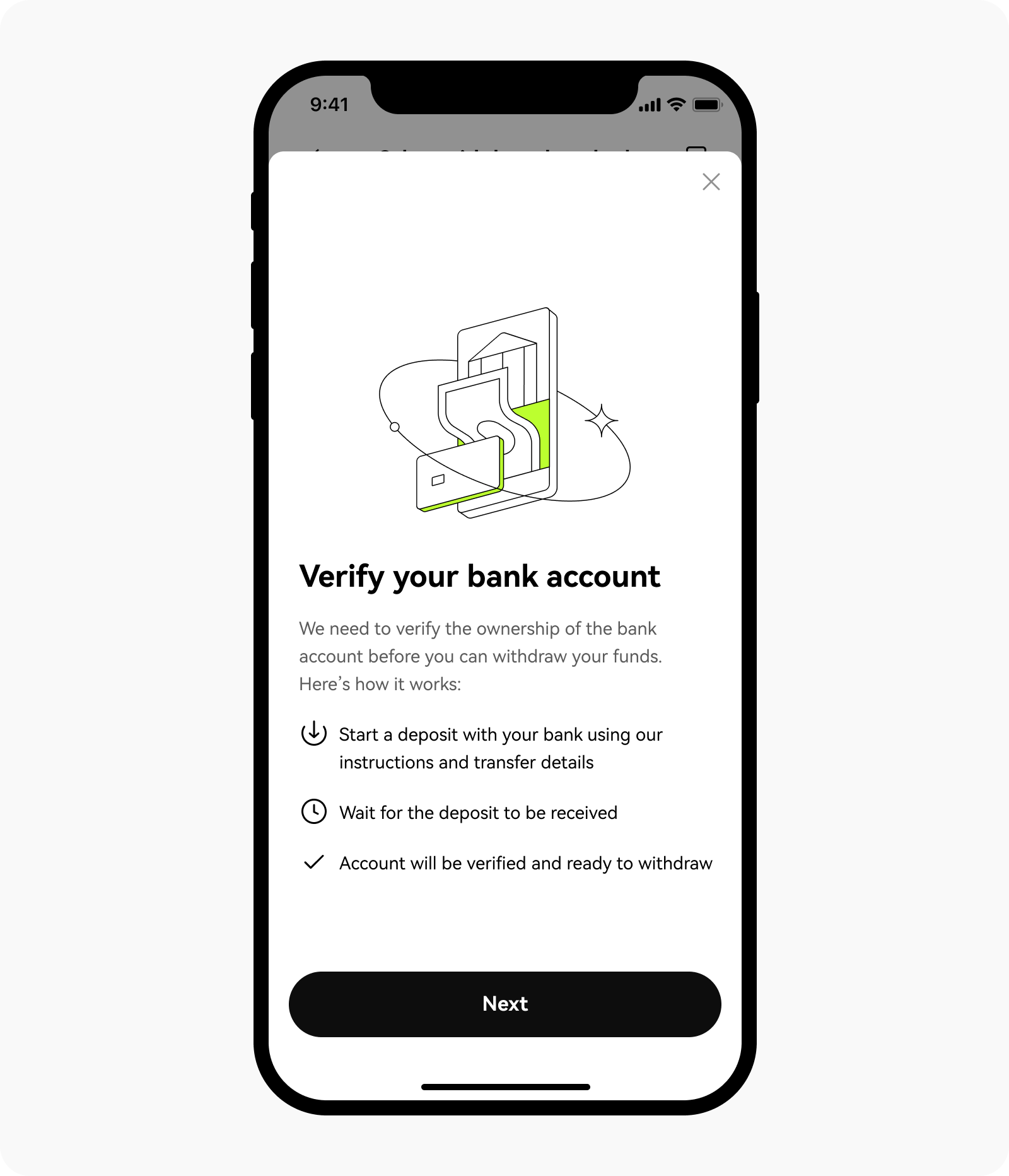

To add a withdrawal account, you must first make an initial deposit from that account to your OKX account. Only bank accounts that have been successfully verified through a deposit can be used for withdrawals.

If your bank supports the Singapore FAST network and your deposit is below 200,000 SGD, we recommend using FAST transfer

PayLah! withdrawals:

The withdrawal account number will be the mobile number linked to your PayLah! e-wallet.

Ensure you withdraw to your latest linked phone number, as an outdated number will send funds to the wrong recipient.

The daily transaction inflow limit for PayLah! e-wallet is 2,000 SGD including transfers from merchants and platforms that are not OKX.

GrabPay, Wise, and LifeSG are not supported for withdrawals.

Fees and processing time information:

Channel | Fee | Min withdrawal amount | Daily Limit (Rolling 24 Hours) | Max Amount per Transaction | Processing time |

|---|---|---|---|---|---|

Bank transfer (FAST) | 0 fee | 10 SGD | 1,000,000 SGD | 200,000 SGD | Instant |

Bank transfer (MEPS) | 20 SGD per withdrawal | 25 SGD | 1,000,000 SGD | 1,000,000 SGD | 1 business day |

International Wire | 35 SGD per withdrawal | 150 SGD | 1,000,000 SGD | 1,000,000 SGD | Up to 5 business days |

How do I verify the ownership of my receiving account for my first cash withdrawal?

To comply with local regulations, you must verify the ownership of your receiving account before making your first withdrawal. You can verify by making a cash deposit into OKX with the same account.

App: verify the ownership of receiving account for the first time cash withdrawal

FAQ

1. Why am I not able to see the "Withdraw cash" feature?

To comply with local laws and regulations, cash withdrawals are only available in specific regions. This may mean that your account is currently not eligible to access this feature.

2. Can I make a withdrawal while my bank account verification is still pending?

No. You can only make the withdrawal once your account ownership is successfully verified.

3. How do I know if my bank account is verified?

Once the deposit has been successfully processed into your OKX account, your bank account will be verified.

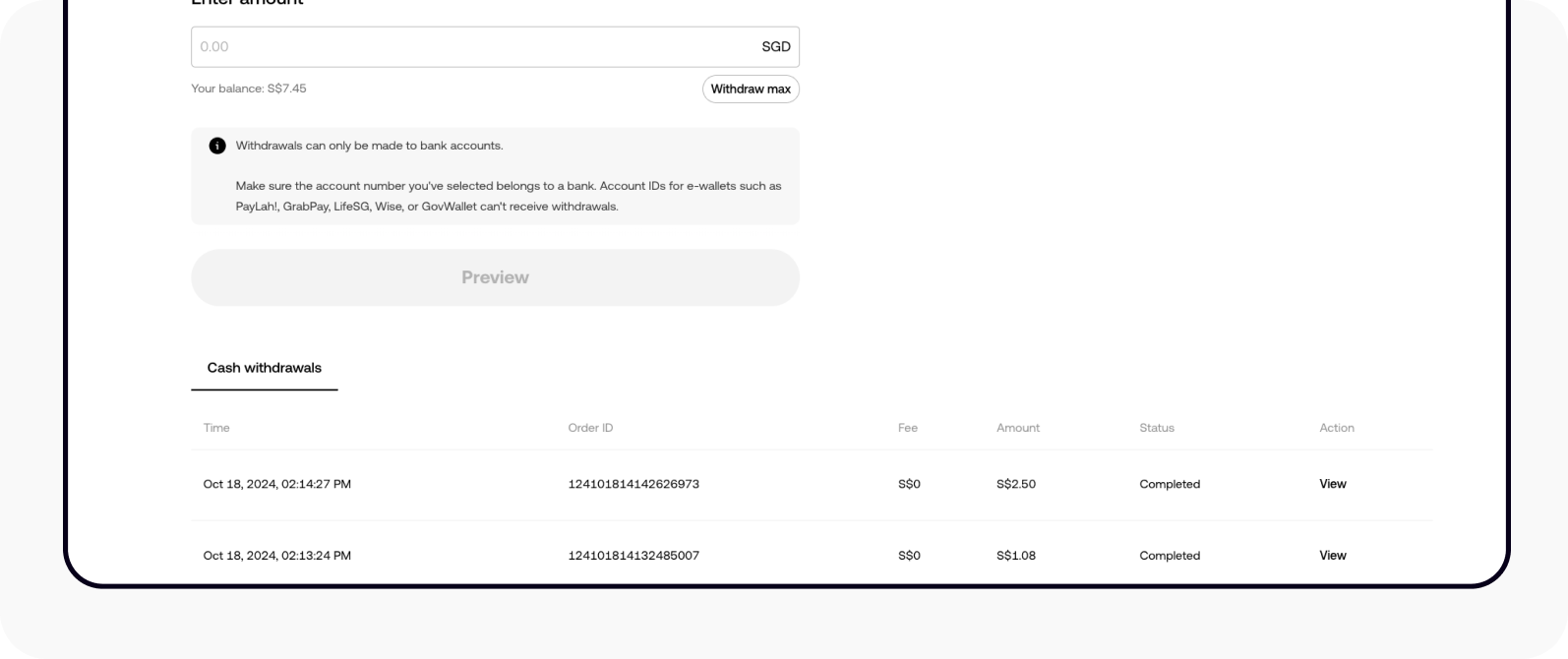

4. How do I check my withdrawal history?

You can review your withdrawal history on the cash withdrawal page.

Web: cash withdrawals on the cash withdrawal page

App: transaction history on the portfolio page